Bitcoin’s Euphoria Fades as Whales Stir: The Americas Crypto Awakening

Whale activity shakes Bitcoin's calm—just as retail investors start catching their breath.

Market tremors ahead? The crypto giants are waking, and their moves could send shockwaves through the Americas.

Meanwhile, Wall Street still can't decide if Bitcoin's a currency, commodity, or the ultimate hedge against their own incompetence.

What to Watch

- Crypto

- July 15: Alchemist staking update launches, allowing token holders to stake ALCH for access to advanced features, premium benefits and ecosystem rewards, potentially boosting token utility and demand.

- July 15: Lynq is expected to debut its real-time, interest-bearing digital-asset settlement network for institutions. Built on Avalanche’s layer-1 blockchain and powered by Arca’s tokenized U.S. Treasury fund shares, Lynq enables instant settlement, continuous yield accrual and improved capital efficiency.

- July 15: TAC, a layer-1 blockchain using proof of stake (POS) consensus and bridging Ethereum DeFi applications into Telegram’s ecosystem, is scheduled to launch its mainnet. Leading DeFi protocols such Curve and Morpho will operate on TAC, bringing decentralized finance to Telegram's 1 billion+ users.

- July 15, 6 a.m.: Layer-1 blockchain Alephium (ALPH) activates the "Danube" hard fork upgrade on its mainnet, promising 8-second block times, 20,000+ TPS, groupless addresses, passkey login, chained transaction and enhanced developer tools.

- July 15, 1 p.m.: Caffeine, an AI-powered platform that lets anyone build Web3 decentralized apps (dapps) using natural language, launches publicly at the “Hello, Self-Writing Internet” event in San Francisco. Caffeine uses Internet Computer (ICP) technology to generate fully on-chain, production-ready apps. Livestream link.

- July 15, 3 p.m.: U.S. Senate Committee on Agriculture, Nutrition, and Forestry holds a market structure hearing titled “Stakeholder Perspectives on Federal Oversight of Digital Commodities.” Livestream link.

- July 16, 9 a.m.: U.S. House Ways and Means Committee oversight hearing titled "Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Built for the 21st Century."

- July 18: Lorenzo Protocol, a Cosmos-based blockchain with native token BANK, launches USD1+ OTF on BNB Chain's mainnet. The institutional-grade on-chain traded fund lets users stake stablecoins to mint sUSD1+ tokens that earn stable, NAV-backed yield from real-world assets, CeFi quantitative strategies and DeFi protocols. All returns are settled in USD1 stablecoin, issued by World Liberty Financial, whose stablecoin infrastructure powers the product’s stable yield mechanism.

- July 18: Shares of the ProShares Ultra XRP Futures ETF (ticker UXRP), providing 2x leveraged exposure to XRP futures contracts, are expected to begin trading on NYSE Arca.

- Macro

- July 15, 8:30 a.m.: Statistics Canada releases June consumer price inflation data.

- Core Inflation Rate MoM Prev. 0.6%

- Core Inflation Rate YoY Prev. 2.5%

- Inflation Rate MoM Est. 0.1% vs. Prev. 0.6%

- Inflation Rate YoY Est. 1.9% vs. Prev. 1.7%

- July 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases June consumer price inflation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Core Inflation Rate YoY Est. 3% vs. Prev. 2.8%

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Inflation Rate YoY Est. 2.7% vs. Prev. 2.4%

- July 15, 4 p.m.: Keynote speeches by Andrew Bailey, the governor of the Bank of England, and Rachel Reeves, U.K. Chancellor of the Exchequer, at the annual financial and professional services dinner at Mansion House, London.

- July 16, 2 a.m.: U.K.'s Office for National Statistics releases June consumer price inflation data.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 3.5% vs. Prev. 3.5%

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.2%

- Inflation Rate YoY Est. 3.4% vs. Prev. 3.4%

- July 16, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June producer price inflation data.

