Ether & AI Tokens Eclipse Bitcoin: The 2025 Crypto Power Shift You Can’t Ignore

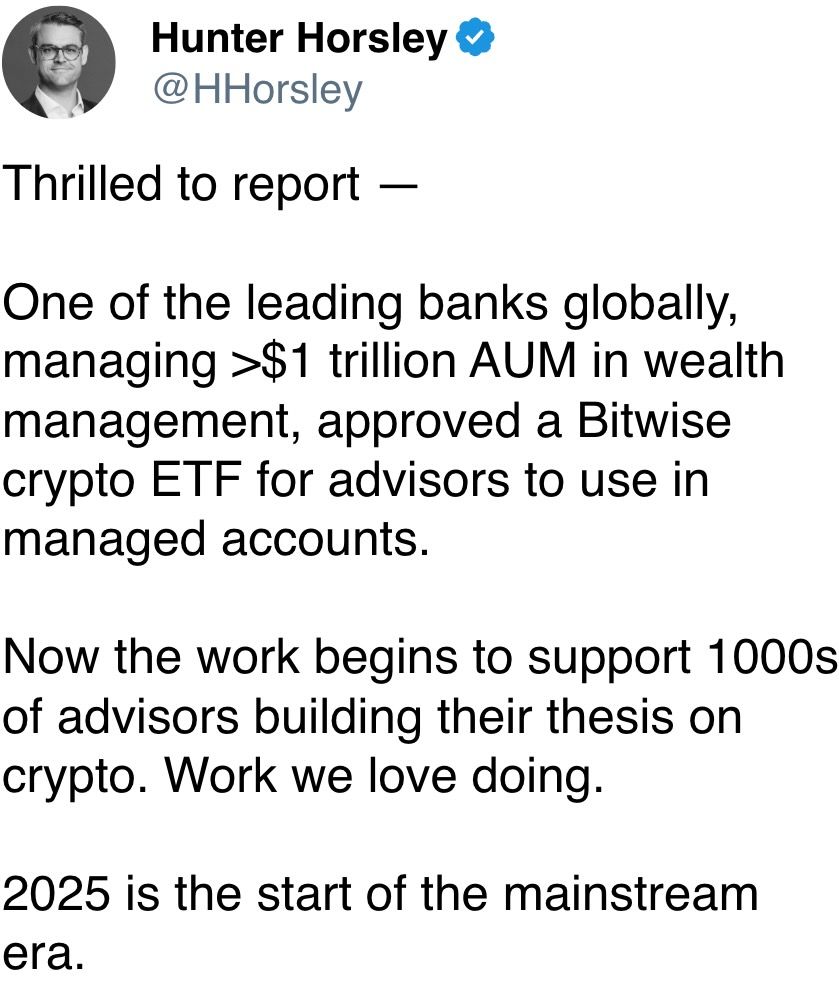

Move over, Bitcoin—there's a new narrative in town. Ethereum and AI-powered cryptocurrencies are rewriting the rules of crypto dominance as institutional money chases the next big tech bet.

The altcoin uprising

While Bitcoin maximalists nap on their digital gold, ETH's ecosystem is eating the world. Layer-2 networks now process transactions at Visa-scale speeds, and DeFi 3.0 protocols are doing things Wall Street still can't comprehend.

AI coins aren't just hype cycles

Machine learning tokens now power everything from decentralized compute markets to prediction engines that outperform hedge fund analysts (who still charge 2-and-20 for subpar returns). The merge of crypto and AI is creating self-improving smart contracts—and keeping regulators up at night.

The closer

Bitcoin will always be the OG, but 2025 belongs to the builders. Just don't tell the Bitcoin whales—they're too busy buying lambos with last cycle's profits.

What to Watch

- Crypto

- July 10, 10 a.m.: The Polygon (POL) Proof-of-Stake (PoS) blockchain is set to activate the Heimdall hard fork on mainnet, reducing finality time to around 5 seconds, and bringing "faster checkpoints, smoother UX, safer bridging, and head-room for the next wave of upgrades."

