Bitcoin Roars Back to $105K as Geopolitical Fears Fade—Bulls Charge Again

Bitcoin's resilience shines as it claws back to $105,000, shrugging off Middle East tensions like a Wall Street banker ignores ethical dilemmas.

Geopolitical relief rally: With Iran tensions cooling, crypto's flagship asset rebounds—proving once again that digital gold thrives on chaos.

Bullish signals emerge: Traders pile back in as the 'buy the dip' mentality overpowers fleeting macro fears. Meanwhile, traditional finance still can't decide if crypto is 'too volatile' or 'too boring' to acknowledge.

What to Watch

- Crypto

- June 25: ZIGChain (ZIG) mainnet will go live.

- June 30: CME Group will introduce spot-quoted futures, pending regulatory approval, allowing trading in bitcoin, ether and major U.S. equity indices with contracts holdable for up to five years.

- Macro

- June 24, 8:30 a.m.: Statistics Canada releases May consumer price inflation data.

- Core Inflation Rate MoM Prev. 0.5%

- Core Inflation Rate YoY Prev. 2.5%

- Inflation Rate MoM Est. 0.5% vs. Prev. -0.1%

- Inflation Rate YoY Est. 1.7% vs. Prev. 1.7%

- June 24, 10 a.m.: Fed Chair Jerome H. Powell testifies before the U.S. House Financial Services Committee on the semiannual monetary policy report. Livestream link.

- June 24, 10 a.m.: The Conference Board (CB) releases June U.S. consumer confidence data.

- CB Consumer Confidence Est. 99.8 vs. Prev. 98

- Day 1 of 2: North Atlantic Treaty Organization (NATO) Summit in The Hague, the Netherlands, where heads of state, foreign and defense ministers of 32 allies and partners will meet to discuss security, defense spending and cooperation.

- June 25, 10 a.m.: Fed Chair Jerome H. Powell testifies before the U.S. Senate Committee on Banking, Housing, and Urban Affairs on the semiannual monetary policy report. Livestream link.

- June 26, 8:30 a.m.: The U.S. Census Bureau releases May manufactured durable goods orders data.

- Durable Goods Orders MoM Est. 7.2% vs. Prev. -6.3%

- Durable Goods Orders Ex Defense MoM Prev. -7.5%

- Durable Goods Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.2%

- June 26, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (final) Q1 GDP data.

- GDP Growth Rate QoQ Final Est. -0.2% vs. Prev. 2.4%

- GDP Price Index QoQ Final Est. 3.7% vs. Prev. 2.3%

- GDP Sales QoQ Final Est. -2.9% vs. Prev. 3.3%

- June 26, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended June 21.

- Initial Jobless Claims Est. 247K vs. Prev. 245K

- Continuing Jobless Claims Prev. 1945K

- June 26, 3 p.m.: Mexico's central bank, the Bank of Mexico, announces its interest rate decision.

- Overnight Interbank Target Rate Est. 8% Prev. 8.5%

- June 24, 8:30 a.m.: Statistics Canada releases May consumer price inflation data.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- ApeCoin DAO is voting on whether to sunset the decentralized autonomous organization and launch ApeCo, a new entity established by Yuga Labs with a mission to “supercharge the APE ecosystem.” Voting ends June 24.

- Arbitrum DAO is voting on lowering the constitutional quorum threshold from 5% to 4.5% of votable tokens. This aims to match decreased voter participation and help well-supported proposals pass more easily, without affecting non-constitutional proposals, which remain at a 3% quorum. Voting ends July 4.

- Polkadot Community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- June 25, 5:30 p.m.: A BNB Super Meetup is being hosted in New York.

- Unlocks

- June 30: Optimism (OP) to unlock 1.79% of its circulating supply worth $15.48 million.

- July 1: Sui (SUI) to unlock 1.3% of its circulating supply worth $109.99 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating supply worth $988 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating supply worth $45.24 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $13.29 million.

