Bitcoin Defies Gravity: July Rally Leaves Options & Futures Traders Unfazed

BTC's summer surge hits stride as derivatives markets shrug—classic crypto irony.

The disconnect deepens: Spot prices rip while paper traders nap.

Futures open interest flatlines like a DeFi project post-VC unlock. Meanwhile, options traders price risk like it's still 2023—either genius foresight or terminal FOMO.

Wall Street's structured product desks quietly reload the cannon: 'Volatility harvesting' they call it; 'dumb money recycling' we call it.

What to Watch

- Crypto

- July 2: Shares of the REX-Osprey Solana Staking ETF (SSK) are expected to begin trading on the Cboe BZX Exchange, making it the first U.S.-listed ETF to combine SOL price exposure with on-chain staking rewards.

- July 15: Lynq is expected to launch its real-time, interest-bearing digital asset settlement network for institutions. Built on Avalanche’s layer-1 blockchain and powered by Arca’s tokenized U.S. Treasury fund shares, Lynq enables instant settlement, continuous yield accrual and improved capital efficiency.

- Macro

- Day 3 of 3: ECB Forum on Central Banking (Sintra, Portugal)

- July 2, 9:30 a.m.: S&P Global releases June Canada data on manufacturing and services activity.

- Manufacturing PMI Prev. 46.1

- July 3, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June employment data.

- Non Farm Payrolls Est. 110K vs. Prev. 139K

- Unemployment Rate Est. 4.3% vs. Prev. 4.2%

- Government Payrolls Prev. -1K

- Manufacturing Payrolls Est. -6K vs. Prev. -8K

- July 3, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended June 28.

- Initial Jobless Claims Est. 240K vs. Prev. 236K

- Continuing Jobless Claims Est. 1960K vs. Prev. 1974K

- July 3, 9 a.m.: S&P Global releases June Brazil data on manufacturing and services activity.

- Composite PMI Prev. 49.1

- Services PMI Prev. 49.6

- July 3, 9:45 a.m.: S&P Global releases (final) June U.S. data on manufacturing and services activity.

- Composite PMI Est. 52.8 vs. Prev. 53

- Services PMI Est. 53.1 vs. Prev. 53.7

- July 3, 10 a.m.: The Institute for Supply Management (ISM) releases June U.S. services sector data.

- Services PMI Est. 50.5 vs. Prev. 49.9

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- GnosisDAO is voting on renewing its partnership with Nethermind for Gnosis Chain maintenance and development, proposing 750,000 DAI funding for the first year from June, with 4% annual increases. Voting ends July 2.

- Radiant DAO is voting on potentially compensating users whose wallets were drained via unlimited token approvals in the October 2024 hack. If passed, a follow-up plan would outline stablecoin conversions, claim contracts on Arbitrum and phased repayments. Voting ends July 2.

- Arbitrum DAO is voting on lowering the constitutional quorum threshold from 5% to 4.5% of votable tokens. This aims to match decreased voter participation and help well-supported proposals pass more easily, without affecting non-constitutional proposals, which remain at a 3% quorum. Voting ends July 4.

- Polkadot Community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- Unlocks

- July 2: Ethena (ENA) to unlock 0.67% of its circulating supply worth $10.58 million.

- July 11: Immutable (IMX) to unlock 1.31% of its circulating supply worth $10.61 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating supply worth $51.69 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $14.39 million.

- July 15: Sei (SEI) to unlock 1% of its circulating supply worth $15.63 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating supply worth $31.76 million.

- Token Launches

- July 4: Biswap (BSW), Stella (ALPHA), Komodo (KMD), LeverFi (LEVER), and LTO Network (LTO) to be delisted from Binance.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- Day 3 of 4: Ethereum Community Conference (Cannes, France)

- Day 3 of 6: World Venture Forum 2025 (Kitzbühel, Austria)

- Day 2 of 6: Bitcoin Alaska (Juneau, Alaska)

- July 4-5: The Bitcoin Paradigm 2025 (Neuchâtel, Switzerland)

- July 4–6: ETHGlobal Cannes (Cannes, France)

- July 10-13: Mallorca Blockchain Days (Palma, Spain)

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Derivatives Positioning

- BTC and ETH futures open interest remain flat at around $25 billion and $11 billion, respectively, showing lack of interest from traders as prices trade and back and forth in a narrow range.

