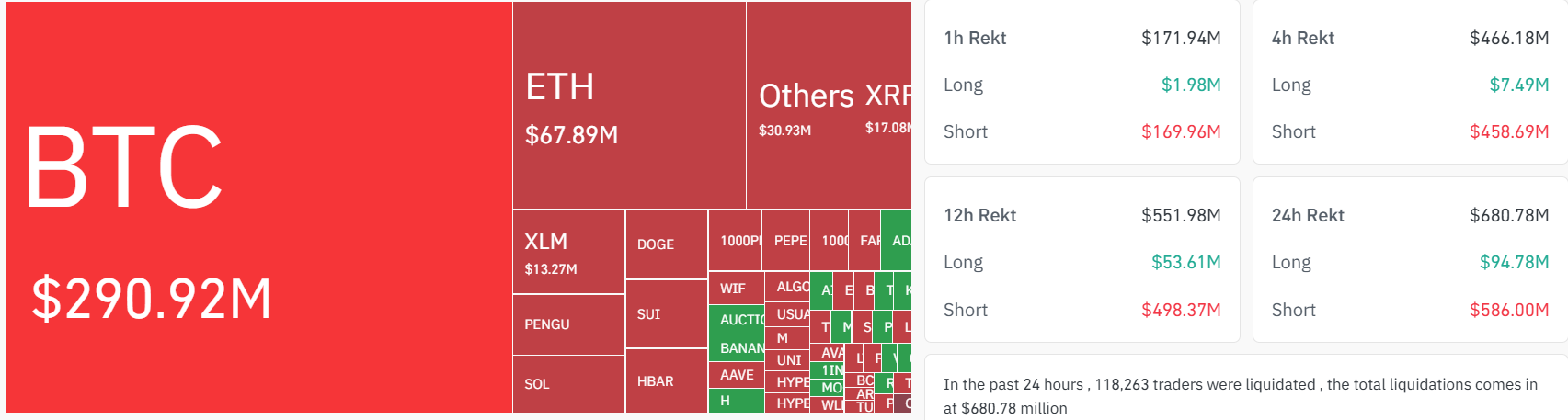

Bitcoin Bulls Crush Bears: $426M Shorts Liquidated as One Trader Loses $92M in Brutal Squeeze

Bitcoin just delivered a masterclass in volatility—and left short sellers nursing nine-figure losses.

The crypto king's sudden surge triggered a bloodbath for bearish traders, vaporizing $426 million in leveraged short positions. One unlucky (or overconfident?) player got rekt for $92 million alone—proof that betting against BTC still carries career-ending risk.

When will they learn? Wall Street's 'smart money' keeps treating crypto like a casino while missing the real game: Bitcoin doesn't care about your charts, fundamentals, or stop-losses. It eats overleveraged traders for breakfast.

Meanwhile, hodlers yawn and check their hardware wallets—another cycle, another reminder that time in the market beats timing the market. Even when traditional finance sneers, the blockchain keeps score in zeros and ones.

Meanwhile, Dogecoin (DOGE), Solana's SOL (SOL), and SUI (SUI) saw rising open interest, though with relatively smaller drawdowns, indicative of higher spot-based demand.

Liquidations occur when traders using leverage are forced to close their positions due to margin calls. While they often signal excessive positioning, they also serve as a reset mechanism for markets, flushing weak hands and clearing the way for new directional flow.

Bitcoin’s rally in the past week has sparked a broader breakout across major crypto assets. Traders say that market structure is evolving under the weight of institutional influence — with eyes on the $130,000 mark in the short term.