XRP Surges 4% After Triangle Breakout—Defies Profit-Taking to Hold Firm at $3.50

XRP bulls just flexed their muscles—a 4% pump follows a textbook triangle breakout, shrugging off profit-taking pressure like it's pocket change.

The $3.50 Standoff

Traders dumped, but the price didn't flinch. That key level's now a battleground between skeptics and true believers.

Cynic's Corner

Wall Street's still calling it a 'speculative asset'—right before they quietly add it to their own balance sheets. Classic.

News Background

- The U.S. Congress advanced the GENIUS and CLARITY Acts, establishing a legal framework for digital assets and reducing uncertainty around XRP's security classification.

- ProShares launched the first XRP futures ETF, a milestone for institutional adoption.

- Wall Street analysts have issued $6.00 price targets on XRP following confirmation of the triangle breakout, with longer-term projections reaching as high as $15.00.

Price Action Summary

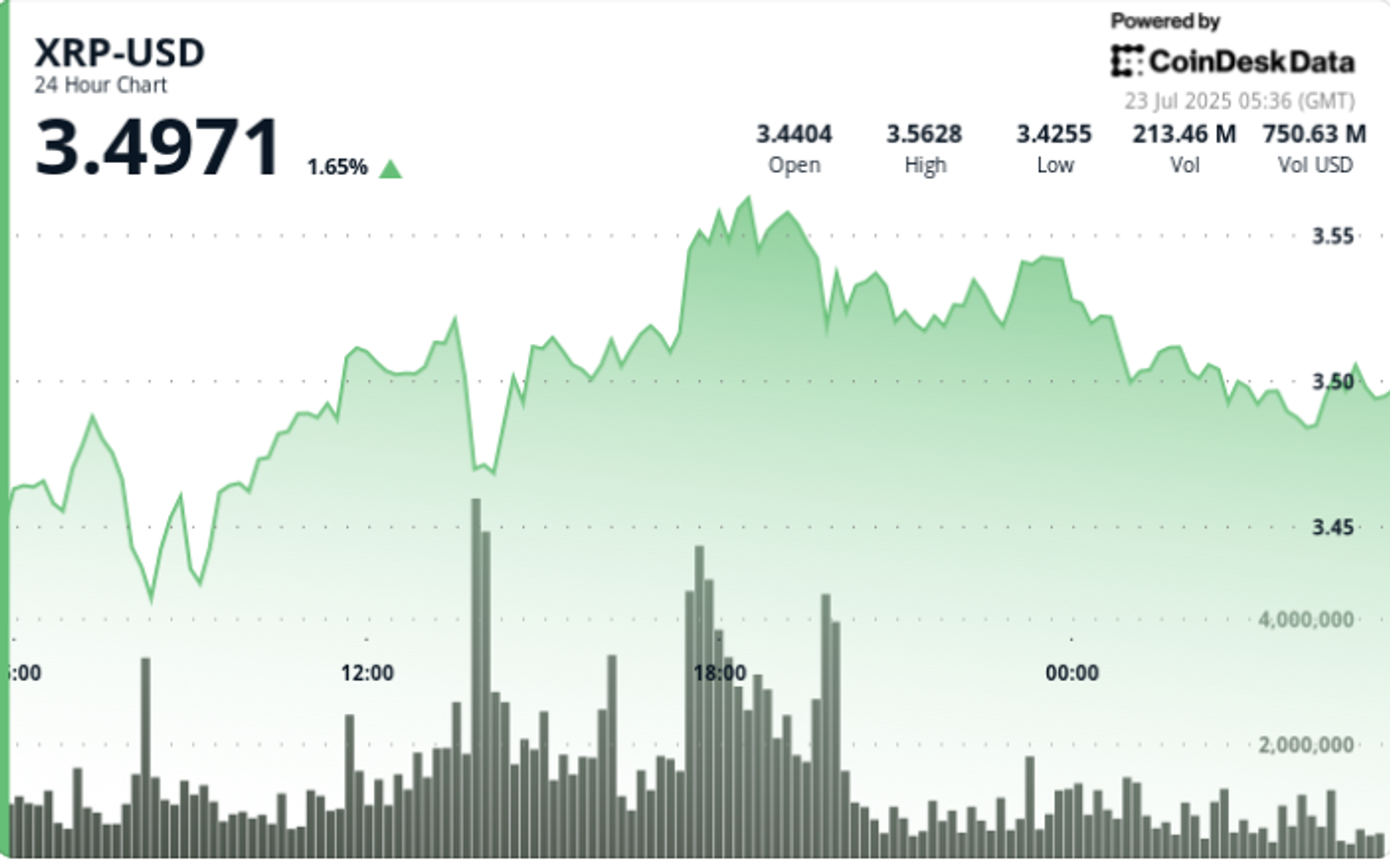

XRP broke above $3.52 resistance during the 17:00–18:00 window on volume of 106.4 million—roughly 52% above the 24-hour average of 70.1 million. The breakout propelled prices toward the $3.57 session high before selling pressure in the final hour dragged prices back to $3.51.

The final 60-minute window from 01:09 to 02:08 GMT showed distribution behavior. Prices climbed from $3.50 to $3.52 by 01:46 before reversing. A high-volume drop of 2.25 million units between 02:02–02:03 marked the day’s most intense sell-off, pushing prices to $3.50 before a marginal recovery.

Technical Analysis

- Symmetrical triangle breakout confirmed above $3.00 with a high of $3.64 earlier in the week.

- Resistance: $3.57 (intraday), with strong overhead supply observed in the final hour.

- Support: $3.42 retested successfully multiple times, confirming strong institutional bid zone.

- RSI and MACD remain neutral, suggesting limited short-term momentum.

- Analysts maintain $6.00 near-term target; $15.00 flagged as long-term projection based on breakout extension.

What Traders Are Watching

- Whether $3.50 holds as a psychological and technical support level in the next 24 hours.

- Follow-through buying interest from institutions post-ETF launch.

- Congressional momentum on further digital asset regulation.

- Spot ETF developments and their influence on broader investor exposure.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.