Bitcoin Nears ATH as Traders Go All-In on Shorts—Here’s Why They’re Playing With Fire

Bitcoin's grinding ascent toward record highs has triggered a frenzy of bearish bets—just as the market's coiled for a potential breakout.

Short sellers pile on

Futures data reveals speculators are loading up on BTC shorts near key resistance levels. Classic 'dumb money' move or calculated hedge? Either way, liquidity hunters smell blood.

The contrarian indicator no one wants to acknowledge

History shows retail traders consistently mis-time market tops. This time, Wall Street's algos might just feast on their leveraged carcasses—again.

Meanwhile, the smart money's quietly...

Institutional accumulation continues unabated. But hey, keep shorting that 'dead' asset while BlackRock builds another ETF vault. What could go wrong?

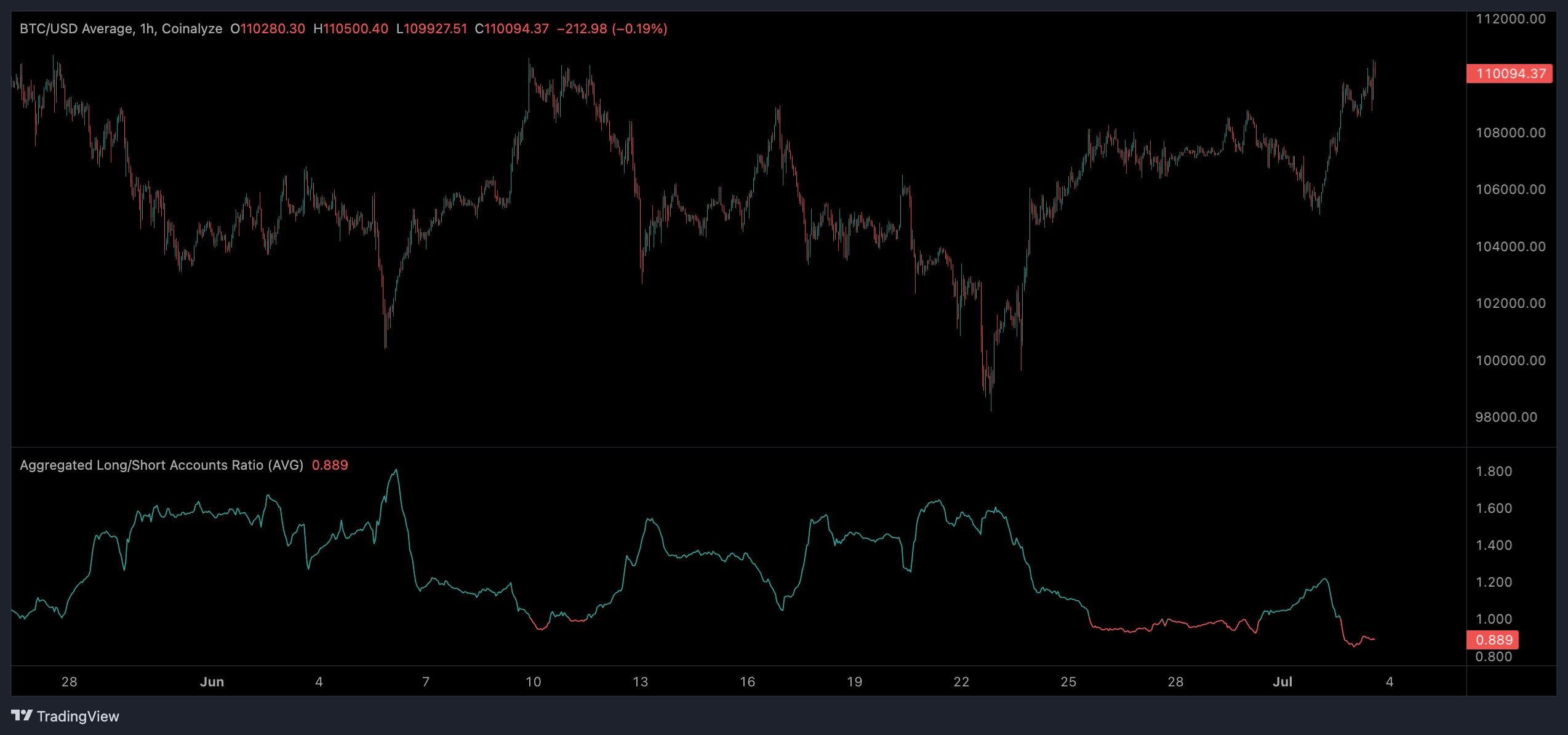

Bitcoin has been trapped in a relatively tight range since early May, trading between $100,000 and $110,000 with three tests of each level of support and resistance.

Technical indicators like relative strength index (RSI) continue to paint a bearish image with several drives of bearish divergence, with RSI weakening on each test of $110,000.

The recent influx of short positions could well be lower timeframe traders capitalizing on the range, shorting resistance before reversing their trade at each test of $100,000.

This rang true on June 22 when the long/short ratio shot up to 1.68 as bitcoin momentarily slumped through $100,000 before bouncing.

There is a potential bull case with the increase in short positions: a short squeeze. This WOULD occur if bitcoin begins to trigger liquidation points and stop losses above a record high, which would cause an impulse in buy pressure and continuation to the upside.