- July 14, 10 p.m.: Singapore High Court hearing on WazirX’s Scheme of Arrangement, marking a critical step in the exchange's restructuring after the $234 million hack on July 18, 2024.

- July 15: Alchemist staking update launches, allowing token holders to stake ALCH for access to advanced features, premium benefits and ecosystem rewards, potentially boosting token utility and demand.

- July 15: Lynq is expected to debut its real-time, interest-bearing digital-asset settlement network for institutions. Built on Avalanche’s layer-1 blockchain and powered by Arca’s tokenized U.S. Treasury fund shares, Lynq enables instant settlement, continuous yield accrual and improved capital efficiency.

- July 15, 3 p.m.: U.S. Senate Committee on Agriculture, Nutrition, and Forestry holds a market structure hearing titled “Stakeholder Perspectives on Federal Oversight of Digital Commodities.” Livestream link.

- July 16: July 16, 9 a.m.: U.S. House Ways and Means Committee oversight hearing titled "Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Built for the 21st Century."

- Macro

- July 10: The 37th U.K.-France Summit takes place in London, where British Prime Minister Keir Starmer and French President Emmanuel Macron will discuss defense cooperation and migration management.

- July 10, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases June consumer price inflation data.

- Inflation Rate MoM Est. 0.2% vs. Prev. 026%

- Inflation Rate YoY Est. 5.32% vs. Prev. 5.32%

- July 10, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended July 5.

- Initial Jobless Claims Est. 235K vs. Prev. 233K

- Continuing Jobless Claims Est. 1980K vs. Prev. 1964K

- July 10, 1:15 p.m.: Fed Governor Christopher J. Waller gives a speech at an event hosted by the Federal Reserve Bank of Dallas and the World Affairs Council of Dallas/Fort Worth. Livestream link.

- July 10–11: The fourth Ukraine Recovery Conference in Rome, bringing together global leaders and stakeholders to advance Ukraine’s recovery and reconstruction as the war with Russia drags on.

- July 11, 8:30 a.m.: Statistics Canada releases June employment data.

- Unemployment Rate est. 7.1% vs. Prev. 7%

- Employment Change Est. 0K vs. Prev. 8.8K

- Aug. 1, 12:01 a.m.: Reciprocal tariffs take effect after President Trump’s July 7 executive order delayed the original July 9 deadline, making this the start date for higher tariffs on imports from countries without trade deals.

- Earnings (Estimates based on FactSet data)

- July 23: Tesla (TSLA), post-market

- July 29: PayPal Holdings (PYPL), pre-market

- July 30: Robinhood Markets (HOOD), post-market

- July 31: Coinbase Global (COIN), post-market

- July 31: Reddit (RDDT), post-market

Token Events

- Governance votes & calls

- Compound DAO is running multiple votes on whether to adopt an Oracle Extractable Value (OEV) solution for Ethereum Mainnet, Unichain, Base, Polygon, Arbitrum, Optimism, Scroll, Mantle, Ronin and Linea. Delegates can choose between implementing Api3, Chainlink’s Secure Value Relay (SVR), or maintaining the current setup without OEV. Voting for all of these ends July 12.

- 1inch DAO is voting on a $25,000 grant proposal to research trustless cross-chain swaps between Bitcoin and Ethereum Virtual Machine networks using native Bitcoin tools like Taproot. Voting ends July 14.

- Aavegotchi DAO is voting on a $245,000 funding proposal to expand Gotchi Battler into a revenue-generating game with PvE modes, NFTs and battle passes, aiming to reverse declining player numbers, boost GHST utility, and create sustainable rewards. Voting ends July 22.

- Unlocks

- July 11: Immutable (IMX) to unlock 1.31% of its circulating supply worth $11.19 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating supply worth $52.14 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $15.69 million.

- July 15: Sei (SEI) to unlock 1% of its circulating supply worth $14.75 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating supply worth $33.35 million.