- Token Launches

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

- June 26: Sahara AI (SAHARA) to be listed on OKX, Bitget, MEXC, CoinW, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- Day 1 of 3: Blockworks' Permissionless IV (New York)

- June 24: Finnovex Qatar 2025 (Doha)

- June 24: ETHMilan 2025 (Milan)

- June 24: Africa Fintech Forum 2025 (Cairo)

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 25-26: CDAO Government 2025 (Washington)

- June 25-26: FinTech Summit Africa 2025 (Johannesburg)

- June 25-26: Money Expo Colombia 2025 (Bogota)

- June 25-26: NFY.NYC 2025 (New York)

- June 25-27: 7th Blockchain and Internet of Things Conference (Tsukuba, Japan)

- June 25-27: 7th International Congress on Blockchain and Applications (Lille, France)

- June 25-28: Solana Solstice 2025 (New York)

- June 26: The Injective Summit (New York)

- June 26: Webit 2025 (Sofia, Bulgaria)

- June 26-27: Istanbul Blockchain Week

- June 26-27: Seoul Meta Week 2025 (Seoul)

- June 28: Cyprus Blockchain Summit 2025 (Limmasol)

- June 28-29: The Bitcoin Rodeo (Calgary, Canada)

- June 30: RWA Cannes Summit 2025 (Cannes, France)

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

- June 30 to July 5: World Venture Forum 2025 (Kitzbühel, Austria)

Token Talk

By Shaurya Malwa

- Ethereum developer Barnabé Monnot proposed EIP-7782, halving slot times from 12 seconds to 6 seconds to boost network speed and user experience.

- Faster blocks mean faster confirmations, with more frequent data updates for wallets, DeFi apps, and L2s — creating a smoother, more responsive blockchain.

- DeFi efficiency could improve as a result of tighter arbitrage windows, faster price discovery and lower trading fees due to higher liquidity in AMMs.

- Key timing changes include reducing block proposal time to 3 seconds, attestations to 1.5 seconds and aggregation to 1.5 seconds.

- Monnot argues Ethereum’s “service price” will rise, making it more competitive as a global settlement and confirmation layer.

- Potential drawbacks include bandwidth pressure, validator performance issues, and network instability if poorly implemented.

- The proposal targets the 2026 Glamsterdam upgrade, which focuses on gas optimizations and protocol-level speedups across the Ethereum blockchain.

Derivatives Positioning

- Cumulative open interest in BTC standard and perpetual futures listed worldwide dropped to 650K BTC on Monday, the lowest since May 18, before bouncing slightly early today. ETH futures showed similar trends.

- BNB, BCH, DOT see negative funding rates in a bias for bearish short positions in perpetual futures markets. BTC, ETH funding rates held moderately positive.

- SHIB, ETH, HBAR have seen the most growth in the positive cumulative volume delta, implying net buying pressure.

- On Deribit, put skews have weakened at the front-end, with ETH puts still pricier than BTC.

- Block flows on OTC network Paradigm have been mixed.

