Monero Traders Pile Into Futures as Price Plummets—Is This a Dip Buy or Desperation?

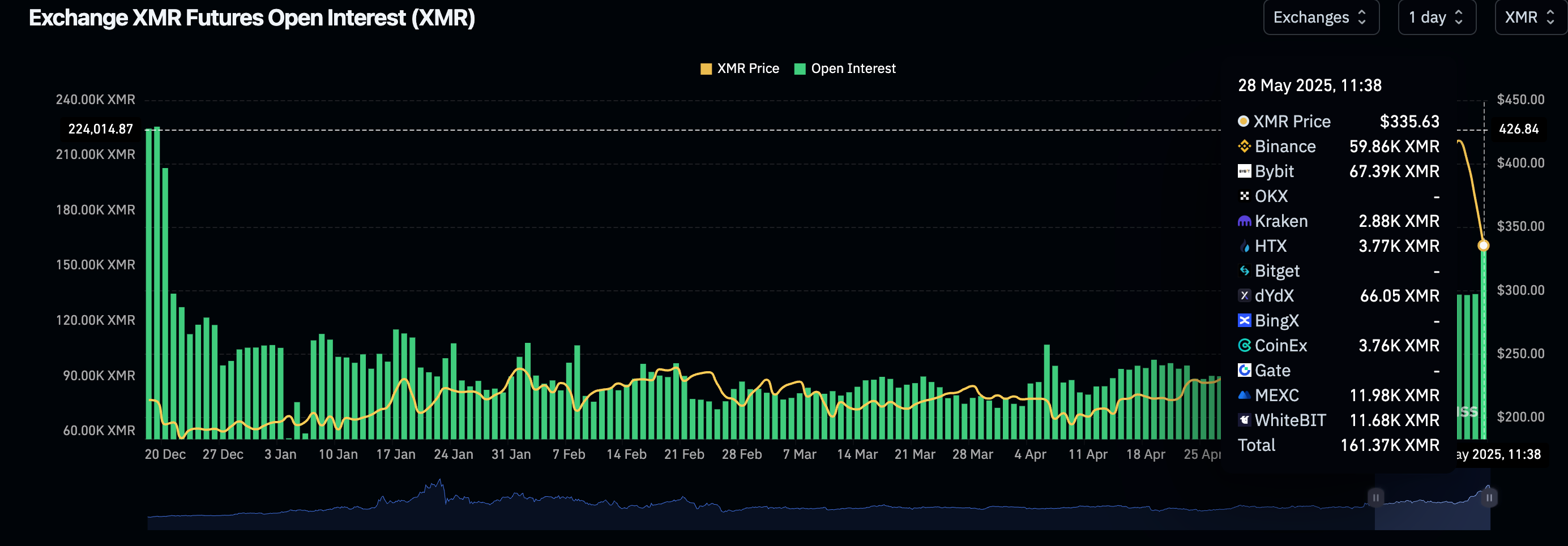

Monero’s price nosedives nearly $100 in three days, yet futures open interest spikes. Are crypto’s privacy maximalists doubling down—or just bag-holding with extra steps?

While Wall Street hedges with gold, crypto degens hedge with leverage. The irony? Both might end up equally buried.

An increase in open interest alongside a price drop is typically interpreted as representing a bearish sentiment, with more traders taking short positions in anticipation of a price decline.

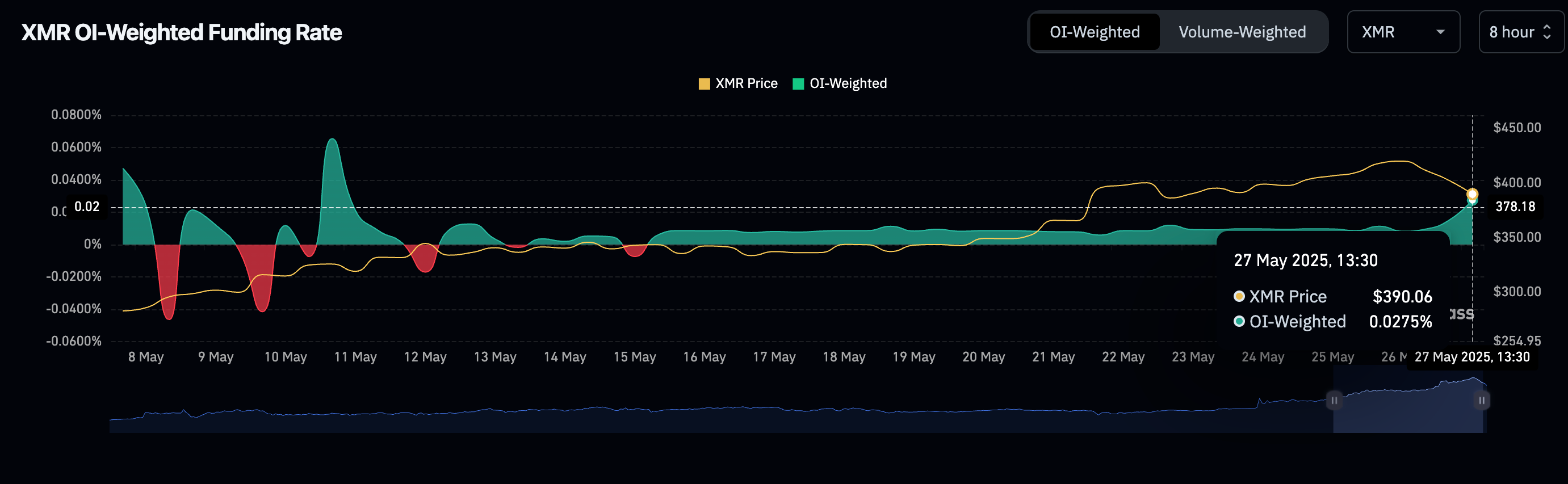

Funding rates hold positiveThat’s not necessarily the case with XMR, as the perpetual funding rates continue to be positive, indicating a bias for long positions. Funding rates, charged every eight hours, represent the cost of holding levered futures bets, with positive values representing a dominance of bullish long bets.

Therefore, the uptick in XMR’s open interest likely represents a "buy the dip" mentality – traders taking long positions on the price dip, anticipating a quick recovery.