Hyperliquid’s HYPE Token: Wall Street and Analysts Weigh In on Its Explosive Future

Hyperliquid’s HYPE token is making waves—again. After a turbulent 2024, the decentralized perpetuals exchange’s native asset is back in the spotlight. But this time, Wall Street’s watching.

Here’s what the suits and quants are saying—and why traders should care.

The Bull Case: Liquidity, Leverage, and Low Fees

Institutional players are eyeing HYPE for its deep liquidity pools and razor-thin trading fees—two things traditional finance still can’t match without middlemen skimming 30%. Analysts point to its 80%+ APY staking rewards (for now) and Hyperliquid’s growing dominance in crypto derivatives.

The Bear Trap: Volatility and Vaporware Risks

Not everyone’s convinced. Some hedge funds dismiss HYPE as ‘leveraged beta with extra steps’—a fancy way of saying it’ll crash harder than Bitcoin in a macro downturn. Regulatory overhang looms too, with the SEC still allergic to anything decentralized.

The Bottom Line

HYPE’s either the next-gen trading asset Wall Street will FOMO into… or another cautionary tweetstorm waiting to happen. Either way—grab popcorn. (And maybe some risk management.)

How HSI Was Created: Atlas and Sonnet Join Forces

The HSI initiative was disclosed on July 14, when Sonnet BioTherapeutics (NASDAQ: SONN) announced a reverse merger with Rorschach I LLC, a newly formed entity backed by Atlas Merchant Capital, Paradigm, and other prominent investors. The transaction will transform Sonnet into a vehicle for a corporate crypto treasury strategy focused on HYPE.

Upon closing, the combined entity will be renamed Hyperliquid Strategies Inc. (HSI) and continue trading on the Nasdaq Capital Market. HSI will initially hold 12.6 million HYPE tokens, valued at $583 million at the time of signing. It will also allocate at least $305 million in additional capital to acquire more HYPE on the open market, creating one of the largest known altcoin-focused treasuries.

Sonnet will remain a wholly owned subsidiary of HSI, maintaining its biotech R&D in parallel. Investors will receive contingent value rights (CVRs) tied to the performance of Sonnet’s therapeutic pipeline.

The board of HSI will be chaired by Bob Diamond, a former CEO of Barclays and co-founder of Atlas Merchant Capital. Eric Rosengren, the former president of the Boston Federal Reserve, is expected to join as a director. The deal is backed by Galaxy Digital, Pantera Capital, D1 Capital, Republic Digital and 683 Capital, and is scheduled to close in the second half of 2025.

What Is Hyperliquid, and How Does the HYPE Token Work?

Hyperliquid is the name of a decentralized exchange (DEX) and a high-performance layer-1 blockchain launched in 2023. It was designed to offer the speed and trading experience of centralized exchanges with the transparency and permissionless access of decentralized finance (DeFi).

Its infrastructure includes two Core layers:

- HyperCore, which powers high-speed spot and perpetual futures trading with on-chain order books —supporting over 200,000 orders per second.

- HyperEVM, a general-purpose smart contract layer compatible with Ethereum, enabling developers to build DeFi applications that can interact with HyperCore’s liquidity.

HYPE is the native token of the Hyperliquid ecosystem. It is used for staking, governance, trading incentives and as the core asset for value capture across the network. As of the time of writing, HYPE is the fifteenth largest cryptocurrency by market capitalization and Hyperliquid has processed over $1 trillion in cumulative trading volume.

Analyst Commentary: Strong Fundamentals, Diverging Views

The surge in institutional attention hasn’t settled the debate around HYPE’s valuation — despite its strong rally earlier this quarter from a low of $37.41 to nearly $50 (reached on July 14).

