Bitcoin Miner Revenue Plunges to 2-Month Low—Yet Zero Sell-Off Panic: CryptoQuant Data Reveals

Bitcoin miners are feeling the squeeze—revenue just hit its lowest point in 60 days. But here’s the twist: no fire sales in sight.

The Miner Paradox

Normally, when miner income tanks, the market braces for a wave of BTC hitting exchanges. Not this time. CryptoQuant’s latest data shows hodling trumping desperation—for now.

Wall Street’s Ghost

Where’s the capitulation? Miners aren’t dumping, but institutional traders still can’t decide if Bitcoin’s a hedge or a punching bag. Meanwhile, the hash rate barely flinches—proof of work doesn’t care about your portfolio.

The Bottom Line

Cheap coins aren’t tempting enough for miners to cash out. Either they’re playing the long game… or waiting for the next sucker to bid up futures. (Spoiler: It’s probably both.)

Hashrate has dipped 3.5% since June 16, marking the most significant pullback in network computing power since July 2024. While modest, it reflects mounting pressure on miners already grappling with tighter margins following the halving.

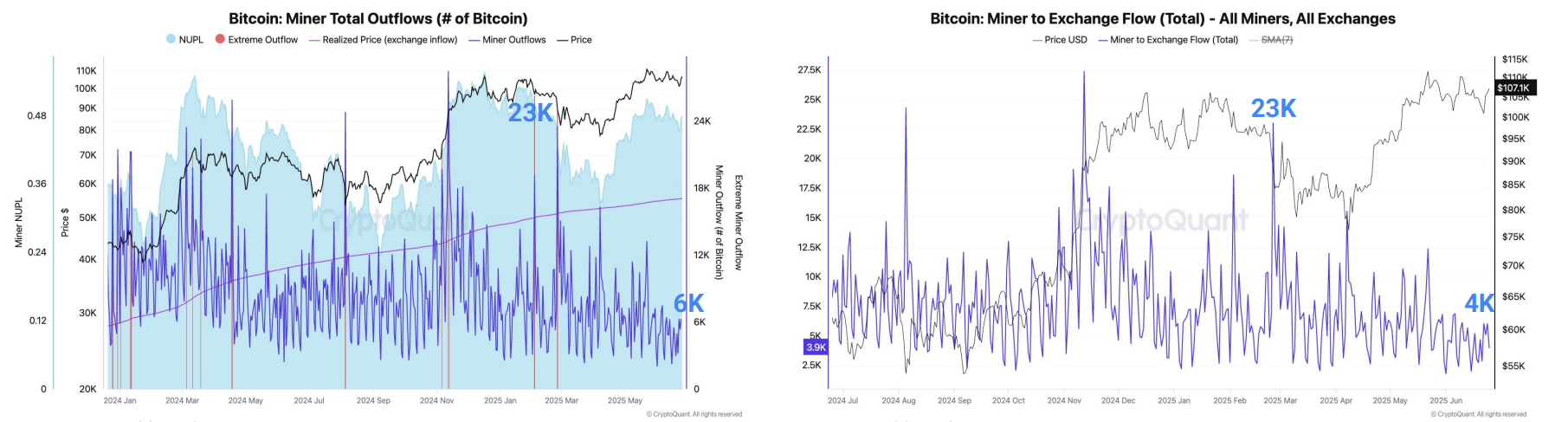

Yet the expected wave of miner capitulation hasn’t materialized. Outflows from miner wallets have remained muted, sliding from 23,000 BTC per day in February to around 6,000 BTC currently — with no exchange transfer spikes recorded.

Even wallets tied to Satoshi-era miners, often a bellwether for long-term sentiment, have barely budged: just 150 BTC sold so far in 2025, compared to nearly 10,000 BTC offloaded in 2024.

Satoshi-era miners refer to network participants who mined their coins during the very early days of the bitcoin network, typically between 2009 and 2011, when Satoshi Nakamoto, Bitcoin's pseudonymous creator, was still active on online forums.

Meanwhile, data shows miner reserves are growing. Addresses holding between 100 and 1,000 BTC — typically operated by mid-sized mining entities — have added 4,000 BTC since March, pushing balances to their highest levels since November 2024.

The takeaway is miners are playing the long game, either anticipating a rebound or preferring to burn through cash rather than sell at current prices.

“This further suggests there’s no selling pressure coming from miners at these price levels,” CryptoQuant concluded.