- Core PPI MoM Est. 0.2% vs. Prev. 0.1%

- Core PPI YoY Est. 2.7% vs. Prev. 3%

- PPI MoM Est. 0.2% vs. Prev. 0.1%

- PPI YoY Est. 2.5% vs. Prev. 2.6%

- July 16, 10 a.m.: Speech by Fed Governor Michael S. Barr on "Financial Regulation" at "Conversation with Governor Barr" in Washington. Livestream link.

- July 17, 10 a.m.: Speech by Fed Governor Adriana D. Kugler on "A View of the Housing Market and U.S. Economic Outlook" at the Housing Partnership Network Symposium in Washington. Livestream link.

- July 17, 6:30 p.m.: Speech by Fed Governor Christopher J. Waller on the economic outlook at an event hosted by the Money Marketeers of New York University.

- Aug. 1, 12:01 a.m.: New U.S. tariffs take effect on imports from trade partners that failed to reach agreements by the July 9 deadline. These increased duties could range from 10% to as high as 70%, impacting a wide range of goods.

- July 15, 8:30 a.m.: Statistics Canada releases June consumer price inflation data.

- Earnings (Estimates based on FactSet data)

- July 23: Tesla (TSLA), post-market, $0.42

- July 29: PayPal Holdings (PYPL), pre-market, $1.29

- July 30: Robinhood Markets (HOOD), post-market, $0.30

- July 31: Coinbase Global (COIN), post-market, $1.35

- July 31: Reddit (RDDT), post-market, $0.19

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting on a $245,000 funding proposal to expand Gotchi Battler into a revenue-generating game with PvE modes, NFTs and battle passes, aiming to reverse declining player numbers, boost GHST utility and create sustainable rewards. Voting ends July 22.

- Uniswap DAO is conducting a temperature check on Etherlink’s request to co-incentivize Uniswap v3 liquidity. Tezos Foundation would put up $300K for three months of rewards on WETH/USDC, WBTC/USDC and LBTC/USDC, and is asking the DAO for $150K more, aiming to anchor Etherlink’s rising TVL and future native tokens on Uniswap. Voting ends July 18.

- Rocket Pool DAO is voting to finalize Saturn 1’s implementation. Approval by a 75% supermajority will ratify key protocol changes, including new transaction designs and a potential revenue share to the pDAO treasury. Voting ends July 24.

- July 16, 5 p.m.: VeChain to host a monthly update with community representatives and the VeChain Foundation.

- Unlocks

- July 15: Sei (SEI) to unlock 1% of its circulating supply worth $19.07 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating supply worth $37.15 million.

- July 17: ZKSync (ZK) to unlock 2.41% of its circulating supply worth $9.24 million.

- July 17: ApeCoin (APE) to unlock 1.95% of its circulating supply worth $9.86 million.

- July 18: Official TRUMP (TRUMP) to unlock 45.35% of its circulating supply worth $827.17 million.

- July 18: Fasttoken (FTN) to unlock 4.64% of its circulating supply worth $90 million.

- Token Launches

- July 15: TAC (TAC) to be listed on Binance, Kraken, Bitget, Bybit and others.

- July 16: Bybit to delist Tap (TAP), VaporFund (VPR), Cosplay Token (COT), Souni (SON), Tenet Protocol (TENE), Havah (HVH), and Brawl AI Layer (BRAWL) among others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 21-22: Malaysia Blockchain Week 2025 (Kuala Lumpur)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Oliver Knight

- Token issuance platform Pump.fun's native token was distributed to early users and ICO participants on Monday, debuting at a $2 billion market cap on the back of $1.46 billion in trading volume.

- PUMP began trading at $0.00756 and soon began to feel the pressure, sliding to as low as $0.051 before settling at $0.0056.

- The ICO price was $0.004, meaning that investors has an opportunity to quickly flip the tokens for a profit, creating a wave of selling pressure.

