SEC Poised to Greenlight Spot Crypto ETFs for XRP, SOL, and DOGE—Bloomberg Sees ’Overwhelming’ Approval Odds

Crypto's regulatory ice age may finally be thawing—at least for some altcoins. The SEC appears to be warming up to spot ETF filings for XRP, Solana, and even Dogecoin, with Bloomberg analysts flagging surprisingly high approval probabilities.

Wall Street's favorite meme coin? Dogecoin's ETF prospects suddenly don't seem so funny anymore as institutional players pile into filings. Meanwhile, XRP's legal clarity and Solana's tech stack are turning heads at the normally skeptical regulator.

Of course, this being crypto, the SEC could still pull the rug—because what's finance without a little performative regulatory theater? But with Bitcoin and Ethereum ETFs already trading, the dam may finally be breaking for altcoin adoption.

These estimates reflect growing Optimism from ETF specialists following a wave of 19b-4 acknowledgements and S-1 amendment requests from the Securities and Exchange Commission.

Analysts view this back-and-forth process as a signal that the SEC is now more willing to work with issuers.

The only asset lagging behind is SUI, filed solely by Canary. Bloomberg assigns it a 60% chance of approval, citing a lack of regulated futures and regulatory uncertainty.

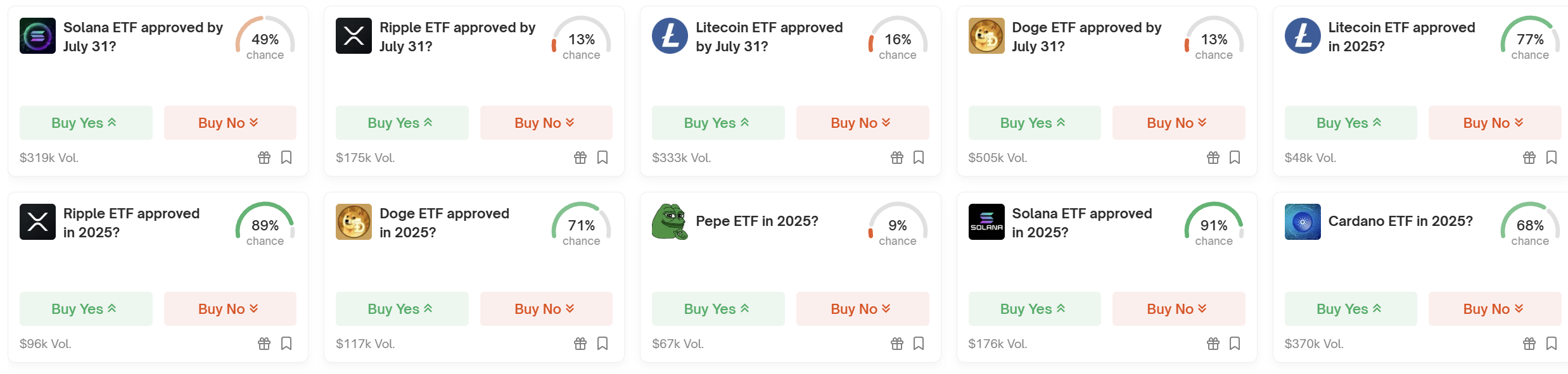

Bettors on Polymarket are also feeling optimistic.

They are giving a 98% chance that an XRP ETF gets approved this year, and a 91% chance a SOL ETF gets the green light. It's also likely that a Doge ETF gets a go-ahead, with bettors giving that a 71% chance of happening.