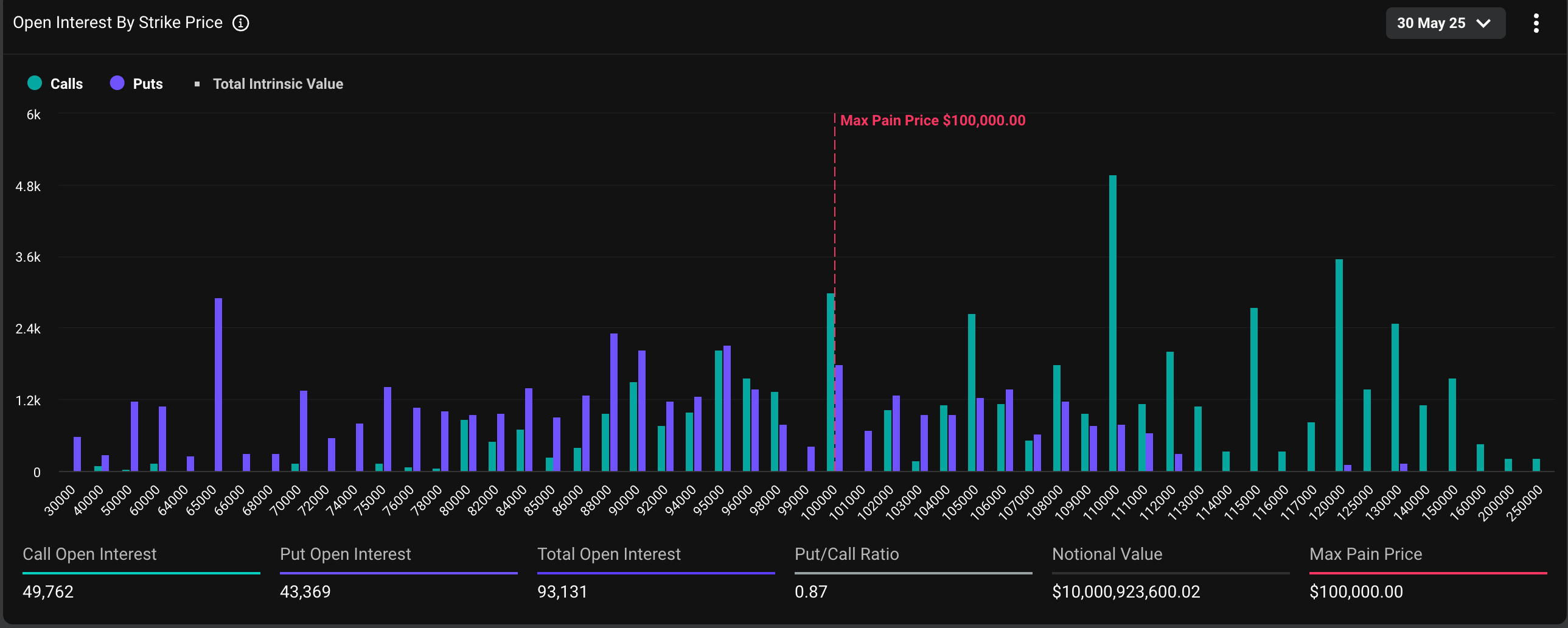

Bitcoin Braces for Volatility as $10B Options Expiry Targets $95K-$105K Range

All eyes on BTC’s make-or-break zone as Wall Street’s crypto casino rolls the dice.

--

The looming options expiry—worth a cool $10 billion—has traders sweating over Bitcoin’s next move. Will it hold the line or get squeezed like an overleveraged hedge fund?

--

Key levels to watch: $95K support and $105K resistance. Because nothing says ’healthy market’ like a digital asset swinging 10% on derivatives activity.

At press time, bitcoin changed hands at $107,700, having reached record highs above $111,000 the previous week, according to CoinDesk data.

Deribit’s DVOL index, which represents the options-based 30-day implied or expected volatility, continued to decline, suggesting minimal concern over volatility driven by the upcoming expiry.

Volmex’s annualized one-day implied volatility index ticked slightly higher to 45.4%. That implies a 24-hour price move of 2.37%.