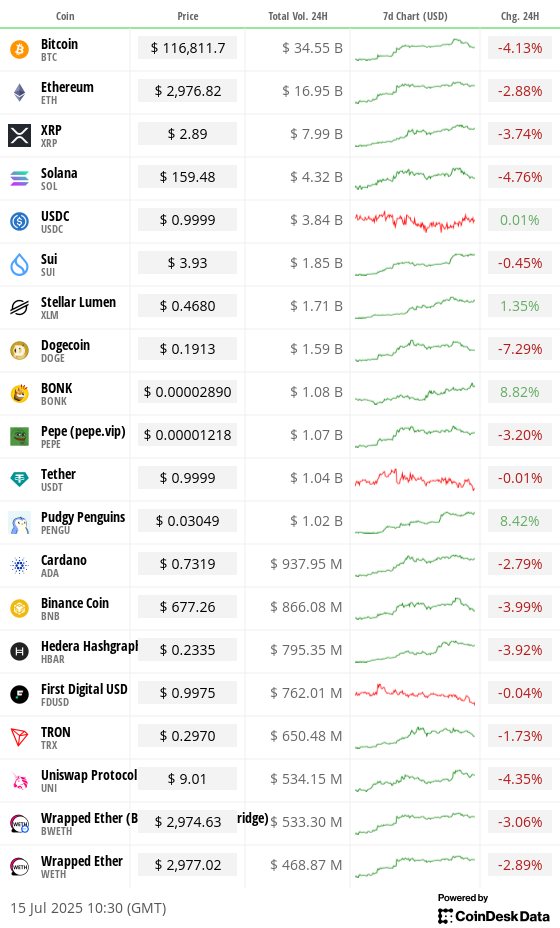

- The token debut coincided with a decline across the wider crypto market, with bitcoin (BTC) losing 4% as it slipped to $117,000 from $123,000, while ether (ETH) and sol (SOL) fell 2% and 4.7%, respectively.

- Crypto exchange Binance also made an attempt to take the limelight, announcing the release of its own token launcher that will rival Pump.fun.