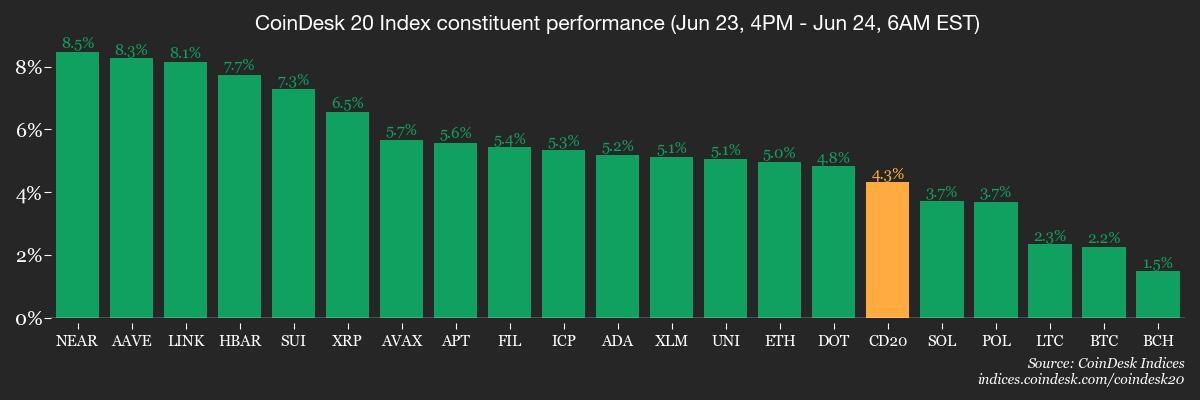

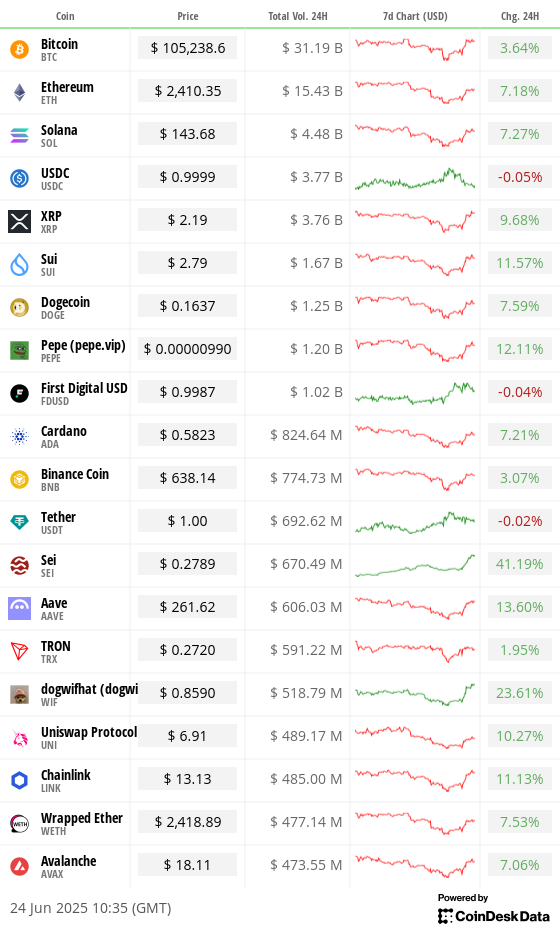

Market Movements

- BTC is up 1.43% from 4 p.m. ET Monday at $105,285.37 (24hrs: +3.78%)

- ETH is up 2.96% at $2,417.93 (24hrs: +7.67%)

- CoinDesk 20 is up 2.89% at 2,970.00 (24hrs: +6.84%)

- Ether CESR Composite Staking Rate is down 1 bps at 3.12%

- BTC funding rate is at 0.0035% (3.804% annualized) on Binance

- DXY is down 0.48% at 97.94

- Gold futures are down 1.75% at $3,335.50

- Silver futures are down 0.38% at $36.05

- Nikkei 225 closed up 1.14% at 38,790.56

- Hang Seng closed up 2.06% at 24,177.07

- FTSE is up 0.41% at 8,793.55

- Euro Stoxx 50 is up 1.77% at 5,314.14

- DJIA closed on Monday up 0.89% at 42,581.78

- S&P 500 closed up 0.96% at 6,025.17

- Nasdaq Composite closed up 0.94% at 19,630.97

- S&P/TSX Composite closed up 0.42% at 26,609.36

- S&P 40 Latin America closed down 0.27% at 2,585.46

- U.S. 10-Year Treasury rate is unchanged at 4.35%

- E-mini S&P 500 futures are up 0.92% at 6,133.00

- E-mini Nasdaq-100 futures are up 1.19% at 22,337.00

- E-mini Dow Jones Industrial Average Index are up 0.80% at 43,246.00

Bitcoin Stats

- BTC Dominance: 65.3 (-0.12%)

- Ethereum to bitcoin ratio: 0.02298 (0.31%)

- Hashrate (seven-day moving average): 799 EH/s

- Hashprice (spot): $53.3

- Total Fees: 4.89 BTC / $500,494

- CME Futures Open Interest: 149,575 BTC

- BTC priced in gold: 31.1 oz

- BTC vs gold market cap: 8.82%

Technical Analysis

- DOGE's daily chart shows prices are looking to bounce from April lows under 15 cents, hinting at a potential double bottom pattern.

- A rise beyond the horizontal resistance (neckline) is needed to confirm the double bottom breakout and signal bullish trend reversal.

Crypto Equities

Effective June 30, the price for Galaxy will be for its Nasdaq listing denominated in U.S. dollars rather than the Canadian-dollar-denominated listing on the TSX.

- Strategy (MSTR): closed on Monday at $367.18 (-0.68%), +1.87% at $374.05 in pre-market

