XRP Traders Target $10 as Ripple’s U.S. Banking Push Fuels Market Frenzy

Ripple’s latest U.S. banking gambit has XRP bulls dreaming of double digits—because nothing screams 'financial revolution' like chasing a price target last seen in crypto’s reckless adolescence.

Banking on Banks

Ripple’s relentless courtship of U.S. financial institutions is injecting fresh adrenaline into XRP markets. Traders are dusting off 2021’s playbook, betting regulatory clarity could turn the remittance token into Wall Street’s favorite crypto middleman.

The $10 Mirage

That audacious price prediction hinges on Ripple executing a perfect trifecta: winning its SEC lawsuit, onboarding major banks, and convincing the world that cross-border settlements need a blockchain Band-Aid. Meanwhile, Bitcoin ETFs are eating the traditional finance pie—but who needs institutional adoption when you’ve got hopium?

News Background

- The cryptocurrency market remains on edge as geopolitical and trade tensions between major economies continue to cloud investor confidence.

- However, XRP’s long-term outlook is bolstered by Ripple’s ongoing push for regulatory clarity and deeper financial integration.

- The firm’s recent application for a U.S. national banking license with the OCC, alongside a separate bid for a Federal Reserve master account, could unlock direct access to the Fed’s payment systems — a groundbreaking development for a crypto-native firm.

- Analysts also point to structural bullish signals, with XRP forming higher highs and higher lows across multiple timeframes.

- Momentum could further accelerate if Ripple secures ETF approval or regulatory breakthroughs, particularly as XRP is increasingly eyed for CBDC bridge infrastructure by more than 50 countries.

- A potential move to $10 — or even higher — is being discussed by market observers, contingent on sustained institutional adoption and market alignment.

Technical Analysis

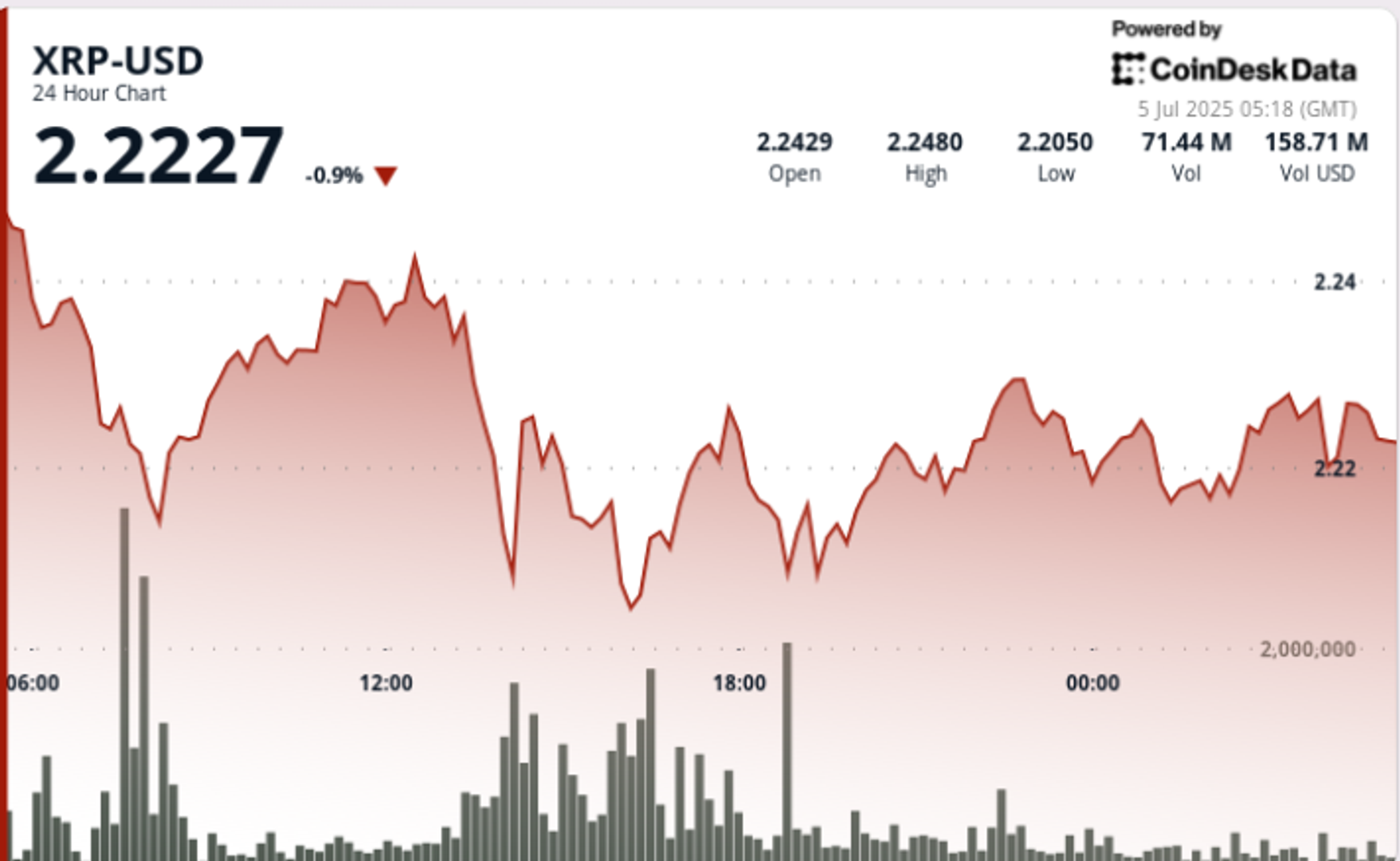

• XRP experienced a notable downtrend over the last 24 hours from 4 July 03:00 to 5 July 02:00, declining from $2.243 to $2.219, representing a 1.07% decrease with a trading range of $0.052 (2.32%).

• The asset encountered strong selling pressure during the 07:00 and 14:00 hours, with volume spikes exceeding 56 million units, establishing key support at $2.209 where buyers consistently emerged.

• A temporary recovery attempt occurred between 21:00-22:00 with price climbing to $2.230 on above-average volume, but momentum failed to sustain, suggesting continued bearish sentiment.

• In the last 60 minutes from 5 July 01:06 to 02:05, XRP experienced a notable decline of 0.35%, dropping from $2.225 to $2.217.

• A significant sell-off occurred at 01:12 where price fell to $2.221 on volume exceeding 418,000 units.

• The asset found temporary support at $2.216 around 01:29 before staging a recovery attempt at 01:59 with the highest volume spike of nearly 249,000 units, pushing price to $2.219.