SHIB Long-Short Ratio Craters as $1.8M in Bullish Bets Gets Wiped Out

SHIB bulls just took a brutal hit—over $1.8M in leveraged long positions evaporated faster than a meme coin’s hype cycle. The long-short ratio nosedived as traders learned the hard way: crypto markets giveth, and they taketh away (usually the latter).

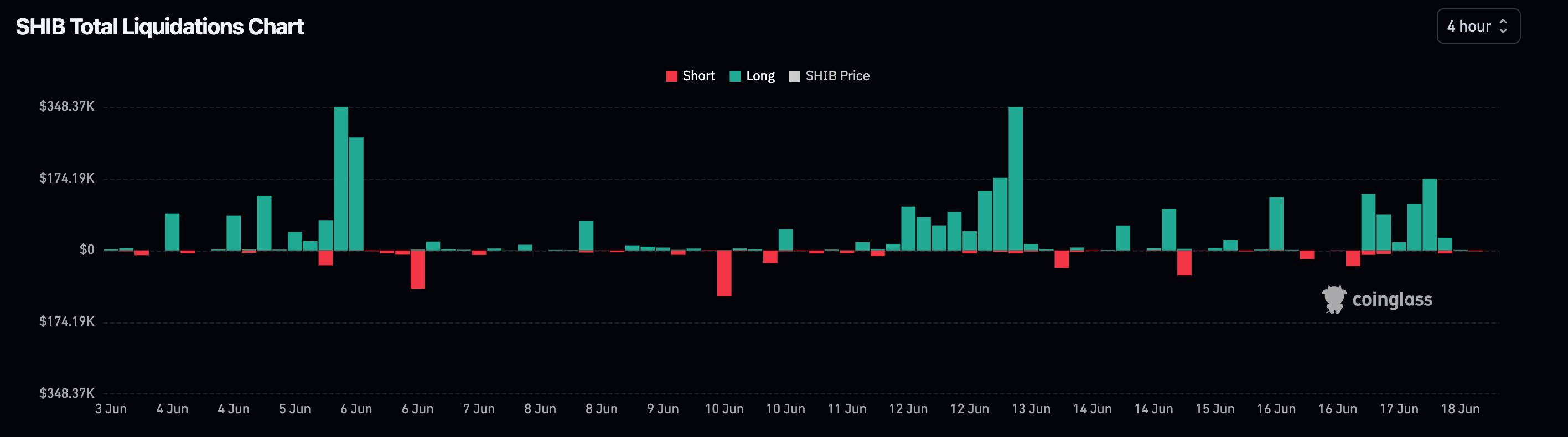

Liquidation bloodbath hits SHIB

The SHIB chart isn’t just red—it’s hemorrhaging. Those betting big on a rally got steamrolled when the market flipped bearish, proving once again that ‘diamond hands’ often turn to panic sells when margin calls hit.

Finance’s dirty little secret? Liquidations fuel the very volatility that creates them—a self-cannibalizing cycle Wall Street would be proud of. SHIB’s latest plunge serves as another reminder: in crypto, even the memes come with margin requirements.

Over the past 24 hours, the derivatives market has exhibited growing caution, with open interest decreasing by 2.14% to $145.33 million and long liquidations surging to $244,000, compared to just $57,000 in short liquidations.

SHIB''s price has dropped by 10% to $0.00001164 since June 12, according to data source CoinDesk. The minor recovery from Tuesday''s two-month low of $0.00001134 is providing bullish hints on short-duration price charts.

Key AI insights- SHIB continues to hold support above the critical $0.00001100 level, indicating a potential trend reversal.

- Technical analysis reveals a minor bullish divergence in the daily RSI, with MACD and signal lines approaching a bullish crossover that could propel SHIB toward the 23.60% Fibonacci level at $0.00001390.

- Above-average volume confirmed buyer interest with the closing price of $0.00001170, suggesting stabilization above critical support.

- Hourly RSI indicates oversold conditions, potentially setting up for a technical bounce if the $0.00001168 support level holds.