Altcoin Bloodbath: SOL, XRP, and TON Lead Market Retreat as Crypto Rally Stalls

Crypto's high-flyers face brutal reckoning

Solana, Ripple, and Telegram's token lead double-digit plunges as traders cash out profits. The 'altseason' rally hits a wall—just as Wall Street starts pretending to care about blockchain again.

Technical carnage across mid-caps

No major altcoin escapes the selloff. Even recent outperformers now bleed value faster than a DeFi protocol with unaudited code. Market watchers spot leverage liquidations compounding the pain.

Silver lining for diamond hands?

History says this shakeout could separate weak hands from true believers. Then again, history also said NFTs were a store of value—so maybe grab some popcorn instead.

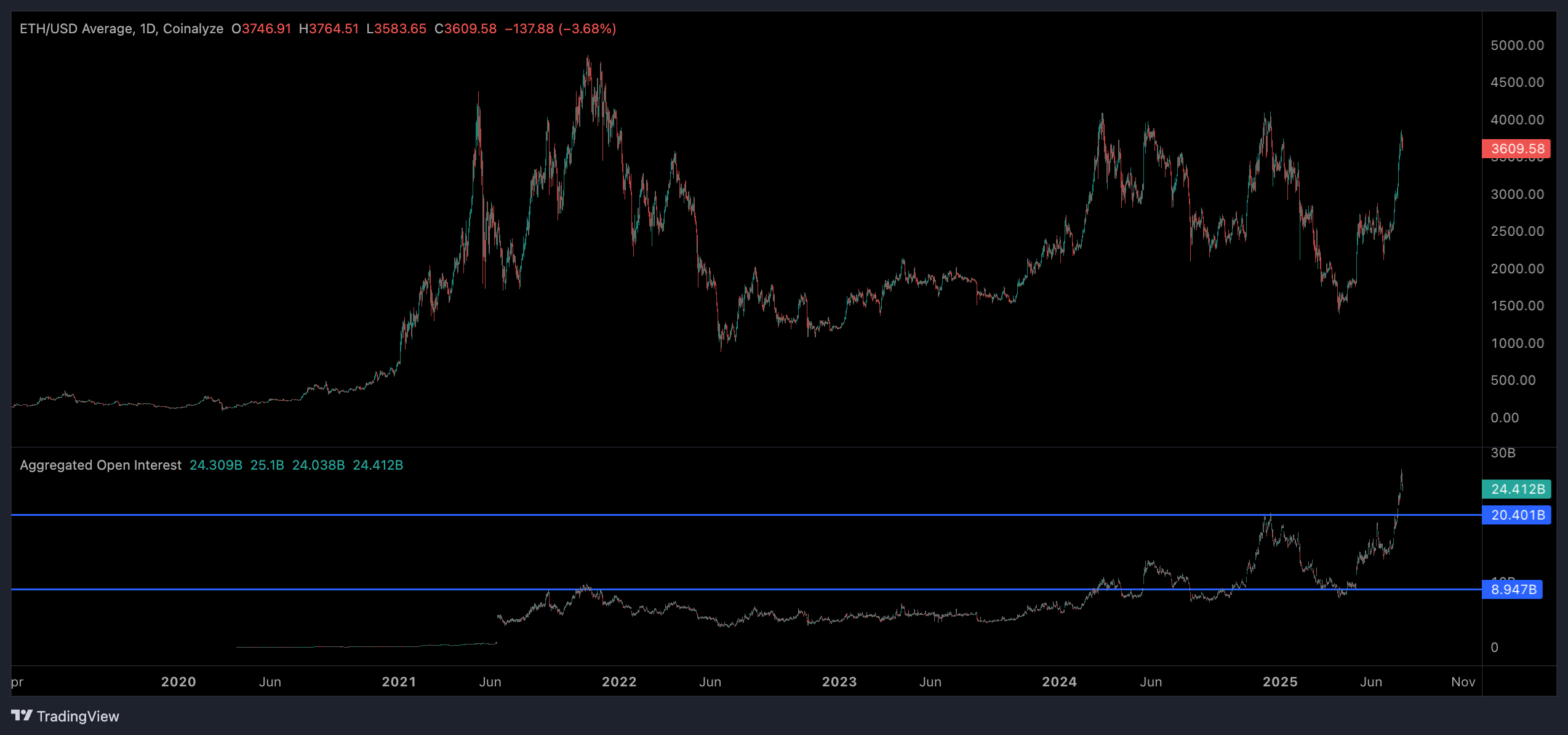

Traders will be eagerly watching to see whether altcoins will bounce following a series of technical breakouts last week. If ETH can hold above $3,470 it WOULD indicate a potentially bullish resolution as that prior point of resistance will have flipped to become support. A break below that level could decimate the altcoin market with more liquidations expected.

Open interest for ETH is still at $24 billion, significantly higher than during its 2021 high when it failed to top $10 billion, indicating that much of the recent MOVE has been driven by leverage.

CoinMarketCap's altcoin season indicator has also ticked down from 55 out of 100 to 47, demonstrating weakness across the altcoin sector despite a recent rise in retail participation.

A return to altcoin season will likely be seen if bitcoin can FORM a new record high above $124,000 and begin to consolidate above that point, leaving capital to rotate to more speculative altcoin bets.