- XRP's open interest has ticked up to a four-week high of $1.4 billion alongside flat-to-negative funding rates, which indicates bias for bearish bets.

- SOL, BCH, SUI, XLM and SHIB markets also showed negative funding rates, while XMR exhibited bullish bias with near 20% rates.

- On Deribit, BTC and ETH options risk reversals continued to show a lack of clear directional bias in short- and near-term tenors, with mild bullishness emerging from September-October expiries.

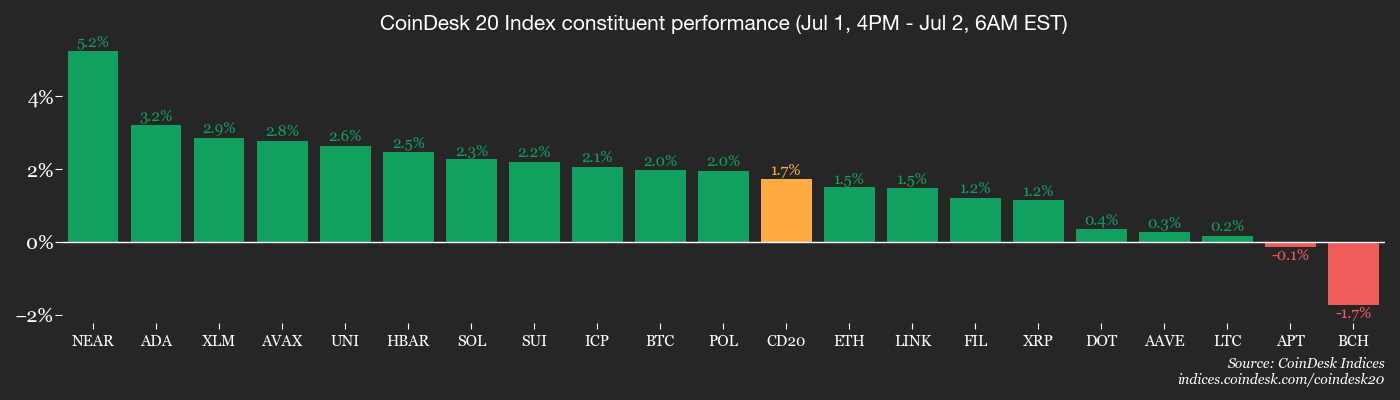

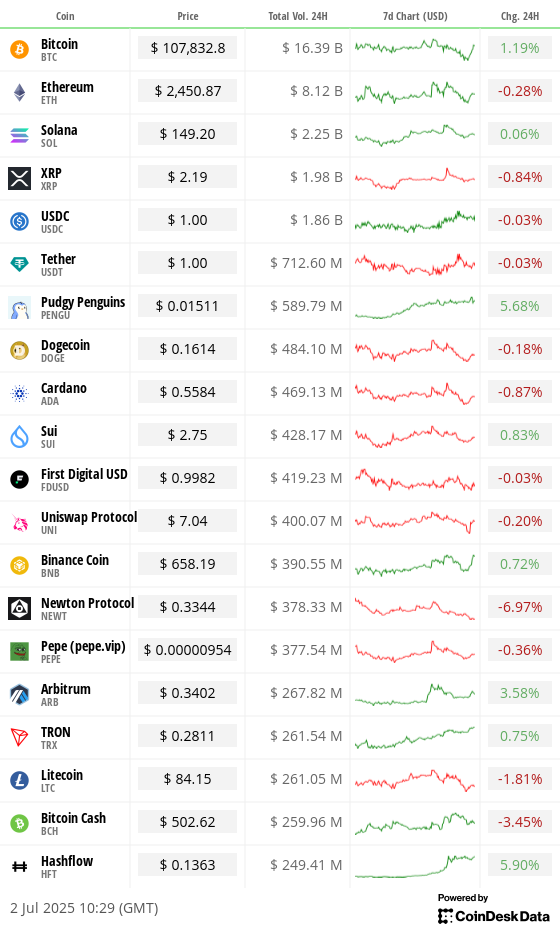

Market Movements

- BTC is up 1.62% from 4 p.m. ET Tuesday at $107,684.07 (24hrs: +1.09%)

- ETH is up 1.33% at $2,449.08 (24hrs: -0.36%)

- CoinDesk 20 is up 1.36% at 3,007.13 (24hrs: -0.1%)

