Brace for Impact: Bitcoin’s August Volatility Surge Looms as VIX Signals Bullish Storm Ahead

Strap in, crypto traders—August is about to shake the tree.

The VIX's notorious bullish seasonality hints at wild Bitcoin price swings, just as markets enter their most unpredictable month. Forget sideways action—this is when BTC either moons or nosedives.

Why August bites

Thin liquidity meets pent-up institutional energy. Hedge funds return from Hamptons vacations itching to reposition, while retail FOMO kicks in post-summer lull. The result? A volatility cocktail that could send BTC 20% in either direction before Labor Day.

Wall Street's open secret

Traders quietly pile into volatility derivatives every August—the same playbook now targets crypto. 'It's the only free lunch left,' quips one sardonic quant, 'assuming you enjoy eating lunch during a rollercoaster blackout.'

Either way, hodlers win. Blood in the streets means accumulation opportunities, while breakout rallies validate the 'digital gold' thesis. Just maybe keep some antacids handy.

History repeating itself?

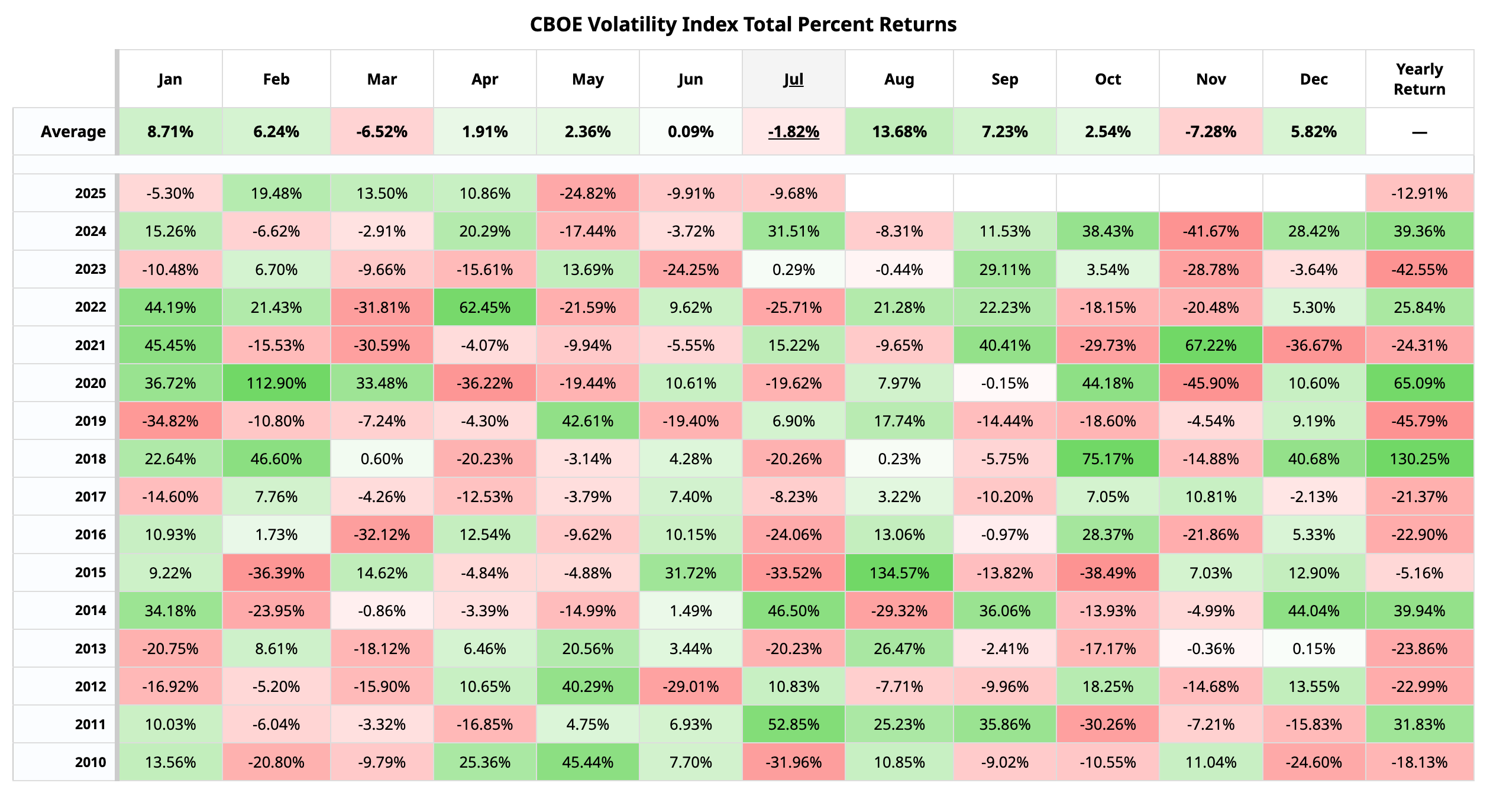

The VIX fell for a third straight month in July, extending the slide from April highs. It hit a five-month low of 14.92 on Friday, according to data source TradingView.

If history is a guide, this decline is likely setting the stage for the August boom in volatility and risk aversion on Wall Street. The VIX, which has been nicknamed the Fear Gauge, spikes higher when stock prices decline and falls when they rise.

In other words, the expected volatility boom on Wall Street could be marked by a stock market swoon, which could spill over into the Bitcoin market.

Bitcoin tends to track the sentiment on Wall Street, especially in the technology stocks, fairly closely. BTC's implied volatility indices have developed a strong positive correlation with the VIX, signaling a steady evolution into VIX-like fear gauges. Since November, BTC's 30-day implied volatility indices have declined sharply, ending the positive correlation with the spot price.