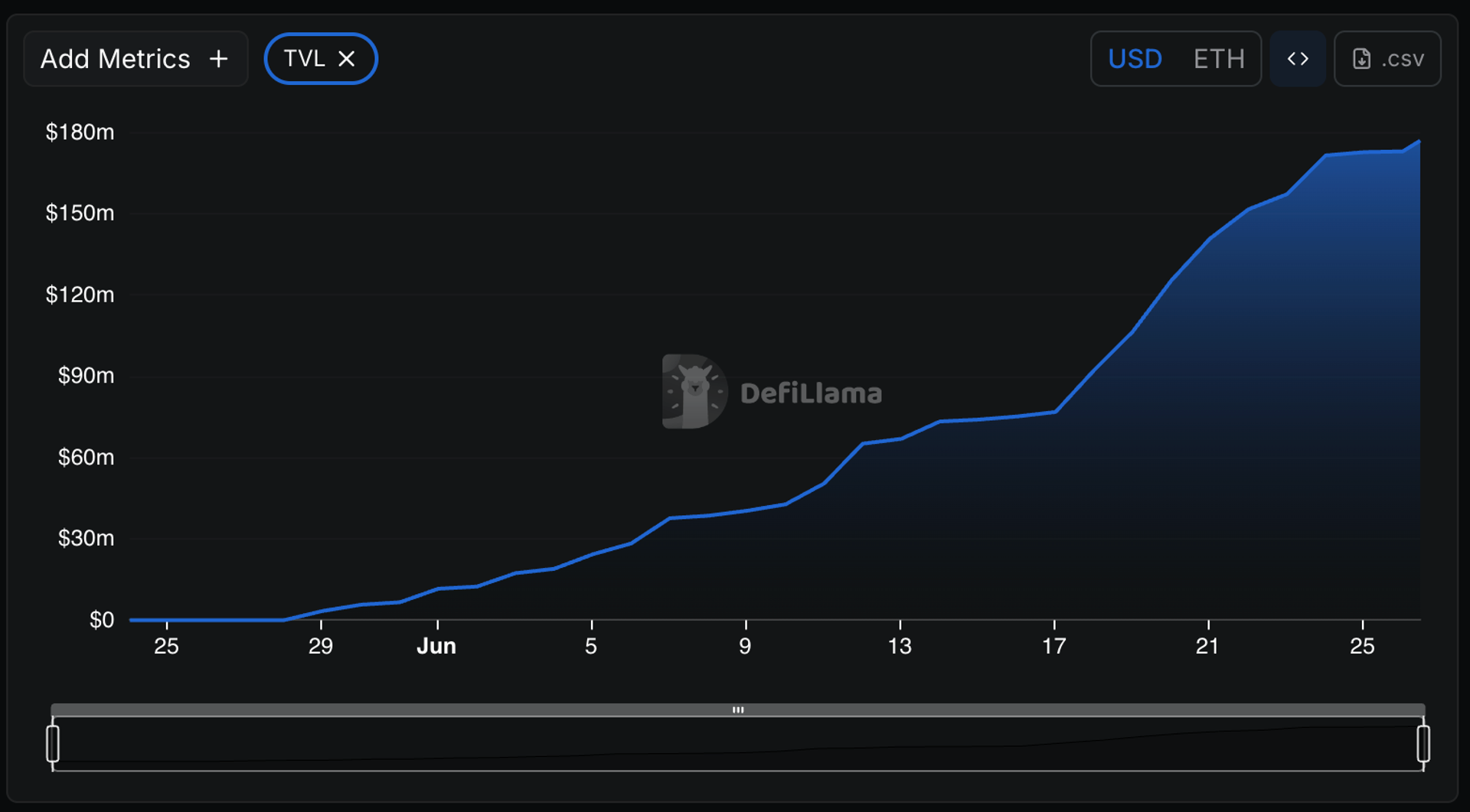

Katana Mainnet Launches with $180M Pre-Deposit Frenzy – DeFi’s Next Killer App?

Katana Mainnet slashes its way into the blockchain arena—pre-launch deposits scream market confidence with a staggering $180M locked and loaded.

Why TradFi Should Sweat

While Wall Street fiddles with 1% yield savings accounts, Katana’s Mainnet launch proves DeFi degens still move faster—and with heavier bags. The protocol’s razor-focused design bypasses legacy finance bottlenecks, turning liquidity into a high-velocity game.

Speculative FOMO or Real Utility?

That $180M isn’t just sitting pretty—it’s a bet that Katana’s infrastructure can outmaneuver Ethereum’s gas wars and Solana’s downtime demons. One anonymous whale dropped 7 figures pre-launch, muttering something about 'alpha leaks' in a now-deleted tweet.

Closed Beta to Mainnet Madness

Three months of closed beta testing paid off: zero critical bugs reported during the transition. Meanwhile, competing L2s are still wrestling with their fifth 'final' testnet.

The Bottom Line

Katana’s launch is either a masterclass in incentivized bootstrapping—or the most elegant liquidity honeypot since Terra’s glory days. Either way, the smart money’s already in. (The dumb money? Still waiting for their bank’s 'blockchain innovation committee' to file a report.)