Summer Crypto Moves: What Bitcoin and Ether Whales Are Plotting Next

As temperatures rise, so does the strategic maneuvering in crypto markets. Savvy traders aren't just HODLing—they're positioning for what could be a volatile season ahead.

The Bitcoin accumulation game

Whale wallets are quietly filling up while retail investors panic about 'summer doldrums.' Pro tip: When institutions buy the dip, you might want to pay attention.

Ether's defi dance

With ETH staking yields still juicy and Layer 2 activity exploding, smart money's building positions before the next protocol upgrade drops. Because nothing says 'summer fun' like gas fee arbitrage.

The cynical take

Meanwhile, traditional finance bros are still trying to explain to their bosses why their 'crypto hedge' underperformed a literal meme coin. Some things never change.

The nervousness is evident from the over-the-counter liquidity platform Paradigm, where the top five BTC trades for the week include a put spread and a bearish risk reversal. Meanwhile, in ETH's case, a long position in the $2,450 put crossed the tape alongside a short strangle (volatility) trade.

Bitcoin, the leading cryptocurrency by market value, has spent over 40 days trading back and forth above $100,000, according to CoinDesk data. According to analysts, profit-taking by long-term holders and miner selling have counteracted the strong uptake for spot ETFs, leaving prices directionless.

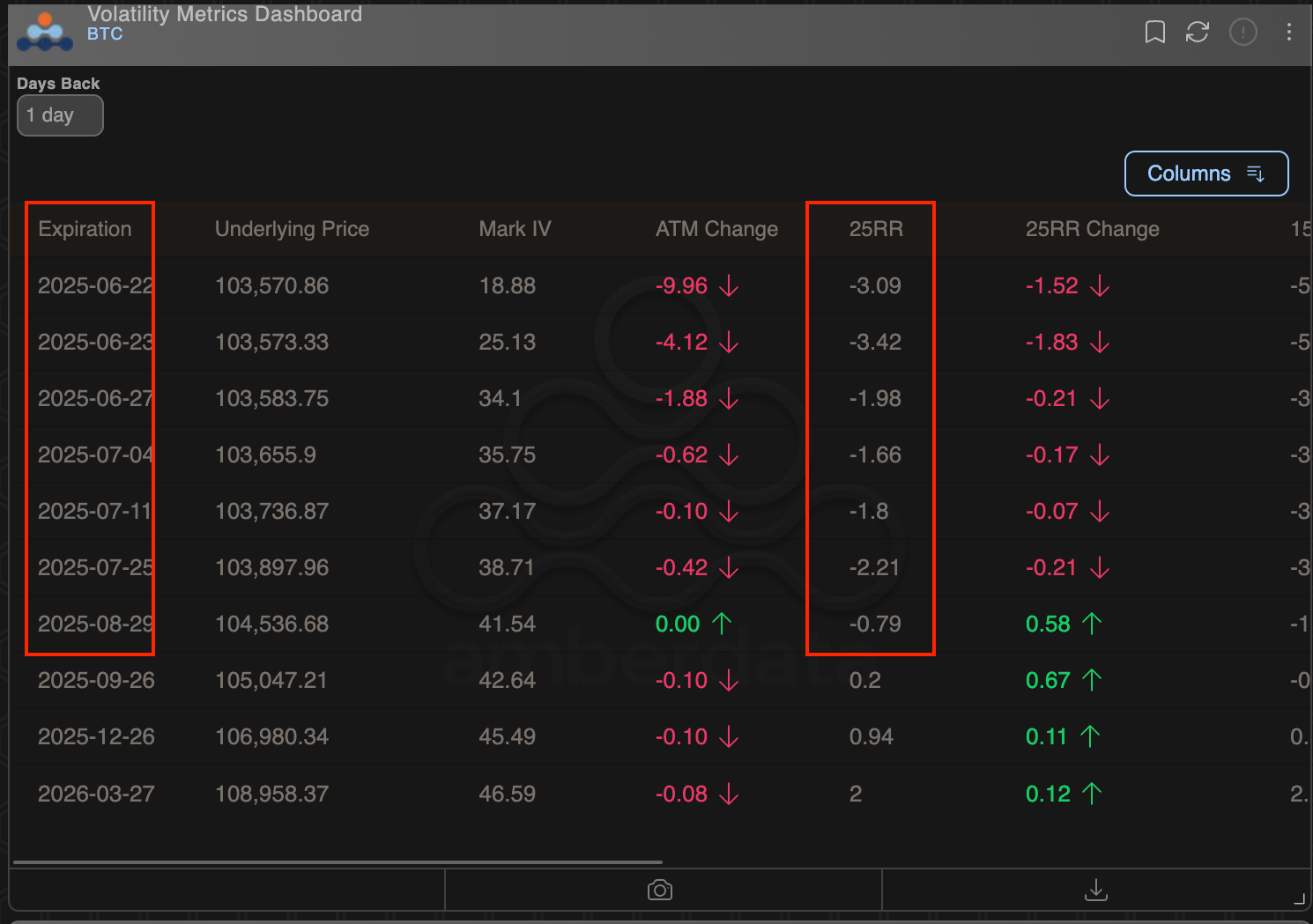

"Bitcoin has recently tracked sideways, suggesting its current price may be too high for many retail investors. Open interest in BTC options has risen, with a positive and rising 25 delta put-call skew on 30-day contracts, which may imply that market participants are seeking short-term protection through put options," Coinbase Institutional's weekly report noted.

On Friday, BTC closed (UTC) below the 50-day simple moving average (SMA) to trade below the key support for the first time since mid-April. The breakdown may lead to more chart-driven selling, potentially resulting in a drop below $100,000.

Some observers, however, expect a rally to new record highs. According to market observer Cas Abbé, BTC's on-balance volume continues to indicate strong buying pressure, suggesting that prices could rise to $130,000-$135,000 by the end of the third quarter.