- July 18: Official TRUMP (TRUMP) to unlock 45.35% of its circulating supply worth $833.52 million.

- July 18: Fasttoken (FTN) to unlock 4.64% of its circulating supply worth $88.8 million.

- Token Launches

- July 10: JPY Coin (JPYC) to be listed on Binance.

- July 10: Pre-market derivatives on Pump.fun’s PUMP launch on Binance, Aevo.

- July 12: Pump.fun to launch itsiInitial coin offering (ICO) where 33% of the supply of PUMP will be sold. The ICO will be conducted on Bybit, Kraken, Bitget, MEXC, KuCoin and Gate.io.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- Day 1 of 4: Mallorca Blockchain Days (Palma, Spain)

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Token Talk

By Shaurya Malwa

- Pump.fun’s token PUMP is currently trading at $0.0056 on derivatives exchange Hyperliquid, a 40% premium to its impending ICO price of $0.004, as traders speculate on post-launch demand.

- The PUMP-USD perpetual contract went live on July 9 following community requests and offers up to 3x leverage.

- In its first 24 hours, the contract saw $30 million in trading volume, indicating strong interest despite the token not yet being live on-chain.

- Open interest on Hyperliquid stood at over $17 million during Asian morning hours on July 10.

- Activity is expected to rise further as Binance Futures introduces its own PUMP perpetual contract at 07:30 UTC today.

- The token sale will distribute 33% of the total 1 trillion supply, with 18% already allocated in a private round and 15% set for the public sale.

- Both tranches are priced at $0.004 and will be fully unlocked at launch.

- The project is marketing PUMP as more than a meme token — positioning it as the foundation for a decentralized Web3-native social platform that rivals TikTok, Twitch and Facebook by rewarding users with financial benefits instead of just engagement.

- Since its rise in early 2024, Pump.fun has played a central role in Solana’s memecoin boom, offering frictionless token launches and capturing over $600 million in protocol revenue, largely from trading and launch fees.