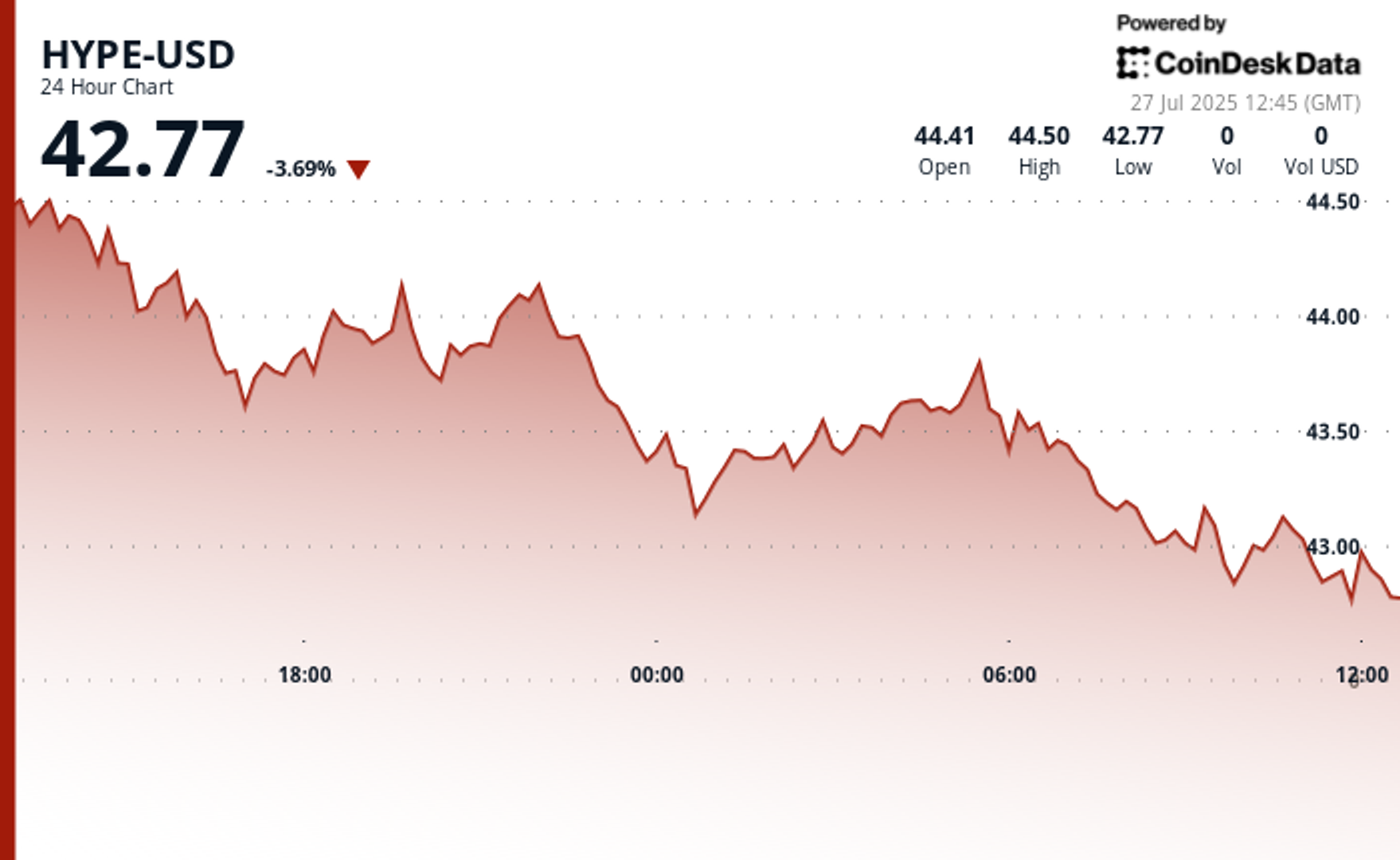

At the time of writing, according to CoinDesk Data, HYPE is trading at $42.77, down 3.69% in the past 24-hour period.

Crypto analyst "McKenna" suggested on Saturday that HYPE may still be undervalued based on revenue metrics. He estimated that if the token were trading at the same valuation multiple (known as SWPE, or sales-weighted price-to-earnings) it reached during its last market peak, its current 30-day average revenue of $3.2 million WOULD imply a fair price of $77. His analysis uses a ratio comparing market cap to trailing platform revenue — a common method in both equity and token analysis.

By contrast, "Altcoin Sherpa" signaled caution earlier today. While he praised HYPE’s fundamentals — including high user activity, reliable tokenomics and strong team execution — he stated that the MOVE from $9 to over $40 likely exhausted the short-term upside. He said he was holding a small staking position for long-term exposure but was not actively accumulating more at current prices. He suggested he’d wait for a more substantial pullback before increasing his allocation.

The two views illustrate a key tension: even with high revenues and institutional backing, tokens like HYPE can become overextended in the short run — especially when driven by narrative momentum and speculative capital.

Institutional Altcoin Bets Are Just Getting Started

Whether HYPE continues climbing or cools from here, the creation of Hyperliquid Strategies Inc (HSI) marks a turning point in how corporate crypto treasury strategies are being executed. Unlike earlier models that focused on bitcoin as a digital reserve asset, HSI is being built around a single altcoin that didn’t exist a year ago. With more than $888 million in combined token and cash commitments, the structure resembles a thematic crypto fund — but with a public listing and institutional leadership.

If this approach proves successful, more firms may follow — raising capital not just to hold crypto, but to take concentrated positions in tokens they believe will define the next phase of digital finance.