Bitcoin’s Titanic Struggle: How Self-Custody Could Capsize Crypto Whales

The crypto seas are getting stormy for Bitcoin's biggest holders. As self-custody gains traction, the whales might be swimming into dangerous waters.

Self-custody: The ultimate power play

Forget exchanges - the real revolution is happening in personal wallets. Retail investors are waking up to the oldest rule in finance: not your keys, not your coins. And that's bad news for the centralized giants who've been playing fast and loose with other people's Bitcoin.

The whale dilemma

Massive holders face an impossible choice: keep coins on risky exchanges or face the operational nightmare of self-management. Either way, their dominance looks increasingly fragile.

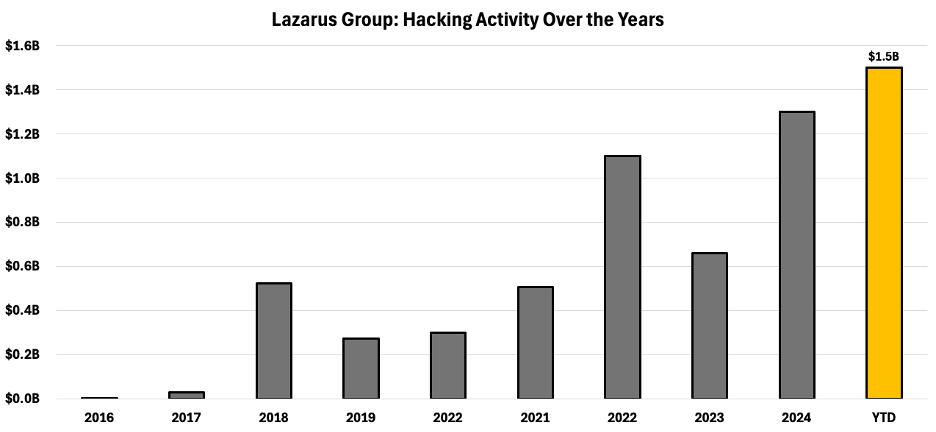

Finance's dirty little secret: the more 'secure' a system claims to be, the more someone's probably skimming off the top. Bitcoin was supposed to change that - but even Satoshi couldn't kill human greed.

Source: Chainalysis

European ETPs allow in-kind transfers which enable investors to MOVE bitcoin directly into and out of the fund without triggering a taxable event. This is especially valuable in jurisdictions like Switzerland and Germany, where long-term holders can optimize capital gains treatment. For whales thinking long term, the flexibility of in-kind flow is a major upgrade. It also unlocks new financial optionality; rather than selling their bitcoin during a major life event like buying a home, investors can borrow against their ETP holdings and access liquidity without ever parting with the underlying asset and triggering capital gains.

Self-custody will always have a place, especially for users in unstable regions or those needing financial sovereignty. But for whales with scale, the trade-offs of holding spot BTC are increasingly hard to justify. Bitcoin ETPs are simply less of a headache: they reduce risk, improve liquidity access, simplify compliance and offer long-term infrastructure for serious capital allocators, allowing big investors to sleep easy at night. The future of bitcoin ownership isn’t about whether you can hold your keys, it’s about whether you should.