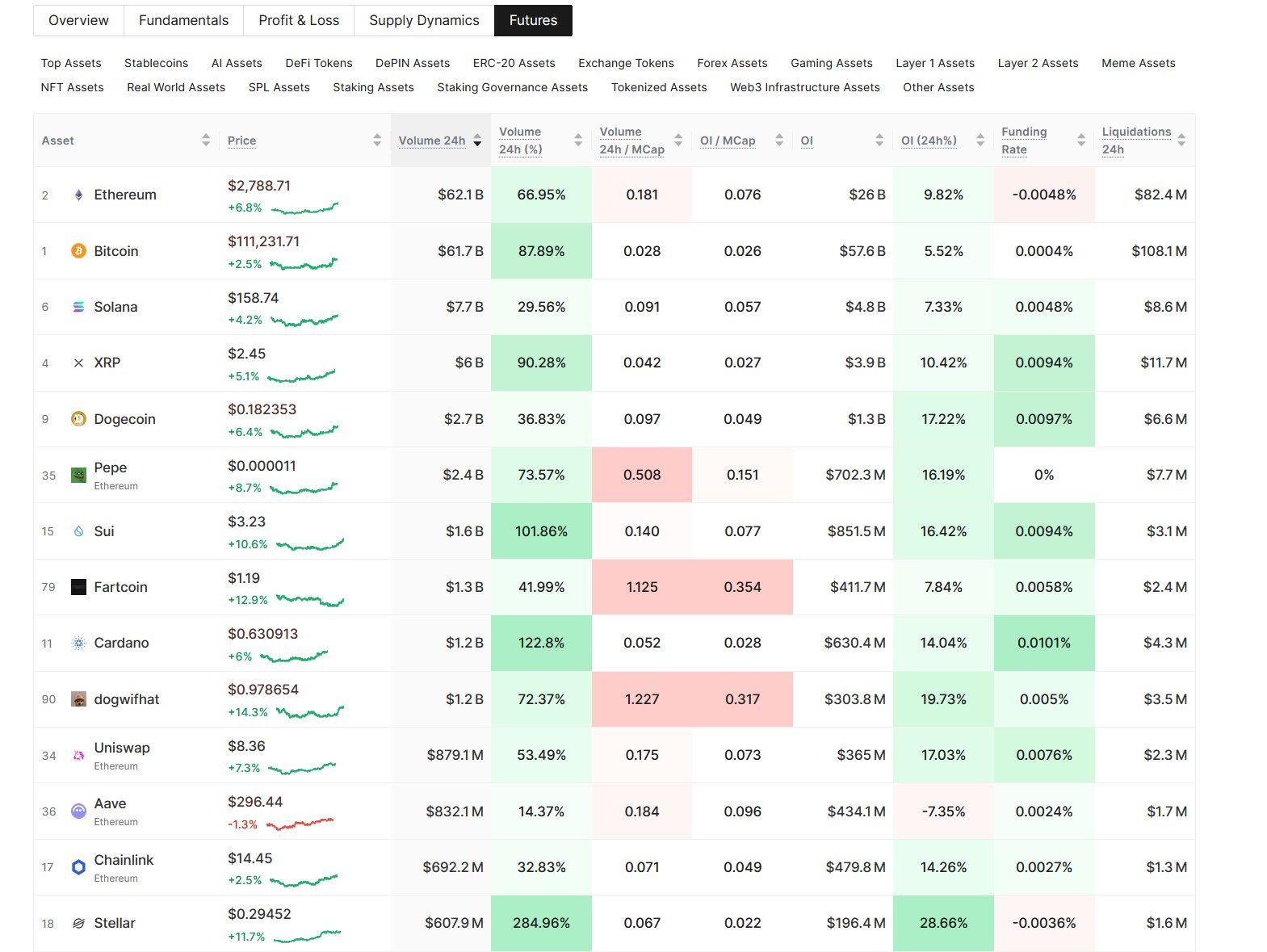

Derivatives Positioning

- BTC and ETH funding rates on offshore perpetual exchanges are holding below annualized 10% despite price rallies, indicating little signs of overheating.

- Ether perpetual futures open interest climbed for a fourth straight day, hitting a tally of 5.46 million ETH.

- Funding rates for XRP, DOGE, ADA, HYPE and SUI topped the 10% mark, indicating a growing interest in long positions.

- On the CME, three-month basis in BTC futures bounced slightly to 8% from 5% early this month, but overall activity remains subdued.

- On Deribit, BTC and ETH call skews strengthened across tenors. However, front-end options show relatively stronger call skew. That's a sign of under-positioned traders panic buying with the price rise.

- OTC network Paradigm reported mixed block flows in BTC options, featuring risk reversals and put spreads. Traders bought ETH topside across tenors from July to December.

