XRP Stages Strong Rebound, Prints Bullish Reversal Pattern At Critical Support Level

XRP bulls just pulled off a textbook recovery play—shaking off early weakness to carve a classic bullish reversal pattern right above make-or-break support.

The setup suggests traders are betting big on this level holding. And why not? When has the crypto market ever passed up an opportunity to turn technical analysis into a self-fulfilling prophecy?

Key levels held. Chart patterns confirmed. Now we wait to see if the 'smart money' agrees—or if this is just another fakeout destined for the crypto graveyard alongside countless 'inverse head and shoulders' that got rekt.

One thing's certain: the trading bots are already frontrunning this. As usual.

News Background

- Market sentiment remains fragile as global economic uncertainty continues to weigh on risk assets.

- Trade tensions and policy shifts among major economies have pressured the broader crypto landscape, triggering liquidations and profit-taking across key tokens.

- Despite the volatility, XRP’s on-chain and technical metrics have held firm. The token continues to benefit from institutional narratives surrounding a potential spot ETF approval and Ripple’s global payments expansion.

- Analysts are focused on XRP’s ability to establish a new higher low, which could set the stage for a breakout if resistance at $2.09 is breached with volume confirmation.

Price Action

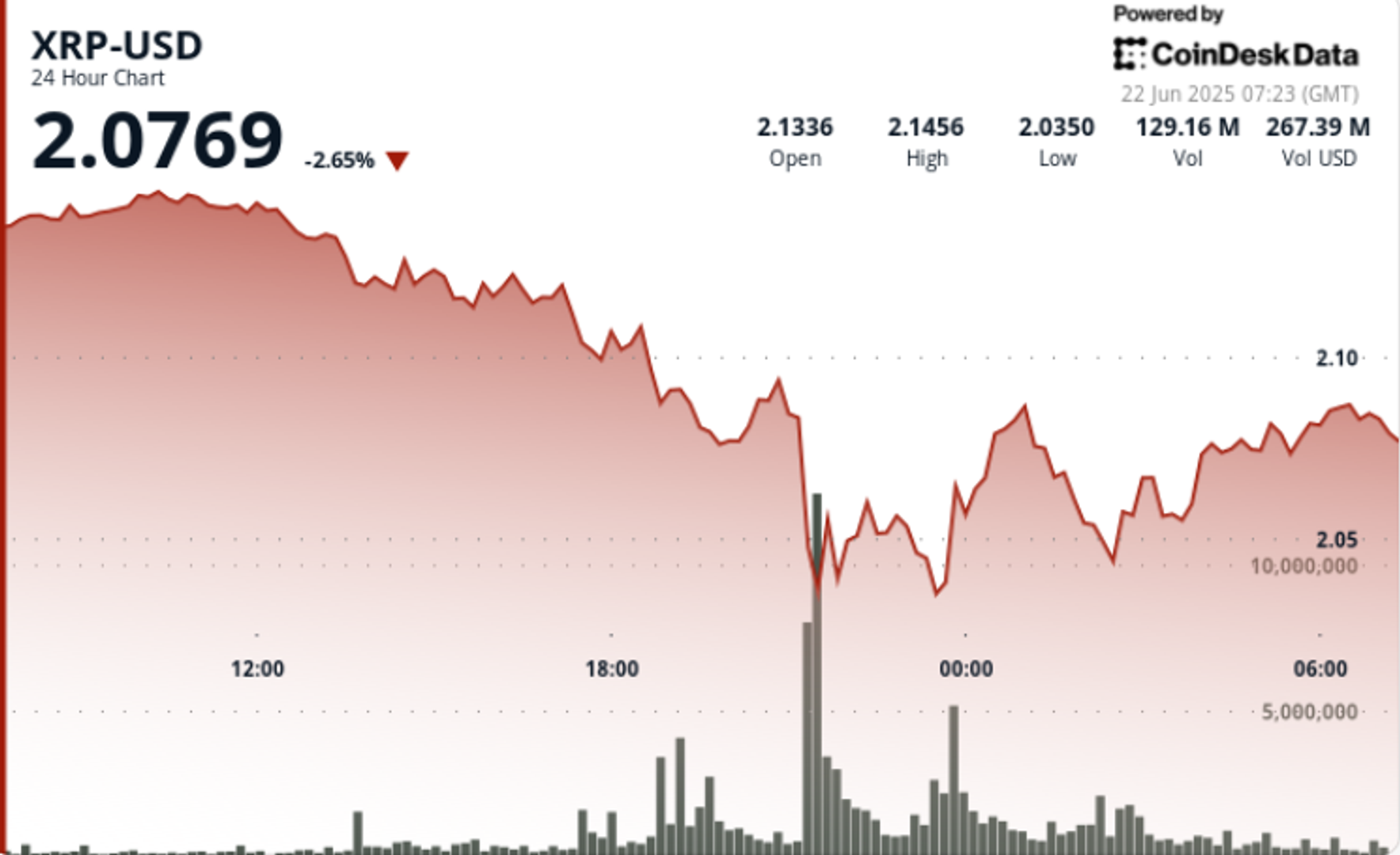

XRP posted a 6.33% range over the last 24 hours, sliding from $2.147 to $2.011 during a sharp sell-off centered around the 21:00 hour. Volume during that period spiked to over 163 million units, confirming intense downward pressure.

The asset then recovered steadily, forming a higher low at $2.042 before pushing up to $2.083. In the final hour, XRP climbed from $2.078 to $2.089, marking the session’s high on a strong 1.38M volume burst at 06:20. This price action has formed a short-term ascending channel, with higher lows observed at $2.079, $2.082, and $2.083.

Technical Analysis Recap

- XRP posted a 6.33% trading range from $2.147 to $2.011.

- Heaviest selling occurred at 21:00 with over 163M in volume.

- Higher low formed at $2.042; recovery to $2.083 suggests buyer control returning.

- Resistance now sits at $2.089–$2.090; support range firm at $2.011–$2.042.

- Final hour saw price jump to $2.089 on 1.38M volume at 06:20.

- Short-term ascending channel confirmed with sequential higher lows.

- Buyers consistently defended $2.082–$2.083 on minor pullbacks, signaling accumulation.

- MACD crossing into positive territory; RSI neutral at ~54 — conditions favor a continuation if resistance is cleared.