- Ether CESR Composite Staking Rate is up 4 bps at 3%

- BTC funding rate is at 0.006% (6.5328% annualized) on Binance

- DXY is up 0.13% at 96.94

- Gold futures are unchanged at $3,350.50

- Silver futures are up 0.15% at $36.45

- Nikkei 225 closed down 0.56% at 39,762.48

- Hang Seng closed up 0.62% at 24,221.41

- FTSE is up 0.26% at 8,808.17

- Euro Stoxx 50 is up 0.68% at 5,318.56

- DJIA closed on Tuesday up 0.91% at 44,494.94

- S&P 500 closed down 0.11% at 6,198.01

- Nasdaq Composite closed down 0.82% at 20,202.89

- S&P/TSX Composite closed up 0.62% at 26,857.11

- S&P 40 Latin America closed up 0.24% at 2,701.08

- U.S. 10-Year Treasury rate is up 3.6 bps at 4.285%

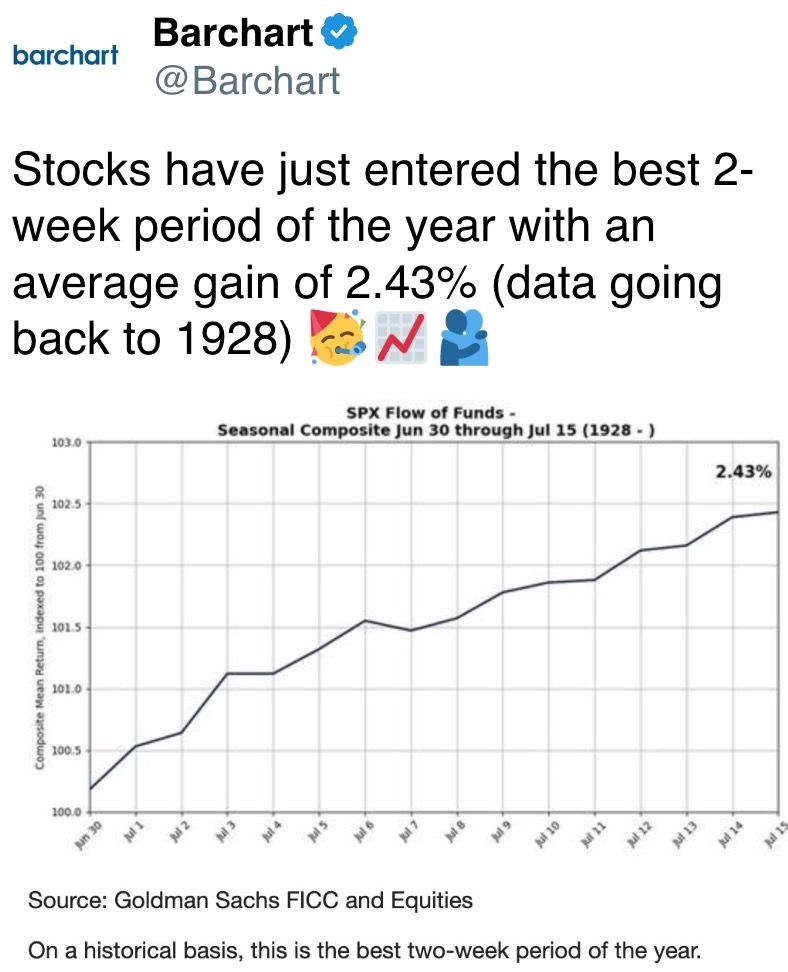

- E-mini S&P 500 futures are up 0.12% at 6,256.25

- E-mini Nasdaq-100 futures are unchanged at 22,710.50

- E-mini Dow Jones Industrial Average Index are up 0.15% at 44,873.00

Bitcoin Stats

- BTC Dominance: 65.65 (+0.17%)

- Ethereum to bitcoin ratio: 0.02277 (0.04%)

- Hashrate (seven-day moving average): 878 EH/s

- Hashprice (spot): $58.44

- Total Fees: 4.19 BTC / $446,034

- CME Futures Open Interest: 146,945

- BTC priced in gold: 32.3 oz.

- BTC vs gold market cap: 9.10%

Technical Analysis

- Bitcoin cash (BCH) has recently outperformed BTC and other major cryptocurrencies.

- Still, it remains locked in a broad range identified by trendlines connecting April 2024 and December 2024 highs and August 2024 and April 2025 lows.

- A potential breakout would confirm a long-term bullish shift in momentum.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $373.30 (-7.65%), +2.98% at $384.44 in pre-market

- Coinbase Global (COIN): closed at $335.33 (-4.33%), +2.54% at $343.85

- Circle (CRCL): closed at $192.53 (+6.2%), +0.97% at $194.40

- Galaxy Digital (GLXY): closed at $21.31 (-2.69%), +3.05% at $21.96

- MARA Holdings (MARA): closed at $15.70 (+0.13%), +2.42% at $16.08

- Riot Platforms (RIOT): closed at $11.27 (-0.27%), +3.19% at $11.63

- Core Scientific (CORZ): closed at $17.25 (+1.05%), +0.12% at $17.27

- CleanSpark (CLSK): closed at $11.08 (+0.45%), +2.89% at $11.40

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.09 (+1.54%)

