Bitcoin Dominated Crypto in H1 2025 While Altcoins Imploded – What’s the Play Now?

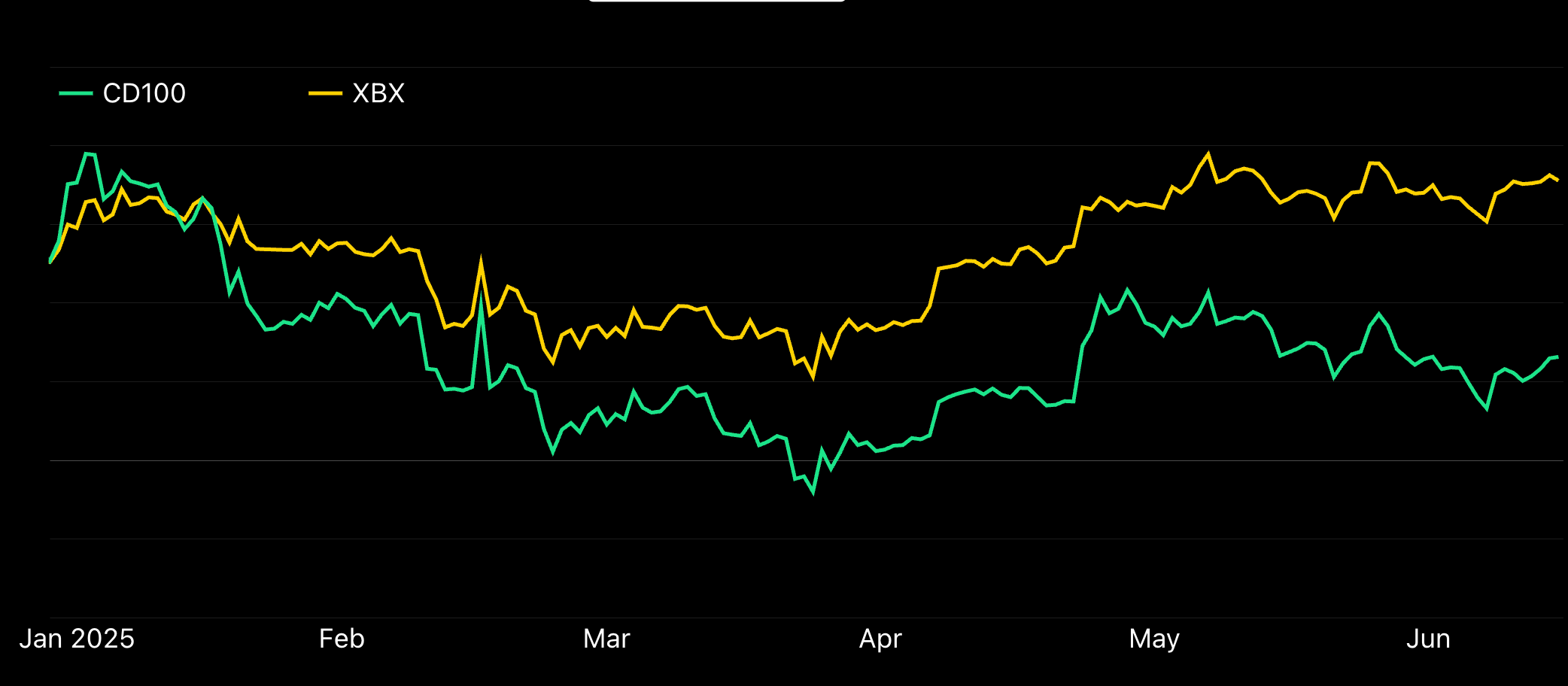

Crypto’s king flexed while the court jesters collapsed. Bitcoin didn’t just lead the market in 2025’s first half—it dragged the entire sector forward as altcoins bled out. Here’s why the divergence happened… and where smart money’s looking next.

The BTC bulldozer effect

While Ethereum and Solana chains gasped for developer oxygen, Bitcoin’s institutional adoption pipeline kept humming. BlackRock’s spot ETF inflows hit $15B by June—turns out Wall Street still prefers digital gold over DeFi vaporware.

Altcoin apocalypse or buying opportunity?

Memecoins got rekt (shocking), but Layer 1s fared worse. The ‘ETH killer’ narrative died screaming when transaction volumes proved even Vitalik can’t bypass the laws of economic gravity. Meanwhile, Tether’s market cap quietly doubled—because nothing beats stability during a crypto winter.

The next move

With the SEC’s war on altcoins escalating and Bitcoin’s halving aftershocks still rippling, one truth emerges: the market’s separating wheat from chaff. As always, the ‘experts’ will overcomplicate it—just follow the liquidity.

What's next?

Despite the modest start to the year, some analysts see room for renewed upside. Joel Kruger, market strategist at LMAX Group, noted that July has historically been a strong month for crypto, averaging 7.56% returns since 2013.

“We enter a period that has traditionally delivered stronger returns,” said Kruger. “With the second half of the year historically producing outsized gains, the broader setup remains encouraging.”

Kruger also highlighted that the crypto treasury strategy trend is increasingly expanding beyond bitcoin, with firms announcing plans to accumulate digital assets like ETH.

Coinbase analysts also maintained a positive outlook for crypto through the second half of the year, driven by favorable macroeconomic backdrop, potential rate cuts by the Federal Reserve and increasing regulatory clarity in the U.S. with lawmakers advancing legislation for stablecoins and the broader crypto market structure.

Still, the next couple months could be lackluster, Bitfinex analysts warned. The next quarter-year starting with July has been historically the weakest for bitcoin, averaging only 6% gains since 2013, they said in a Monday report.

"This is also where average volatility is subdued, adding to our bias of range bound price action continuing for longer," the authors noted.