XRP, TRX, DOGE Defy Gravity With Bullish Funding Rates as Bitcoin Braces for Its Worst Quarter

Crypto's underdogs are stealing the spotlight while Bitcoin limps into its seasonally weak period. Here's why traders are betting against the grain—and how long the party might last.

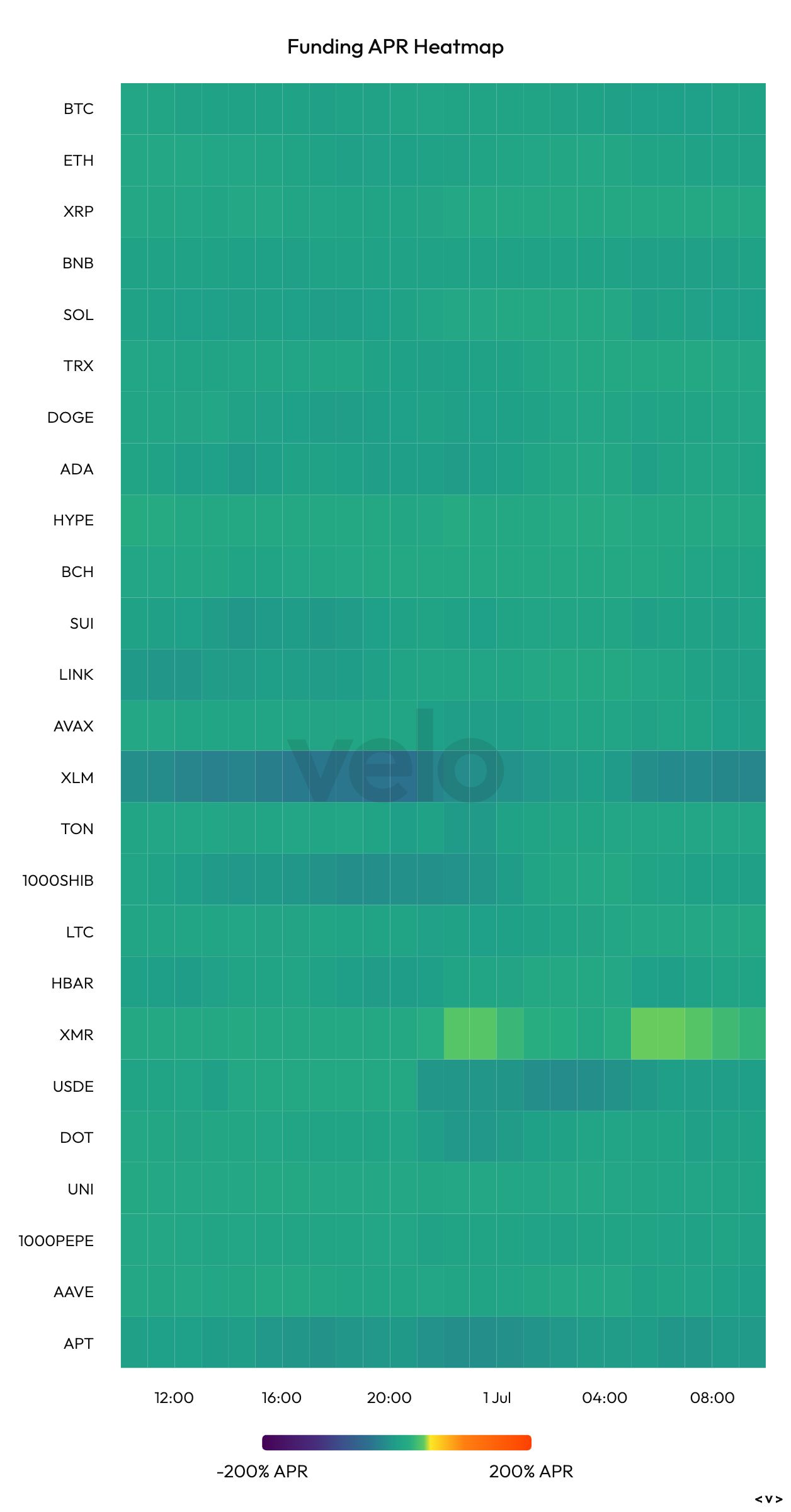

The Funding Rate Frenzy

Perpetual contracts show XRP, TRX, and DOGE commanding positive funding rates—a rare feat when BTC typically dominates sentiment. Either the crowd knows something or this is another case of 'retail FOMOing at the worst possible time.'

Bitcoin's Q3 Curse

Historical data screams caution: BTC averages -11% returns this quarter. Yet the alts keep rallying, proving once again that crypto markets thrive on irrationality. Traders appear to be pricing in a 'halving hangover' scenario for the king coin.

The Cynic's Take

Wall Street would call this 'diversification.' Crypto natives know it's desperation—when your moonshot portfolio underperforms stablecoins, you double down on dog-themed tokens. The leverage building in these markets suggests we're either early... or very, very late.

Privacy-focused Monero (XMR) stood among tokens beyond the top 10 list with a funding rate of over 23%, while Stellar's XLM token signaled a strong bias for bearish bets with a funding rate of 24%.

Seasonally weak quarter

Historically, the third quarter has been a weak period for bitcoin, with data indicating an average gain of 5.57% since 2013, according to Coinglass. That's a far cry compared to the fourth quarter's 85% average gain.

BTC's spot price remained flat at around $107,000 at press time, offering no clear direction bias. Valuations have been stuck largely between $100,000 and $110,000 for nearly 50 days, with selling by long-term holder wallets counteracting persistent inflows into the U.S.-listed spot exchange-traded funds (ETFs).

Some analysts, however, expect a significant MOVE to occur soon, with all eyes on Fed Chairman Jerome Powell's speech on Tuesday and the release of nonfarm payrolls on Friday.