Bitwise CIO Reveals Ether’s ‘Demand Shock’: Why ETH’s Rally Isn’t Just Hype

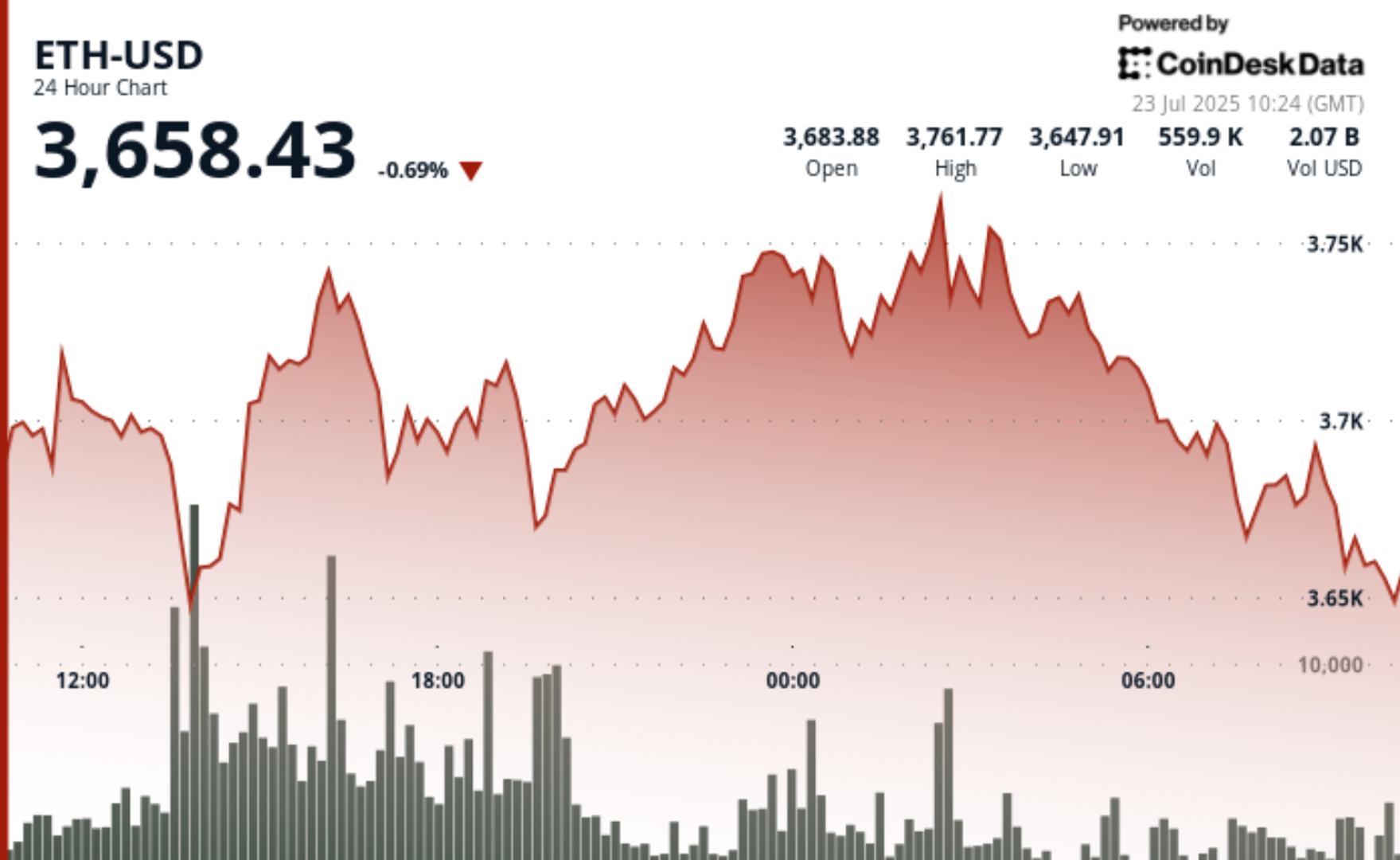

Ethereum’s price surge isn’t just another crypto pump—it’s a structural shift. Bitwise’s Chief Investment Officer breaks down the ‘demand shock’ fueling ETH’s relentless climb.

### The Mechanics Behind the Momentum

Forget memecoins and celebrity endorsements. Ether’s rally is built on real adoption—DeFi, NFTs, and institutional inflows are swallowing supply faster than miners can mint it. The numbers don’t lie: ETH’s circulating supply just shrank for the third straight quarter.

### Why This Rally Has Teeth

Unlike 2021’s leverage-fueled mania, this run’s anchored in protocol upgrades and burning mechanisms. The Merge turned ETH into a yield-bearing asset, and Wall Street’s finally paying attention—even if they still pronounce it ‘Ee-ther’.

### The Cynic’s Corner

Sure, traditional finance will claim they saw this coming—right after they finish downgrading ETH to ‘speculative trash’ for the eighth time this year. Meanwhile, the smart money’s already repositioning.

Bottom line? This isn’t your degenerate cousin’s crypto boom. The fundamentals have changed—and so has the game.