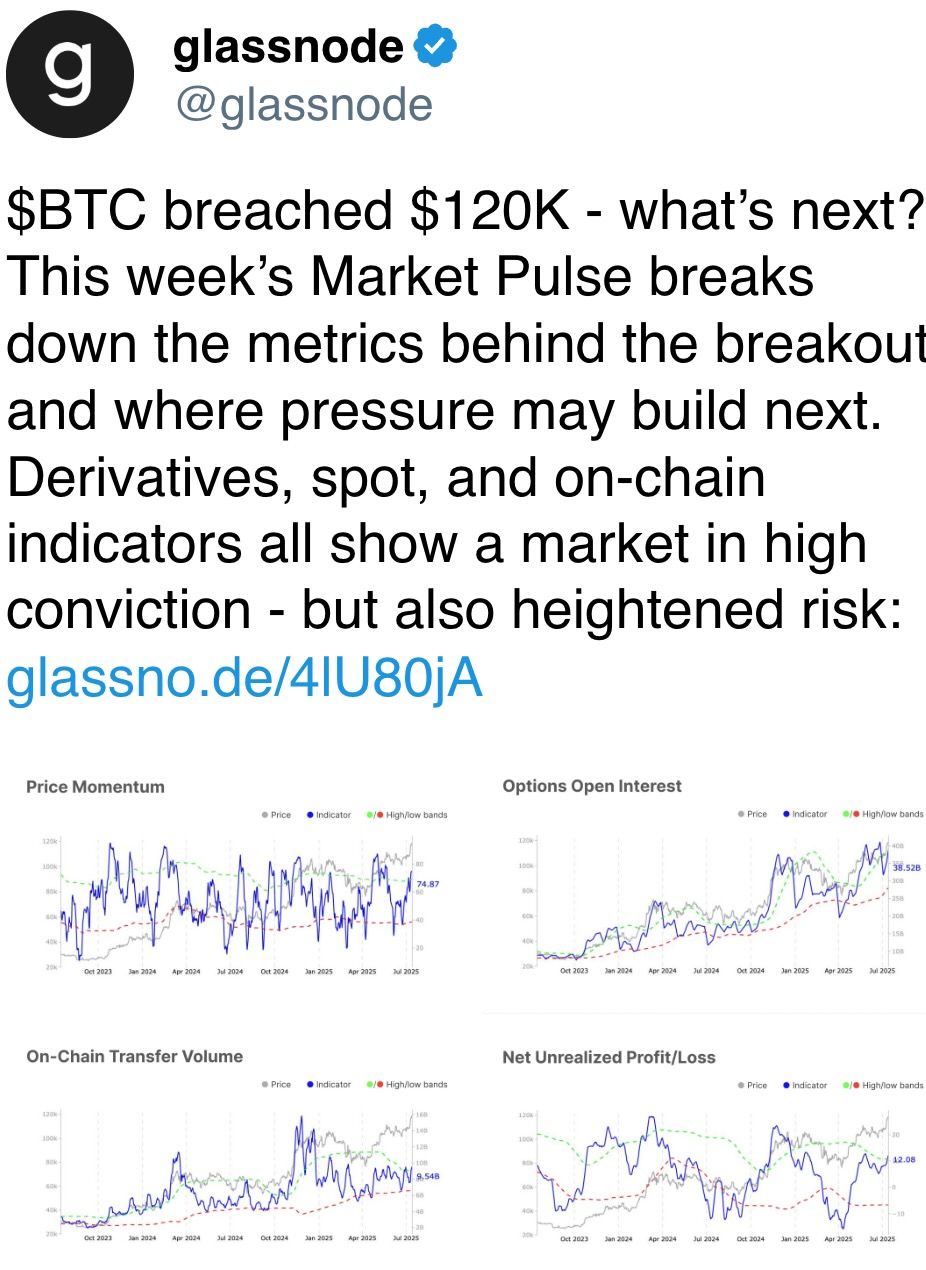

Derivatives Positioning

- Open interest in XRP futures hit all-time highs alongside record activity in BTC futures, both pointing to elevated price volatility ahead.

- Funding rates for major coins are holding above an annualized 10%, suggesting bullish market sentiment. The reading, however, is far from signaling overheated conditions typically seen at market tops or record high prices.

- The cumulative volume delta for the top 25 coins for the past 24 hours is negative, a sign of sellers becoming more aggressive. The pullback might deepen in the short-term.

- Risk reversals tied to short-term BTC and ETH options now show a bias for protective puts, which is common during price declines. The long-end remains bullish.

- Block flows on OTC liquidity network Paradigm featured December risk reversals and ETH out-of-the-money call spreads.

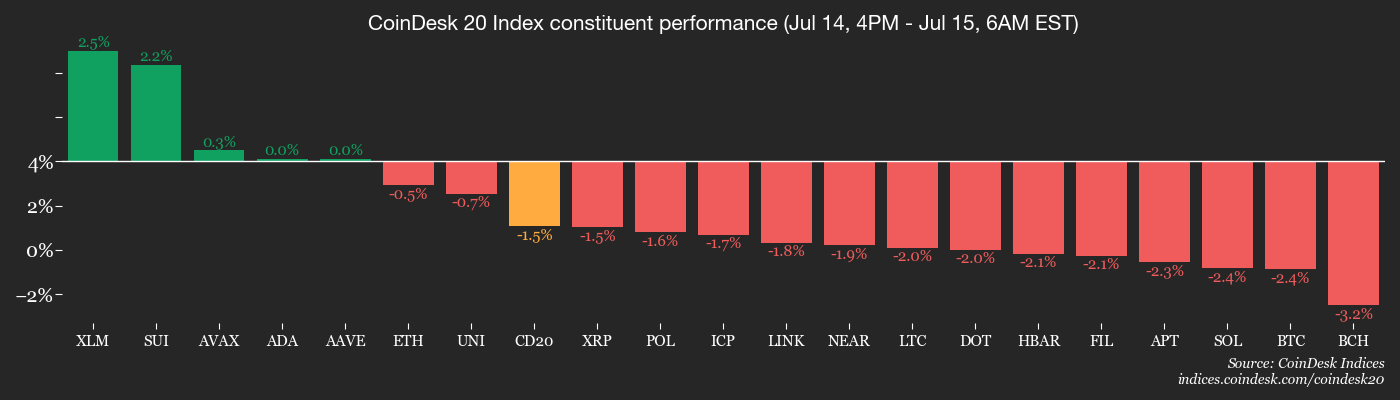

Market Movements

- BTC is down 2.86% from 4 p.m. ET Monday at $116,734.47 (24hrs: -4.13%)

