Bitcoin’s $300K Jackpot Frenzy Heats Up—Are Traders Overplaying Their Hand?

FOMO sweeps crypto markets as Bitcoin’s speculative rally pushes toward the mythical $300K target. Retail traders pile in—hedge funds quietly take profits.

When Lambos meet leverage, things get messy. Remember: the house always wins in volatility casino.

A call option gives the purchaser the right but not the obligation to buy the underlying asset, BTC, at a predefined price on or before a specific date. A call buyer is implicitly bullish on the market.

The $300,000 call expiring on June 27 represents a bet that bitcoin’s price will rise three times from the present $110,000 to over $300,000 by the end of the first half.

The bet sounds outlandish, as the first half will end in roughly four weeks. But that’s been the case lately on Deribit, with traders increasingly targeting upside potential through short-term options.

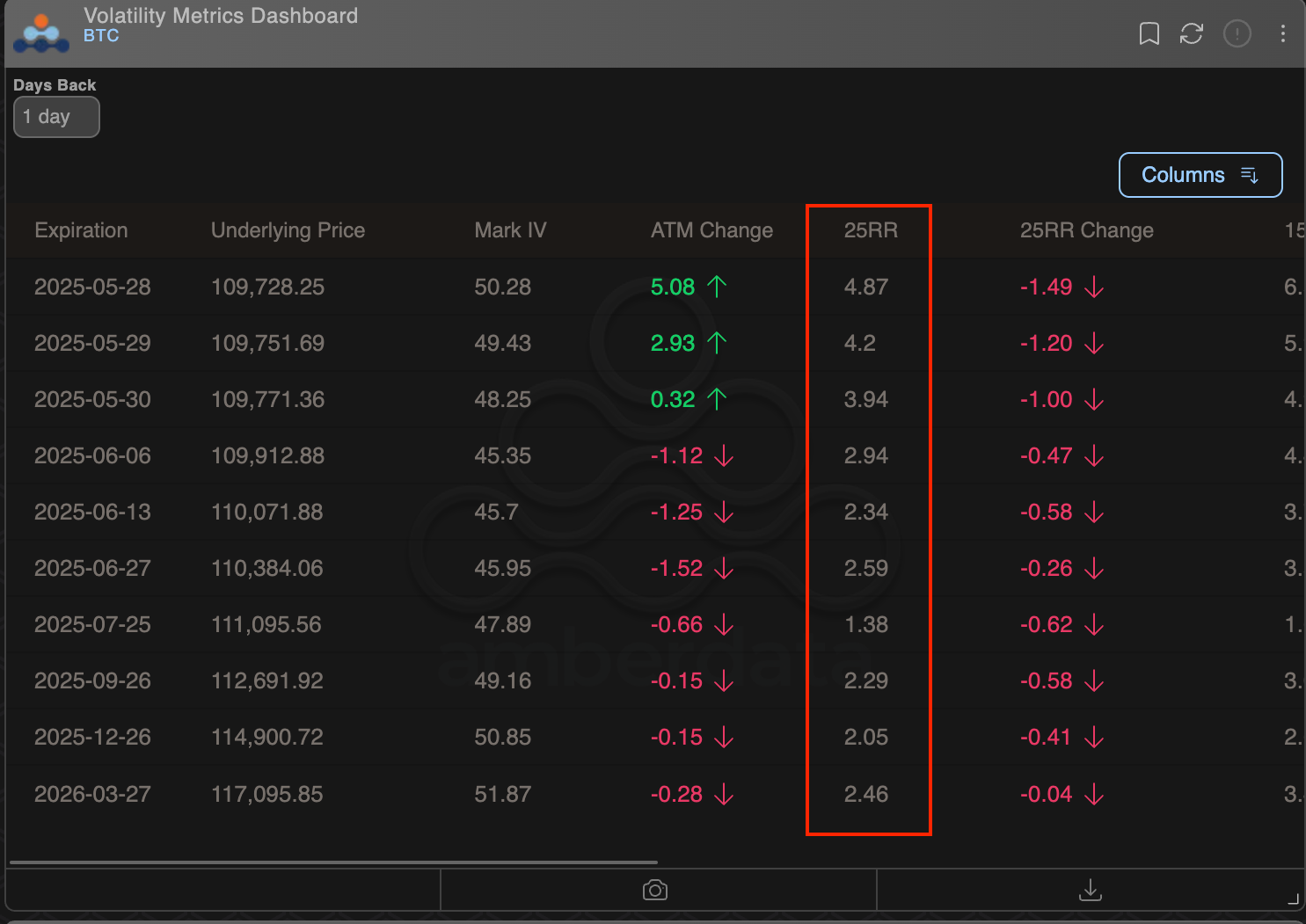

That is evidenced by front-end risk reversals, measuring the demand for calls relative to puts over short-term, being pricier than those with longer maturities.

The chart by Amberdata shows risk reversals are positive across the board, indicating a bias for bullish call options. However, short-duration calls are pricer than longer-duration ones. Usually, the opposite is the case.

The trend indicates a heightened appetite for quick-paced bullish bets among market participants.

"The three-day bitcoin Conference 2025 is all set to start in Las Vegas today, and so people are speculating on what new bullish announcements will be released at the event," Chen explained.

Contrarian signalThe growing demand for short-duration calls could be a contrarian signal suggesting that speculative excess is often seen NEAR market tops, according to Markus Thielen, founder of 10x Research.

Thielen said the options market is flashing a warning, with the seven-day calls trading at a 10% premium to puts.

"The options market is flashing a warning: Bitcoin’s skew, measuring the difference in implied volatility between puts and calls, has dropped to nearly -10%, indicating calls are pricing in significantly more volatility than puts," Thielen said in a note to clients.

"This suggests traders are aggressively chasing upside rather than hedging downside risk. In our experience, such extreme skew levels often reflect peak bullish sentiment, a classic contrarian signal," Thielen added.