- Semler Scientific (SMLR): closed at $35.42 (-8.57%), +3.08% at $36.51

- Exodus Movement (EXOD): closed at $29 (+0.59%), -2.76% at $28.20

ETF Flows

- Daily net flows: -$342.2 million

- Cumulative net flows: $48.61 billion

- Total BTC holdings ~ 1.25 million

- Daily net flows: $40.7 million

- Cumulative net flows: $4.27 billion

- Total ETH holdings ~ 4.11 million

Source: Farside Investors

Overnight Flows

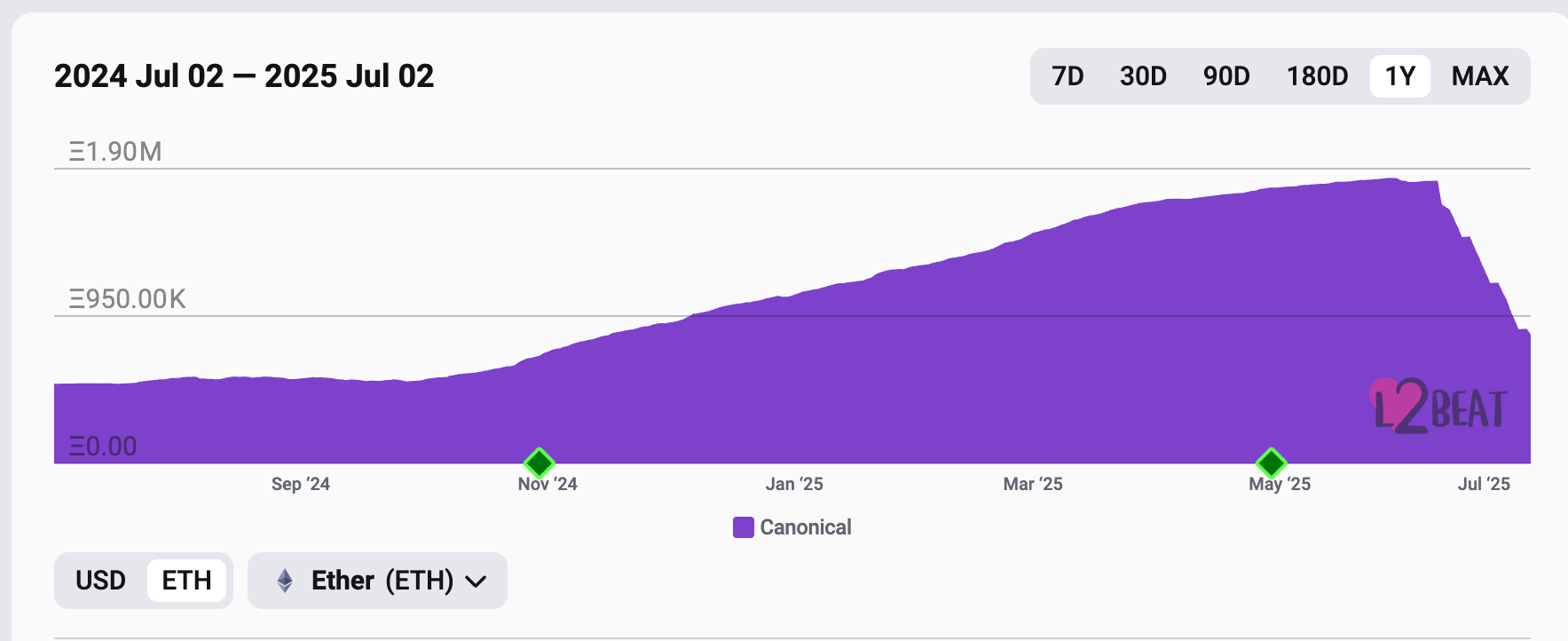

Chart of the Day

- The number of ETH deposited on Coinbase's layer-2 blockchain, Base, through crypto bridges has crashed to 831,980 from 1.81 million a month ago.

- The reason for the exodus is not known.

While You Were Sleeping

- Iran Made Preparations to Mine the Strait of Hormuz, U.S. Sources Say (Reuters): After Israel’s initial airstrikes, Iran loaded naval mines onto vessels, a move U.S. intelligence interpreted as serious preparation to blockade the critical Strait of Hormuz, according to two U.S. officials.

- Visa, Mastercard Race to Tame a $253 Billion Crypto Threat (Bloomberg): With stablecoin legislation poised for presidential approval, Visa and Mastercard are ramping up integration efforts, framing the tokens not as threats but as enablers of new use cases.

- Bitcoin CME Futures Premium Slides, Suggests Waning Institutional Appetite (CoinDesk): Bitcoin’s CME futures premium has fallen to its lowest since October 2023, according to 10x Research. Combined with negative funding rates, this signals bearish sentiment and reduced arbitrage activity.

- Stablecoin Push Gains Ground in China in New Challenge to U.S. (Bloomberg): Recent remarks from China’s central bank governor revived interest in stablecoins for global payments. Morgan Stanley's Robin Xing proposed Hong Kong as a testing ground for offshore yuan tokens.

- Deutsche Bank’s DWS, Galaxy, Flow Traders Venture to Introduce German-Regulated Stablecoin (CoinDesk): The AllUnity joint venture secured a BaFin license to launch EURAU, a MiCA-compliant euro stablecoin that will be fully backed and offer institutional-grade transparency via proof-of-reserves and regulatory reporting.

- Trump Said Trade Deals Would Come Easy. Japan Is Proving Him Wrong. (The Wall Street Journal): Japanese officials say any trade deal must lower U.S. industry-specific tariffs, noting that failure to secure relief could trigger political backlash ahead of Japan’s July 20 upper house election.

In the Ether