- ETH is down 1.12% at $2,970.70 (24hrs: -2.89%)

- CoinDesk 20 is down 1.79% at 3,566.75 (24hrs: -3.85%)

- Ether CESR Composite Staking Rate is up 15 bps at 3.04%

- BTC funding rate is at 0.0315% (34.40% annualized) on KuCoin

- DXY is down 0.12% at 97.97

- Gold futures are up 0.41% at $3,372.90

- Silver futures are down 0.11% at $38.70

- Nikkei 225 closed up 0.55% at 39,678.02

- Hang Seng closed up 1.45% at 24,553.52

- FTSE is up 0.06% at 9,003.57

- Euro Stoxx 50 is up 0.40% at 5,392.29

- DJIA closed on Monday up 0.20% at 44,459.65

- S&P 500 closed up 0.14% at 6,268.56

- Nasdaq Composite closed up 0.27% at 20,640.33

- S&P/TSX Composite closed up 0.65% at 27,198.85

- S&P 40 Latin America closed down 0.92% at 2,597.40

- U.S. 10-Year Treasury rate is down 1.2 bps at 4.415%

- E-mini S&P 500 futures are up 0.29% at 6,329.00

- E-mini Nasdaq-100 futures are up 0.54% at 23,158.75

- E-mini Dow Jones Industrial Average Index are unchanged at 44,694.00

Bitcoin Stats

- BTC Dominance: 64.25% (-0.41%)

- Ether to bitcoin ratio: 0.02549 (1.39%)

- Hashrate (seven-day moving average): 906 EH/s

- Hashprice (spot): $58.8

- Total Fees: 5.74 BTC / $693,498

- CME Futures Open Interest: 153,280 BTC

- BTC priced in gold: 34.8 oz

- BTC vs gold market cap: 9.86%

Technical Analysis

- Since 2024, every new high in BTC has seen dogecoin (DOGE), the world's largest meme token, hit a lower high than the preceding one.

- The divergence hints at declining investor interest in non-serious tokens.

Crypto Equities

- Strategy (MSTR): closed on Monday at $451.02 (+3.78%), -2.04% at $441.80

- Coinbase Global (COIN): closed at $394.01 (+1.8%), -1.41% at $388.47

- Circle (CRCL): closed at $204.7 (+9.27%), -1.93% at $200.75

- Galaxy Digital (GLXY): closed at $21.45 (+3.97%), unchanged in pre-market

- MARA Holdings (MARA): closed at $19.21 (+0.37%), -1.56% at $18.91

- Riot Platforms (RIOT): closed at $12.51 (+0.72%), -2.4% at $12.21

- Core Scientific (CORZ): closed at $13.56 (+8.39%), +2.58% at $13.91

- CleanSpark (CLSK): closed at $12.6 (-0.4%), -1.9% at $12.36

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.57 (+3.19%)

