Trump Media and Semler Scientific: The Stealth Bitcoin Bargains Wall Street Missed

Forget MicroStrategy—these unlikely contenders might be hiding the most undervalued Bitcoin treasuries in plain sight.

While crypto whales chase shiny new ETFs, two unconventional players are quietly sitting on Bitcoin stashes that could make their stocks dirt-cheap proxies for BTC exposure. No hype, no fanfare—just cold, hard Satoshis lurking on balance sheets.

Wall Street analysts too busy downgrading Coinbase to notice? Probably. But when the next bull run hits, these under-the-radar holdings could turn into rocket fuel for shareholders—or another case of 'should've bought the asset, not the stock.'

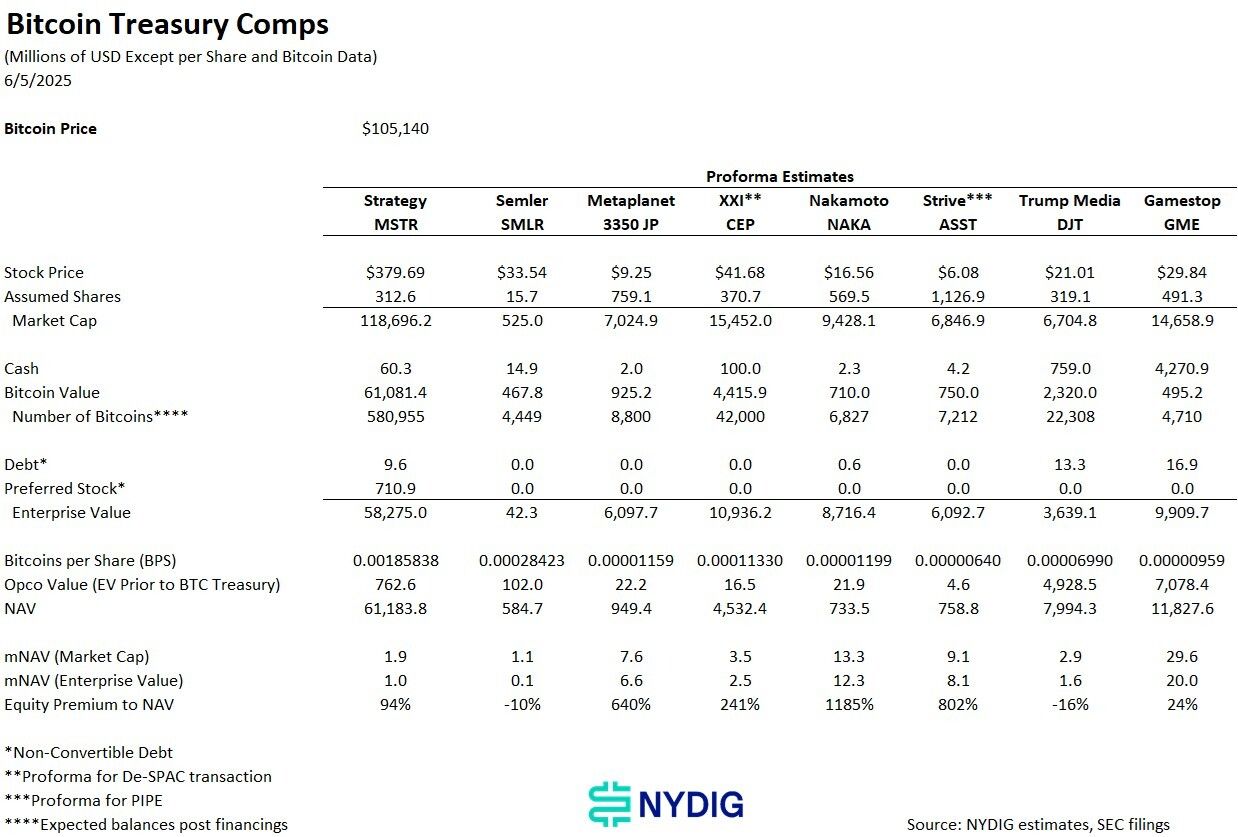

The table shows, for example, that Semler Scientific’s (SMLR) and TRUMP Media’s (DJT) equity premium to NAV (which measures the percentage difference between a fund's market price and its net asset value), are the lowest of the eight measured companies, coming in at -10% and -16% respectively, despite the fact that both companies have an mNAV above 1.1.

Alas, both SMLR and DJT are little-changed on Monday even as bitcoin climbs to $108,500 versus Friday evening's $105,000 level. MSTR is higher by just shy of 5%.