Home on the (BTC) Range: Why Bitcoin is the New American Frontier in 2025

Bitcoin isn''t just surviving—it''s homesteading in your portfolio.

From Wild West to Wall Street darling

Once dismissed as cowboy money, BTC now anchors retirement funds and corporate treasuries. The SEC''s 2024 ETF approval turned speculators into settlers.

The new digital land rush

Institutions are fencing off supply at $150K while retail investors play pioneer with lightning network sats. (Goldman still won''t return your calls though.)

Bull market or final frontier?

With halving-induced scarcity and Tether''s printing press working overtime, this train''s leaving the station—whether you''ve finished DYOR or not.

Just don''t tell the Fed we''re having this much fun.

For the store-of-value thesis, range-trading is actually fine. As bitcoin accumulates more days of "not unexpected" behavior, it supports the narrative of relative independence from other risk assets and improved stability. (The S&P 500 has also kept an 8% range through the same 39 days, so bitcoin isn''t alone in this holding pattern, although recent news flows might have knocked a younger bitcoin off the track.)

But traders are getting restless. Bitcoin''s basement-level thirty-day realized volatility below 30% crimps opportunity. Implied vols are also down as option buyers grow fatigued and sellers grab yield more confidently. Like any market, a range that holds too long creates complacency—making the eventual exit more "exciting" than it WOULD otherwise be.

The stalled mood is hurting breadth. Without bitcoin providing leadership, other digital assets are wilting. The CoinDesk 20 Index has trailed bitcoin by about 5% over the past month, as the lack of sentiment has stalled the late-April rally, even in ETH, which had bounced strongly.

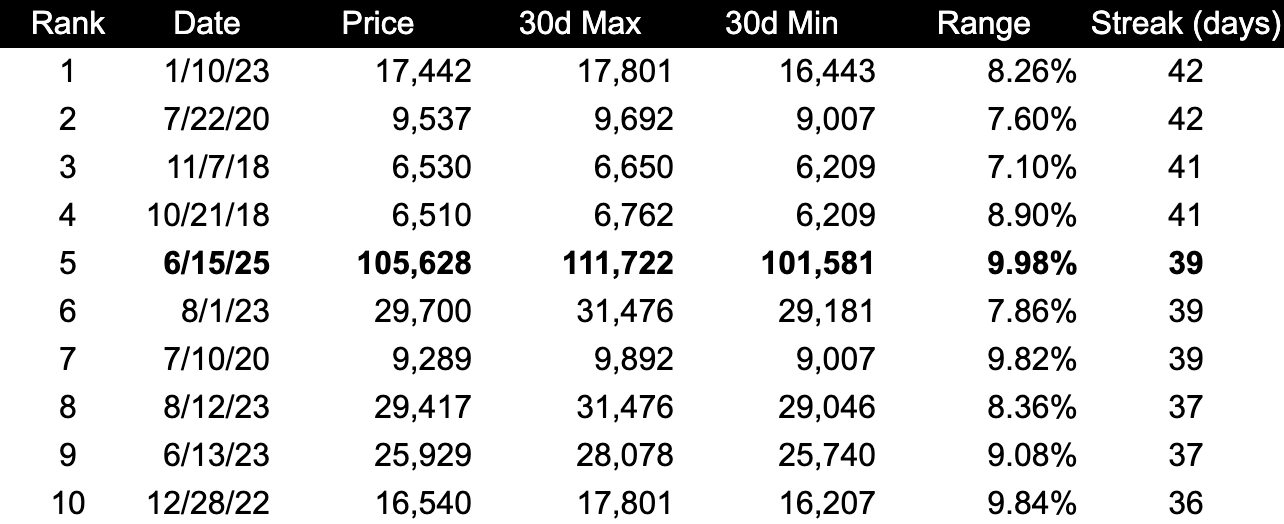

How does this compare historically? With some truly unattractive vibe coding (I take the blame), we studied bitcoin''s longest streaks of holding 10% ranges. The current 40-day stretch isn''t the longest—that was 42 days—but it''s close. Similar streaks occurred in 2018, 2020, and 2023. Given bitcoin''s evolved ownership structure (ETFs, MSTR) and more accessible spot and derivatives markets, would a 50-day streak surprise anyone? Not sure.