XRP Retreats After Explosive Rally—But This Bull Flag Still Screams $6 Ahead

XRP just gave traders whiplash—another fakeout or the calm before the storm?

The digital asset peeled back 12% overnight after a blistering 48-hour surge, triggering stop losses across retail portfolios. But zoom out: that textbook bull flag formation still paints a $6 target, a 300% moonshot from current levels.

Chartists are salivating. Fundamentals? Not so much.

Ripple's never-ending SEC saga drags on like a bad Netflix season, while 'utility' remains crypto's most elastic marketing term. But hey—when the pattern's this clean, even Wall Street quant jocks might sneak a position.

Watch the $0.85 level like a hawk. Break that, and the $6 dream gets shelved alongside 'Bitcoin at $100K by 2024' memes.

News Background

• XRP broke above $3.65 last week, completing a six-year symmetrical triangle.

• ProShares launched the first XRP futures ETF, marking a milestone in regulated institutional access.

• U.S. Congress advanced the GENIUS and CLARITY Acts, pushing forward crypto regulation clarity, fueling fund flows into large-cap digital assets.

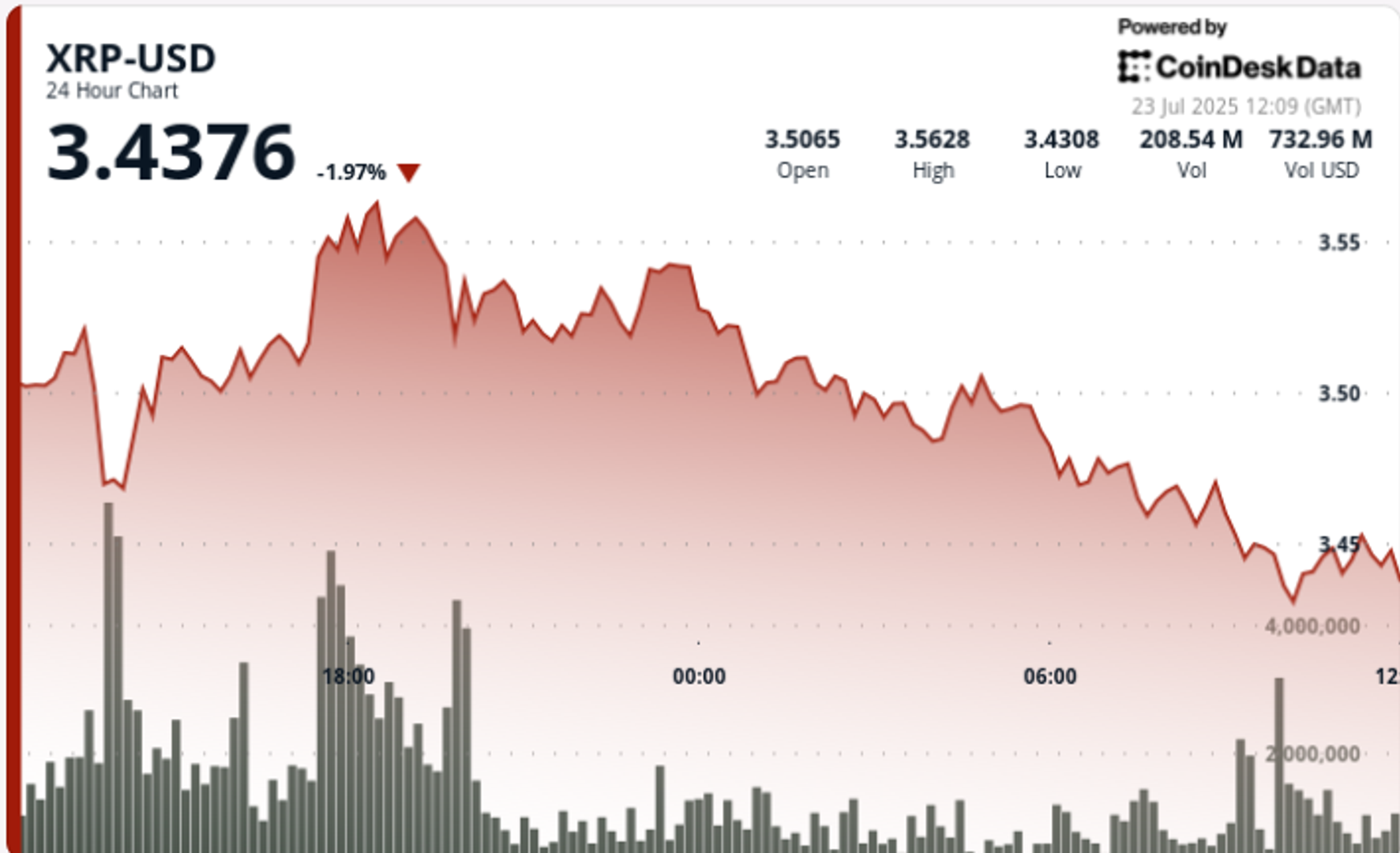

Price Action Summary

The most aggressive MOVE came at 17:00 GMT on July 22, when XRP jumped from $3.52 to $3.56 in under an hour on 106.4 million volume—over 50% above the daily average of 70.1 million. Resistance formed at the $3.56–$3.57 zone, capping upside and triggering a steady retreat through the overnight session.

The final hour (07:10–08:09 GMT) saw a breakdown from $3.47 to $3.46, as volume spiked to 2.5 million between 07:37 and 07:49. That move cracked the previously firm $3.49–$3.51 support band, confirming a short-term trend shift as selling overwhelmed buyers.

Technical Analysis

• 24-hour trading range: $3.46–$3.57 (3.18%)

• Bullish breakout at 17:00 July 22: $3.52 → $3.56 on 106.4M volume

• Support zone: $3.49–$3.51 tested multiple times overnight, failed by session close

• Resistance zone: $3.56–$3.57 capped rally, now defining next breakout point

• Breakdown confirmation: $3.47 → $3.46 on 2.5M volume spike

• RSI neutral; MACD turning lower — signals likely consolidation before next directional move

What Traders Are Watching

Institutional participation remains elevated amid ETF inflows and improving regulatory optics. Despite the near-term rejection at $3.57, analysts continue to flag bullish setups targeting $6.00 and even $15.00 over multi-month timeframes. The $3.50 level now acts as psychological pivot for bulls to defend in upcoming sessions.