- Semler Scientific (SMLR): closed at $45.23 (-0.66%), -0.51% at $45

- Exodus Movement (EXOD): closed at $33.70 (+2.12%), +2.34% at $34.49

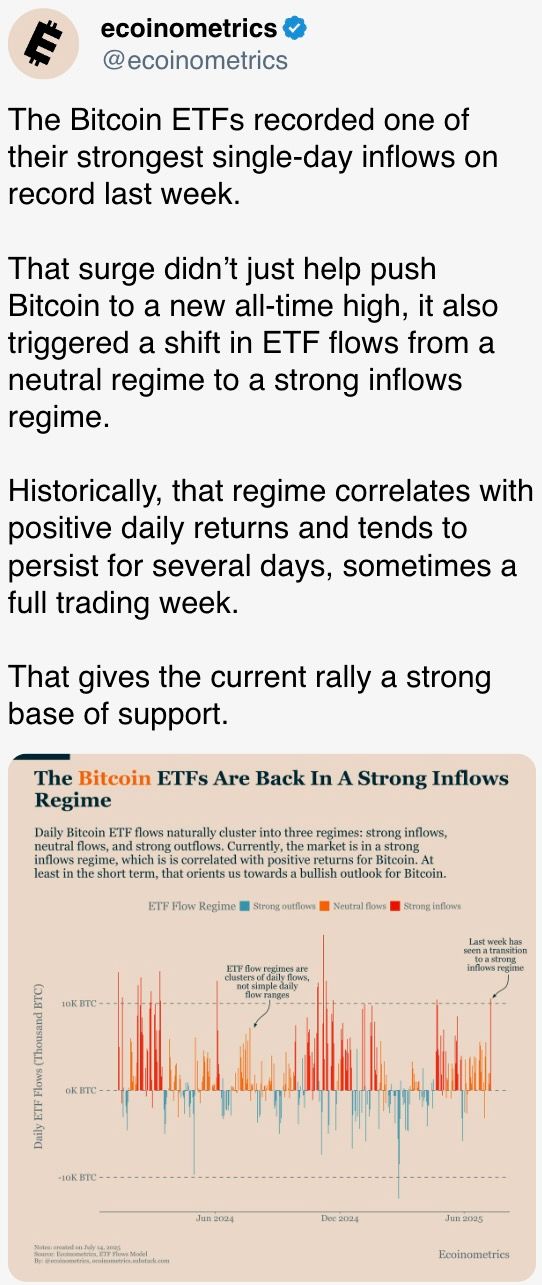

ETF Flows

Spot BTC ETFs

- Daily net flows: $297.4 million

- Cumulative net flows: $52.64 billion

- Total BTC holdings ~1.28 million

Spot ETH ETFs

- Daily net flows: $259 million

- Cumulative net flows: $5.58 billion

- Total ETH holdings ~4.47 million

Source: Farside Investors

Overnight Flows

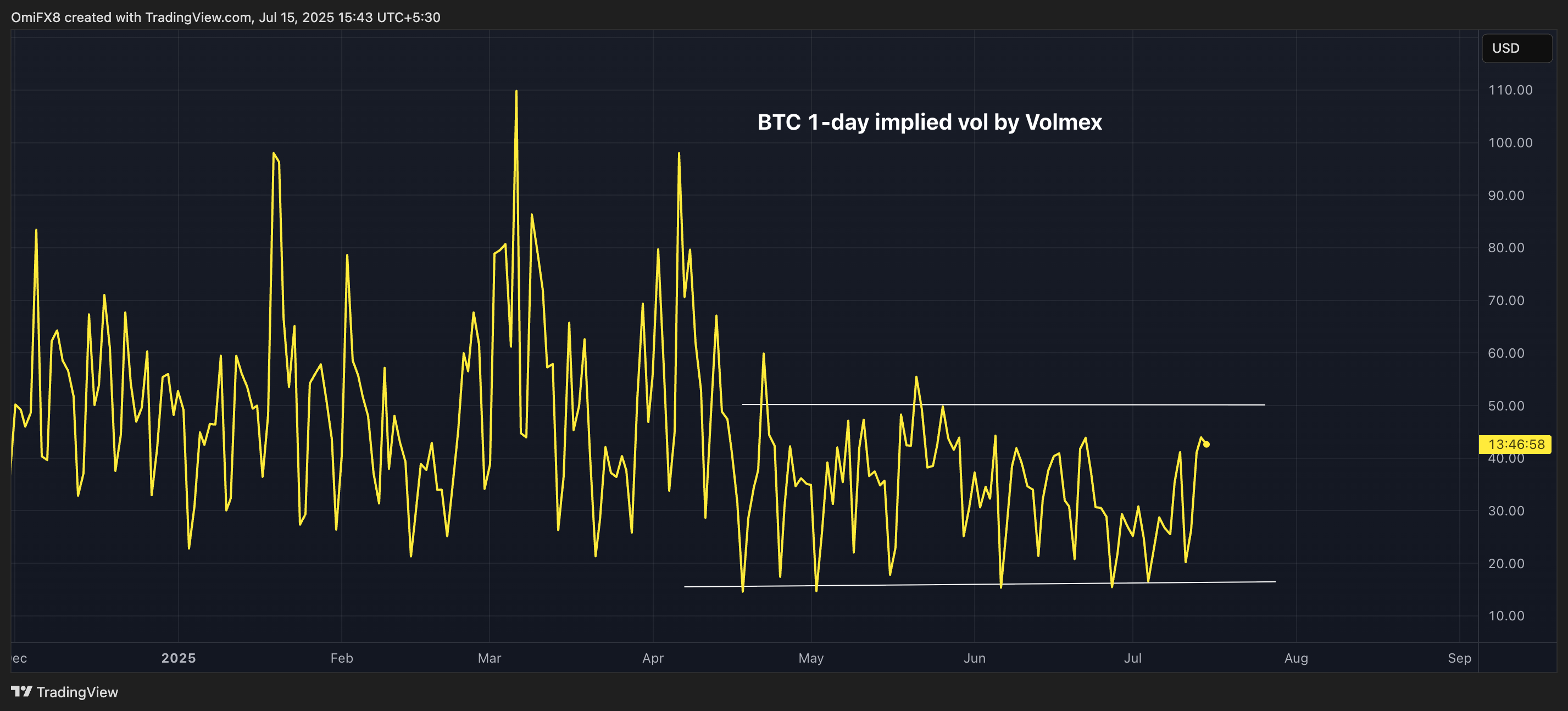

Chart of the Day

- Volmex's annualized one-day BTC implied volatility index remains locked in a sideways range.

- It's a sign that traders do not expect the impending U.S. CPI to breed significant market volatility.

While You Were Sleeping

- Bitcoin Rally Stalls as Long-Term Holders Cash Out (CoinDesk): Bitcoin dropped nearly 5% from its $123,000 peak with long-term holders — those holding BTC for over 155 days — accounting for the bulk of the $3.5 billion in profits realized over 24 hours.

- Standard Chartered Says It’s the First Global Bank to Offer Spot Bitcoin, Ether Trading (CoinDesk): Standard Chartered began offering spot bitcoin and ether trading to institutional clients in the U.K., saying it's the first global systemically important bank to provide such crypto asset services.