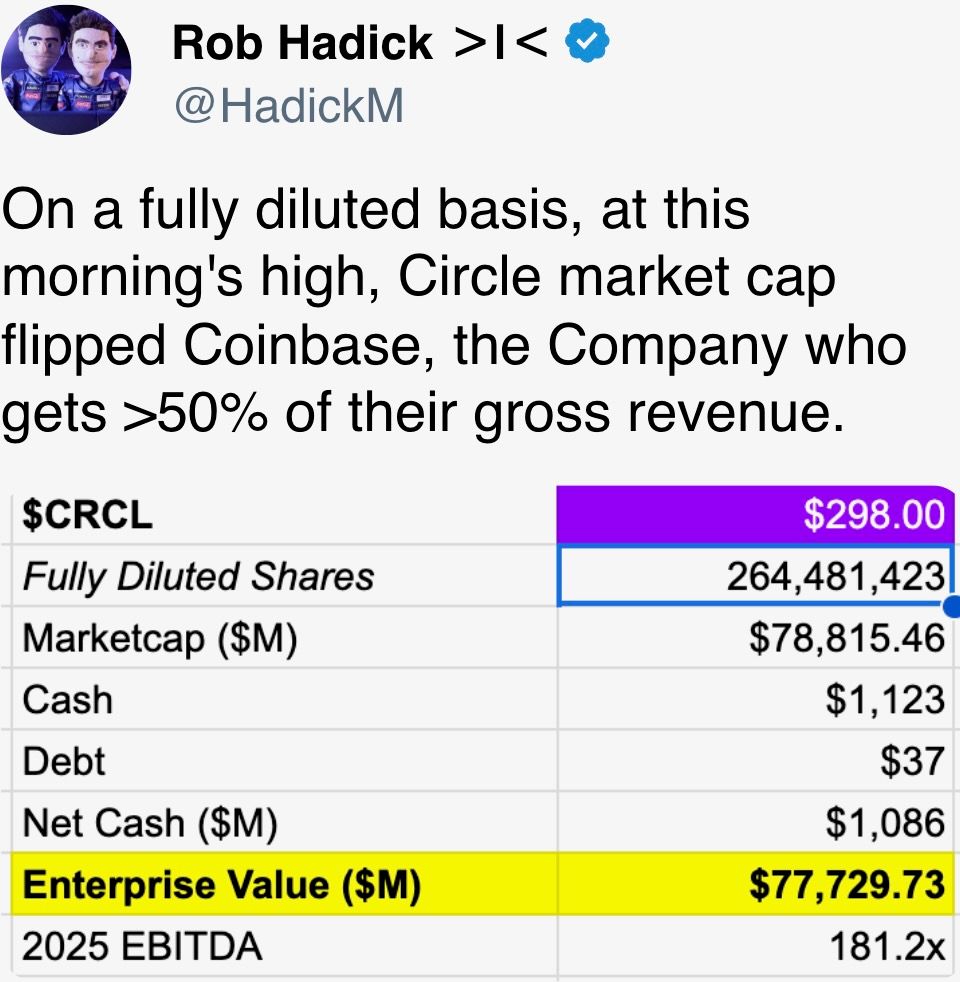

- Coinbase Global (COIN): closed at $307.59 (-0.26%), +3.09% at $317.10

- Circle (CRCL): closed at $263.45 (+9.64%), +0.46% at $264.66

- Galaxy Digital Holdings (GLXY): closed at C$25.38 (-1.63%)

- MARA Holdings (MARA): closed at $14.18 (-0.98%), +2.61% at $14.55

- Riot Platforms (RIOT): closed at $9.27 (-3.03%), +2.91% at $9.54

- Core Scientific (CORZ): closed at $11.35 (-4.3%), +2.82% at $11.67

- CleanSpark (CLSK): closed at $8.85 (-1.67%), +2.82% at $9.10

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $18.09 (-2.64%)

- Semler Scientific (SMLR): closed at $41.98 (+16.17%), +1.94% at $42.80

- Exodus Movement (EXOD): closed at $28.77 (-9.07%), +6.6% at $30.67

ETF Flows

- Daily net flow: $350.6 million

- Cumulative net flows: $47.0 billion

- Total BTC holdings ~ 1.23 million

- Daily net flow: $ 100.7 million

- Cumulative net flows: $4.0 billion

- Total ETH holdings ~ 3.98 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows the number of active or open BTC/USD longs (bullish bets) on crypto exchange Bitfinex.

- The tally is rising again.

- Historically, there has been an inverse correlation between the longs and bitcoin's price.

While You Were Sleeping

- Israel Says It Agreed to Bilateral Ceasefire With Iran, Will ‘Respond Forcefully’ to Any Violation (The Times of Israel): The Israel Defense Forces (IDF) met and surpassed all the operation's objectives, eliminating nuclear and ballistic missile threats deemed immediately existential, according to the prime minister's office.