Market Movements

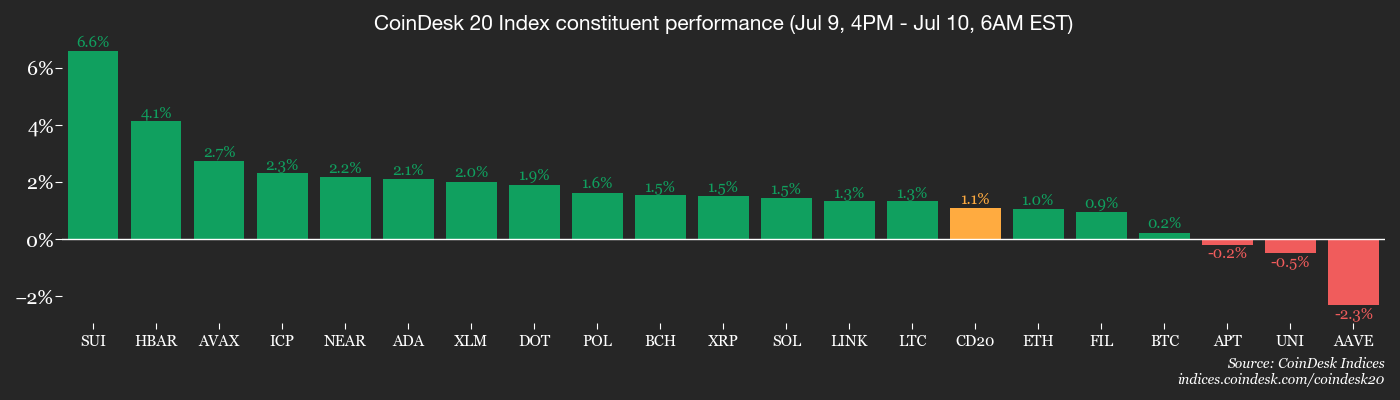

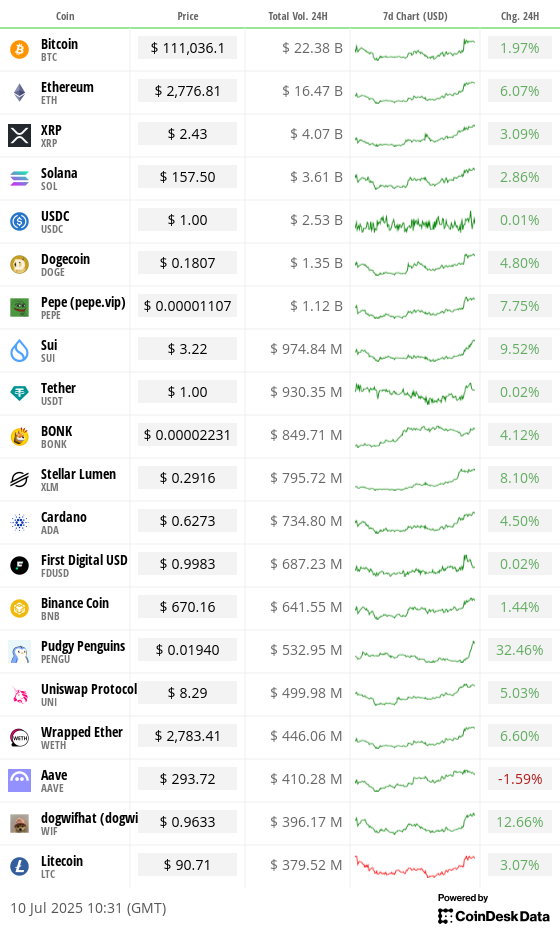

- BTC is up 0.31% from 4 p.m. ET Wednesday at $111,066.23 (24hrs: +1.99%)

- ETH is up 1.4% at $2,776.71 (24hrs: +6.09%)

- CoinDesk 20 is up 1.28% at 3,278.09 (24hrs: +3.75%)

- Ether CESR Composite Staking Rate is up 22 bps at 3.19%

- BTC funding rate is at 0.0083% (9.1224% annualized) on Binance

- DXY is down 0.16% at 97.40

- Gold futures are up 0.42% at $3,335.00

- Silver futures are up 0.68% at $36.88

- Nikkei 225 closed down 0.44% at 39,646.36

- Hang Seng closed up 0.57% at 24,028.37

- FTSE is up 1.12% at 8,966.42

- Euro Stoxx 50 is up 0.36% at 5,465.01

- DJIA closed on Wednesday up 0.49% at 44,458.30

- S&P 500 closed up 0.61% at 6,263.26

- Nasdaq Composite closed up 0.94% at 20,611.34

- S&P/TSX Composite closed up 0.26% at 26,972.32

- S&P 40 Latin America closed down 1.42% at 2,669.65

- U.S. 10-Year Treasury rate is up 1.2 bps at 4.354%

- E-mini S&P 500 futures are down 0.15% at 6,297.50

- E-mini Nasdaq-100 futures are down 0.13% at 23,022.00

- E-mini Dow Jones Industrial Average Index are down 0.20% at 44,631.00

Bitcoin Stats

- BTC Dominance: 64.55 (-0.32%)

- Ether-bitcoin ratio: 0.02506 (0.67%)

- Hashrate (seven-day moving average): 902 EH/s

- Hashprice (spot): $60.45

- Total fees 4.95 BTC / $541,118

- CME Futures Open Interest: 151,575

- BTC priced in gold: 33.4 oz.