- Strategy Bears Cave In as Anti-MSTR Leveraged ETF Hits Rock Bottom (CoinDesk): The Defiance Daily Target 2X Short MSTR ETF (SMST) dropped 7.6% to a record low of $18.17 on Monday, with trading volume reaching its second-highest level ever at 2.88 million shares.

- Behind Trump’s Tough Russia Talk, Doubts and Missing Details (The New York Times): Trump warned of 100% tariffs on Russia’s trade partners if no ceasefire with Ukraine emerges within 50 days. Analysts say the threat lacks teeth because targets include China and U.S. allies.

- China’s Economy Slows as Consumers Tighten Belts, US Tariff Risks Mount (Reuters): China’s second-quarter growth slipped to 5.2% year-over-year, and falling consumption and looming U.S. tariffs are fueling concern that more stimulus may be needed to meet the 5% annual growth target.

- Plan to Boost Returns From Russian Assets ‘Expropriation’, Warns Euroclear (Financial Times): The European securities depository holding most frozen Russian assets said EU plans to reinvest them more aggressively could deepen legal exposure, damage financial credibility and provoke further retaliation from Moscow.

- BofA Poll Shows Investors Flock Into Risk Assets at Record Pace (Bloomberg): The 175 fund managers surveyed by Bank of America boosted allocations to U.S. and eurozone stocks at a record pace, citing stronger earnings, tech momentum, and optimism about trade deal prospects.

In the Ether