Bitcoin’s Hidden Growth Signal: Why This Metric Points to Massive Upside Ahead

Bitcoin's not done yet—and one key indicator screams bullish.

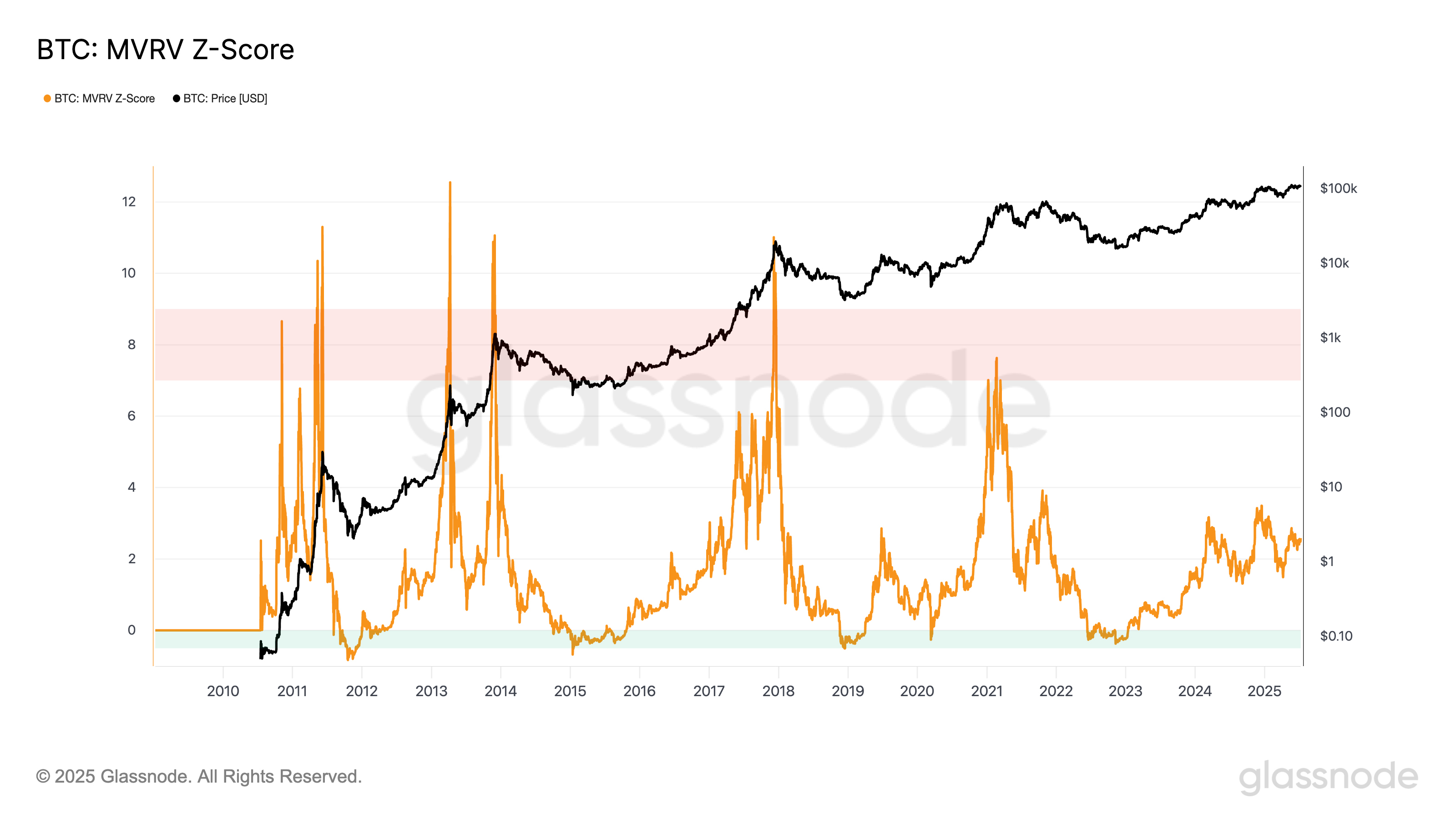

Forget the noise. While Wall Street debates 'overbought' signals, a rarely discussed on-chain metric suggests BTC's rally has legs. We're talking about the kind of structural demand that precedes parabolic moves.

Here's what matters:

The Accumulation Game

Whales aren't selling—they're stacking. Exchange reserves just hit a 5-year low as long-term holders refuse to cash out. That's supply shock 101.

Network Momentum

Active addresses are climbing despite higher prices. Retail FOMO? Maybe. But institutional wallets are growing faster—a telltale sign of real adoption.

The Cynical Kick

Meanwhile, traditional finance still can't decide if crypto is 'digital gold' or a 'Ponzi scheme.' Good. More time for us to accumulate before they finally 'discover' it (with 2% management fees, of course).

Bottom line? When this metric flashes green, history says ignore it at your peril. The runway looks longer than most think.