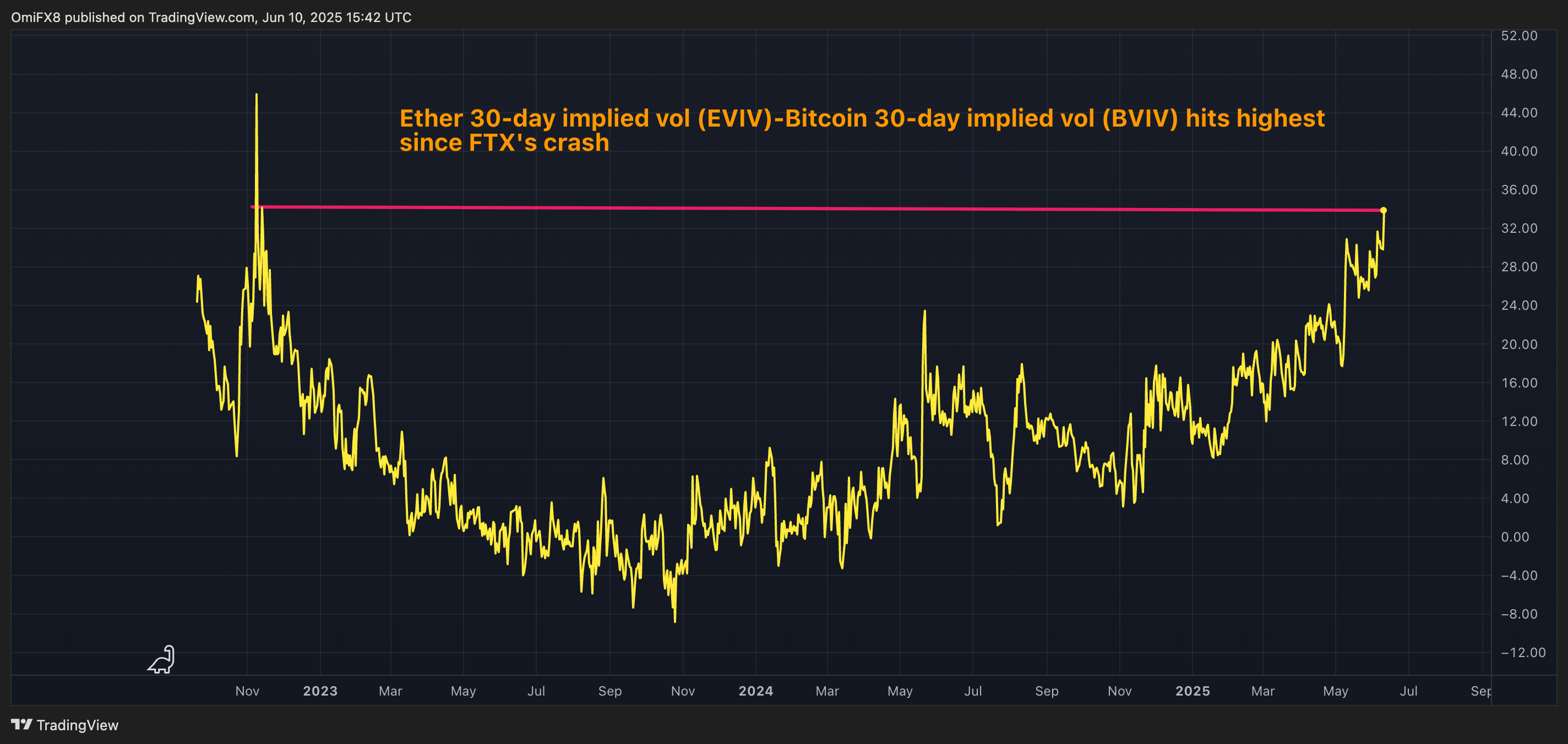

Ether Outshines Bitcoin as Volatility Spikes to Post-FTX Collapse Highs

Traders are piling into Ether as its price swings against Bitcoin hit levels not seen since the FTX meltdown—because nothing says ''healthy market'' like gambling on altcoin roulette.

ETH/BTC volatility surges: The crypto crowd''s latest flavor of the month gets a stress test. Will it hold or fold? Only the leveraged degens know for sure.

Meanwhile, Bitcoin maximalists clutch their whitepapers tighter—because when the alts run hot, someone''s always left holding the bag.

While inflows into the ether spot ETFs have picked up pace, BTC ETFs have managed to draw in less than $400 million in the past two weeks, according to data source SoSoValue.

According to the Singapore-based trading firm QCP, several factors have aligned in favor of the ether bulls.

"Looking ahead, macro tailwinds are aligning for ETH. With the GENIUS Act advancing in the US Senate, Circle’s IPO discussions resurfacing, and stablecoins gaining regulatory traction, Ethereum’s native role in tokenization and settlement rails may be primed for outsized structural upside," QCP said in a market update.

The bias for ether is also evident from the fact that on options exchange Deribit, ETH call options are trading at a premium of at least 2% to 3% relative to puts out to the March 2027 expiry. On the contrary, BTC calls are trading at 0.5%-1.5% premium, according to data source Amberdata.

In other words, traders are paying more for the upside exposure in ether compared to bitcoin.

"ETH options markets have surged with 30-day call-skew hitting 6.24% and funding rates spiking to 0.009%, while the term structure of volatility has reinverted once more," analytics firm Block Scholes said in its daily report.