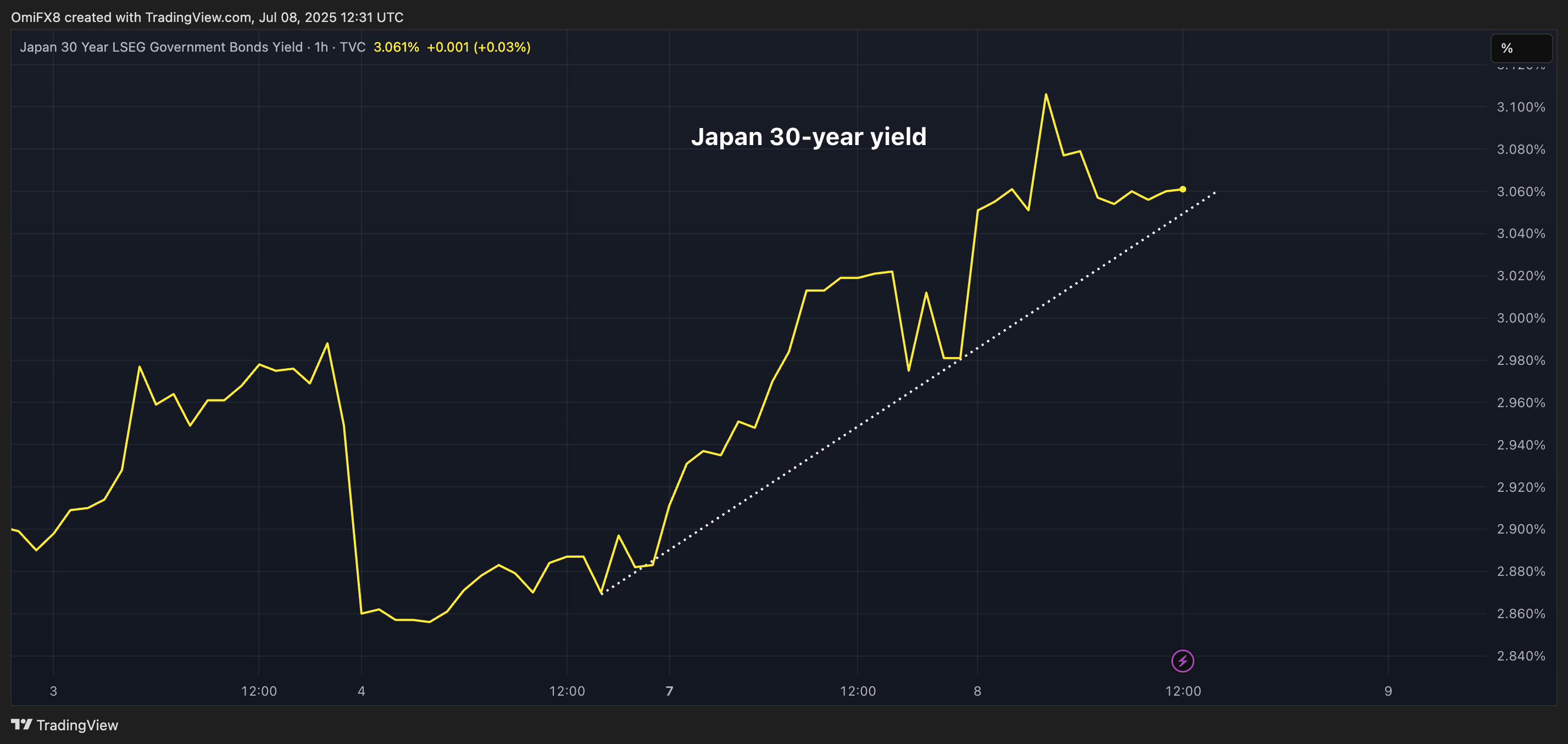

Japan’s 30-Year Yield Spike Sends Shockwaves Through Risk Assets – Macro Markets on High Alert

Tokyo's bond market just dropped a truth bomb—and risk assets might not like what they're hearing.

The yield curve's revenge

Japan's 30-year government bond yield is doing its best Godzilla impression, trampling through Tokyo's financial district. When the world's third-largest economy starts flashing bond market fireworks, global traders reach for their risk-off hard hats.

Liquidity vampires awake

Higher long-term yields suck capital out of risk assets faster than a Goldman Sachs algo. Crypto traders know the drill—when sovereign debt starts offering real returns, the 'digital gold' narrative gets tested.

The BoJ's impossible choice

Japan's central bankers are trapped between defending yield curve control and watching their currency implode. Meanwhile, crypto markets keep trading like they're immune to traditional finance rules—until they're not.

Remember kids: in macro, there are no free lunches—just different expiration dates on the pain. (And yes, we see you there, 'stablecoin yields'—looking suspiciously like 2008 shadow banking with extra steps.)

The uptick likely represents markets' concerns about fiscal profligacy ahead of the impending Upper House election in Japan later this month. Last week, Japan's Prime Minister Shigeru Ishiba defended his plans to distribute cash handouts as the opposition called for tax cuts.

Further, President Donald Trump's decision to impose a 25% tariff on Japan may be causing stress in the market.

Watch out for rates volatility

The latest uptick in the Japanese ultra-long bond yields could add to the momentum in yields in the U.S. and other countries, whose governments are spending beyond their means.

That, in turn, may lift rates volatility, potentially causing financial tightening and weighing over risk assets, including bitcoin. crypto bulls, therefore, may want to keep track of the MOVE index, which measures the options-based 30-day implied volatility in the U.S. Treasury notes.

Historically, majors tops in BTC have corresponded to bottoms in the MOVE index and vice versa.

Focus on Thursday's auction

The volatility in JGB and other bond markets may increase later this week if the Japanese Ministry of Finance’s sale of 20-year bonds on Thursday disappoints expectations.

According to Bloomberg, the 20-year bond auction has a history of disappointing outcomes, leading to volatility in longer-duration bond yields.

Japan is no longer a source of low rates

For years, Japan maintained ultra-low bond yields through a cocktail of unconventional monetary policy measures. That effectively exerted downward pressure on yields across the advanced world, while underpinning the Japanese yen's role as funding currency for the risk-on carry trades.

However, since 2023, Japan has slowly normalized its monetary policy, greasing the rally in yields worldwide.