- BTC vs gold market cap: 9.47%

Technical Analysis

- The BTC breakout from the counter-trend channel, although encouraging, still warrants caution as prices remain below the May high of around $112K.

- A firm move above that level is needed to cement bullish expectations, opening doors for $115K, the long-term trendline hurdle. The positive MACD histogram supports the bull case.

- Still, traders need to be vigilant for a renewed weakness here as that would likely strengthen the double top narrative, leading to a self-fulfilling decline.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $415.41 (+4.65%), -0.38% at $413.85

- Coinbase Global (COIN): closed at $373.85 (+5.36%), +1.34% at $378.87

- Circle (CRCL): closed at $200.68 (-2.02%), +3.72% at $208.15

- Galaxy Digital (GLXY): closed at $20.17 (+3.65%), +0.3% at $20.23

- MARA Holdings (MARA): closed at $18.46 (+5.37%), +0.81% at $18.61

- Riot Platforms (RIOT): closed at $12.24 (+5.79%), -0.33% at $12.20

- Core Scientific (CORZ): closed at $13.43 (-4.21%), -0.3% at $13.39

- CleanSpark (CLSK): closed at $12.47 (+7.5%), -0.16% at $12.45

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.24 (+1.37%)

- Semler Scientific (SMLR): closed at $42.32 (+1.46%), +0.14% at $42.38

- Exodus Movement (EXOD): closed at $32.4 (+0.87%), unchanged in pre-market

ETF Flows

- Daily net flows: $215.7 million

- Cumulative net flows: $50.13 billion

- Total BTC holdings ~1.26 million

- Daily net flows: $211.3 million

- Cumulative net flows: $4.74 billion

- Total ETH holdings ~4.22 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Ether has replaced bitcoin as the most active cryptocurrency in the futures market.

- The switch follows reports that market makers are "short gamma" in ether options and could trade in the direction of the market, adding to volatility.

While You Were Sleeping

- This One Metric Suggests Bitcoin Has Plenty of Room Left to Run (CoinDesk): Despite a wave of corporate adoption, with public companies adding bitcoin and fueling a boom in the BTC price, on-chain data suggests there's room for further gains. The MVRV Z-Score of 2.4 remains far below the 7+ levels seen at past cycle peaks.

- BlackRock's Spot Ether ETF Registers Record Trading Volume of 43M Amid Net Inflows of $158M (CoinDesk): Daily volumes have been rising for over a month, as evidenced by the 30-day average, which climbed to a record 18.83 million from 12.97 million in early June, TradingView data shows.

- Bitcoin Bulls Increase Exposure as Trump's Pressure on Fed Pushes $15B Into BTC ETFs, Analyst Says (CoinDesk): The relentless flows are now forcing "under-positioned" traders to chase upside through derivatives, reviving the bullish momentum in the cryptocurrency, according to Markus Thielen, founder of 10x Research.

- Trump Says 50% Tariff on Copper Imports Will Begin Aug. 1 (CNBC): In a Wednesday Truth Social post, the president cited national security concerns, highlighting copper’s importance to the Department of Defense. The metal has surged over 15% in the past two days.

- Brazil Won’t Take Orders From Trump, President Says (The Wall Street Journal): Trump linked the 50% tariff on Brazil to the prosecution of former leader Jair Bolsonaro, prompting President Lula to denounce U.S. interference and convene an emergency cabinet meeting to plan a reciprocal response.

- Starmer and Macron Agree to Nuclear Deterrence Pact to Fend Off Threat to Europe (New York Times): Britain and France’s new pact marks their first coordinated nuclear strategy and reflects growing pressure to bolster European defense as U.S. support for Ukraine becomes less certain.

In the Ether