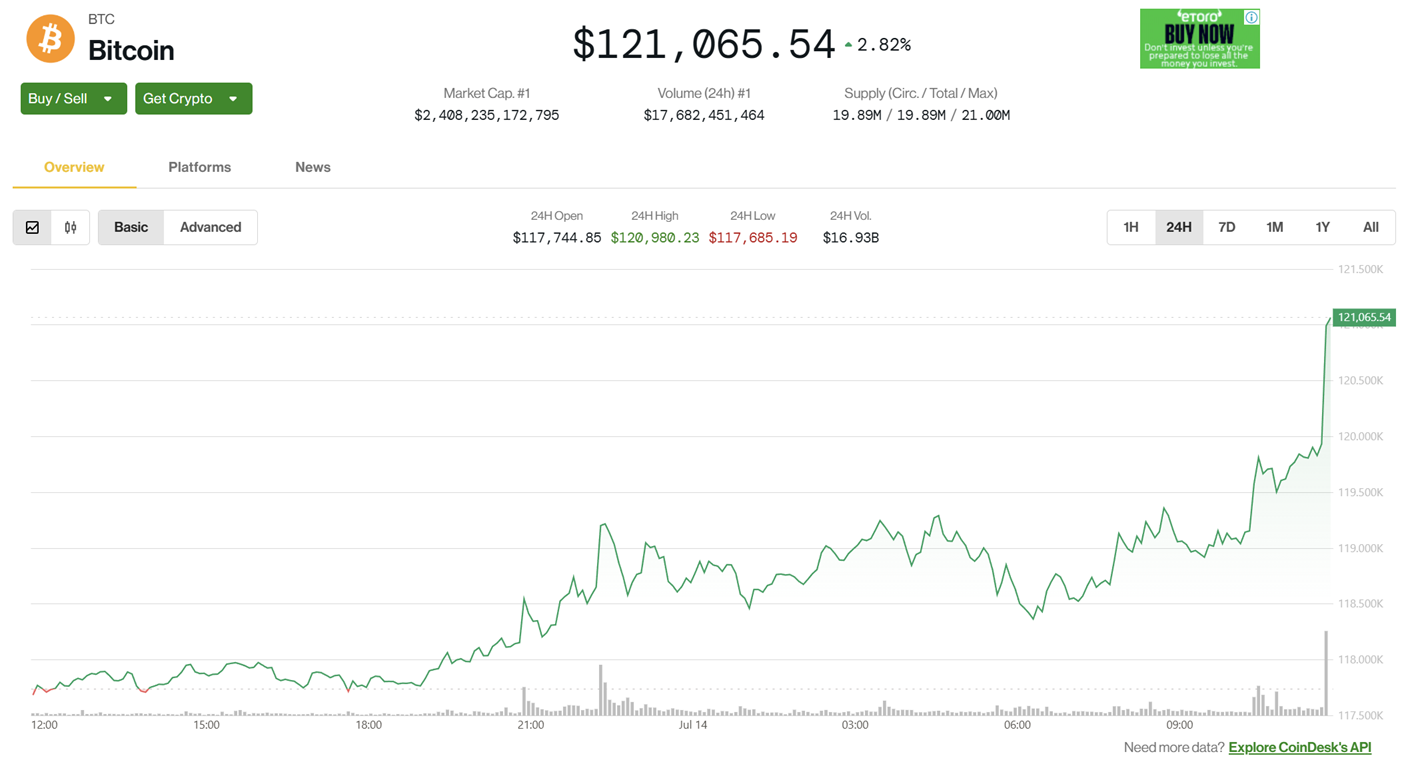

🚀 Bitcoin Shatters Records: Soars Past $120K Ahead of U.S. Inflation Bombshell

Bitcoin just rewrote the rulebook—again. The crypto king smashed through $120,000 like Wall Street bonuses through moral boundaries, marking a historic ATH as inflation jitters grip traditional markets.

Why this isn’t your grandma’s store of value:

While fiat currencies sweat over Fed reports, BTC’s supply cap laughs at quantitative easing. This rally’s timing? Poetic—just as the U.S. prepares to release CPI data that’ll either justify those ‘transitory inflation’ lies or send gold bugs scrambling.

The institutional effect:

BlackRock’s BTC ETF now holds more coins than MicroStrategy. Guess Jamie Dimon’s ‘fraud’ comments aged like milk in a bull market.

Cynical take: If Bitcoin’s volatility makes you queasy, maybe stick to Treasury bonds—where your money’s guaranteed to lose value at the government’s preferred pace.

The MOVE follows President Donald Trump's decision to impose a 30% tariff on the EU and Mexico, starting Aug. 1, and marks a bullish resolution to roughly 48 hours of choppy price action that allowed overbought signals from short-duration indicators to reset to bullish.

The focus now shifts to the U.S. inflation data due this week, which is expected to show the cost of living ticked up in June against the backdrop of Trump's trade war.

According to FactSet, economists expect that the consumer price index (CPI) rose 0.25% on a monthly basis in June, equating to 2.6% annualized growth. The Core CPI, which excludes the volatile food and energy, is forecast to have risen 0.3% monthly and 3% on an annualized basis.

Risk assets, including BTC, may wobble a bit if inflation accelerates, delaying the Fed rate cut. That said, the downside could be limited given the strong momentum in terms of corporate adoption of BTC, ETF inflows and positive regulatory outlook in the U.S.

According to John Glover, CEO of Ledn, BTC's rally has legs and prices could rise to $136,000 by the year-end.

"We have finally broken to new highs, which confirms that the dip to $96k in late June satisfied the wave (ii) pullback (yellow line) within the larger Wave 5 (orange line)," Glover said in an email.

"While this doesn’t change the ultimate target of circa $136k to complete this bull run, it does likely reduce the time it will take to complete. I was previously looking for this in Q1 of 2026, but now it looks likely to hit $136k by year-end," he added.