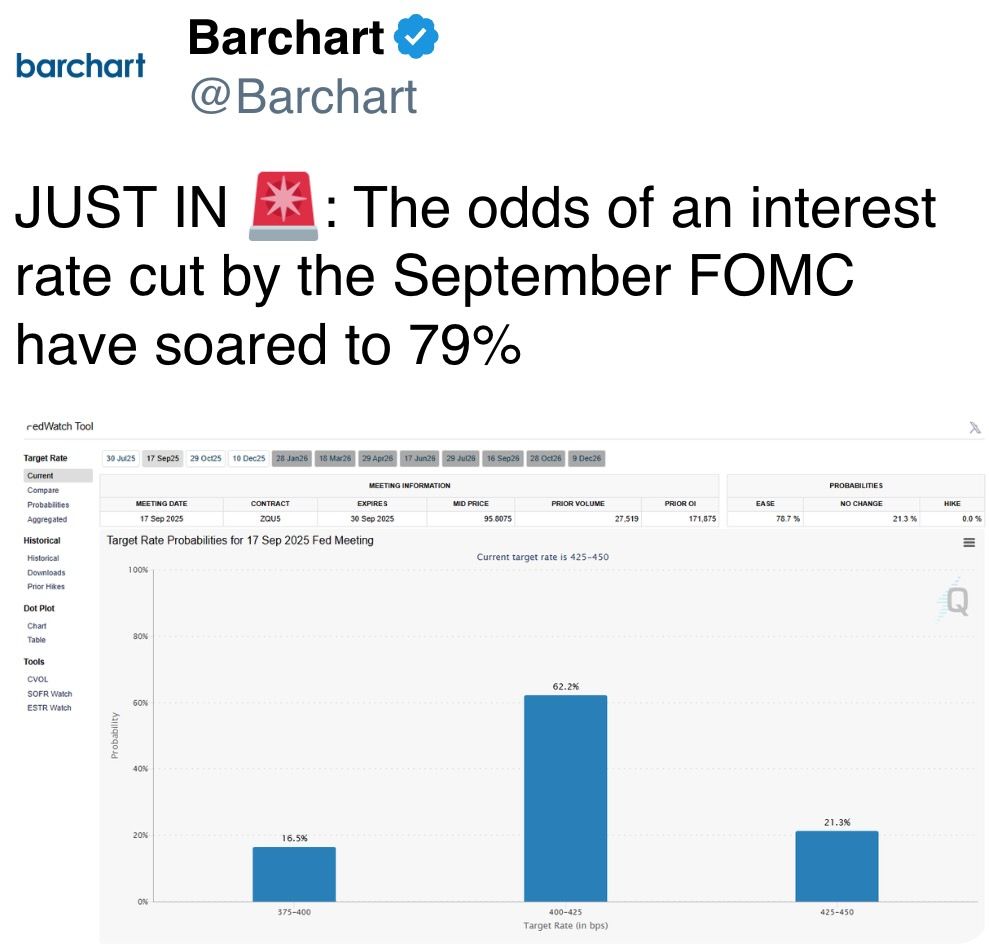

- Bitcoin Could Spike to $120K, Here Are 4 Factors Boosting the Case for a BTC Bull Run (CoinDesk): Bitcoin’s resilience throughout the Iran-Israel war, falling oil prices, potential Fed rate cuts and bullish technical signals are reinforcing the case for further gains.

- Metaplanet Plans to Inject $5B Into U.S. Unit to Accelerate Bitcoin Buying Strategy (CoinDesk): The Japanese firm will use its Florida-based unit, launched May 1, to accelerate bitcoin accumulation toward a 210,000-coin goal by the end of 2027, leveraging U.S. financial infrastructure for efficient large-scale acquisition.

- Ark Invest Continues to Dump Circle Shares, Buys Robinhood and Coinbase (CoinDesk): ARK sold 415,855 Circle (CRCL) shares across three ETFs on Monday, following last week’s 609,175-share sale, after the stock surged more than sevenfold since its IPO.

- Trump’s Iran Attack Spurs Concerns of Retaliation in the U.S. (The Wall Street Journal): FBI offices in major U.S. cities were ordered to refocus on Iran-related threats, while Department of Homeland Security flagged increased risks of cyberattacks and hate crimes targeting Jewish and pro-Israel communities.

- Starmer and Zelenskiy Agree Military Production Project in London (Reuters): Under the new three-year agreement, Ukraine will share battlefield drone data with the U.K., enabling British factories to rapidly produce and supply large numbers of drones for use against Russia.

In the Ether