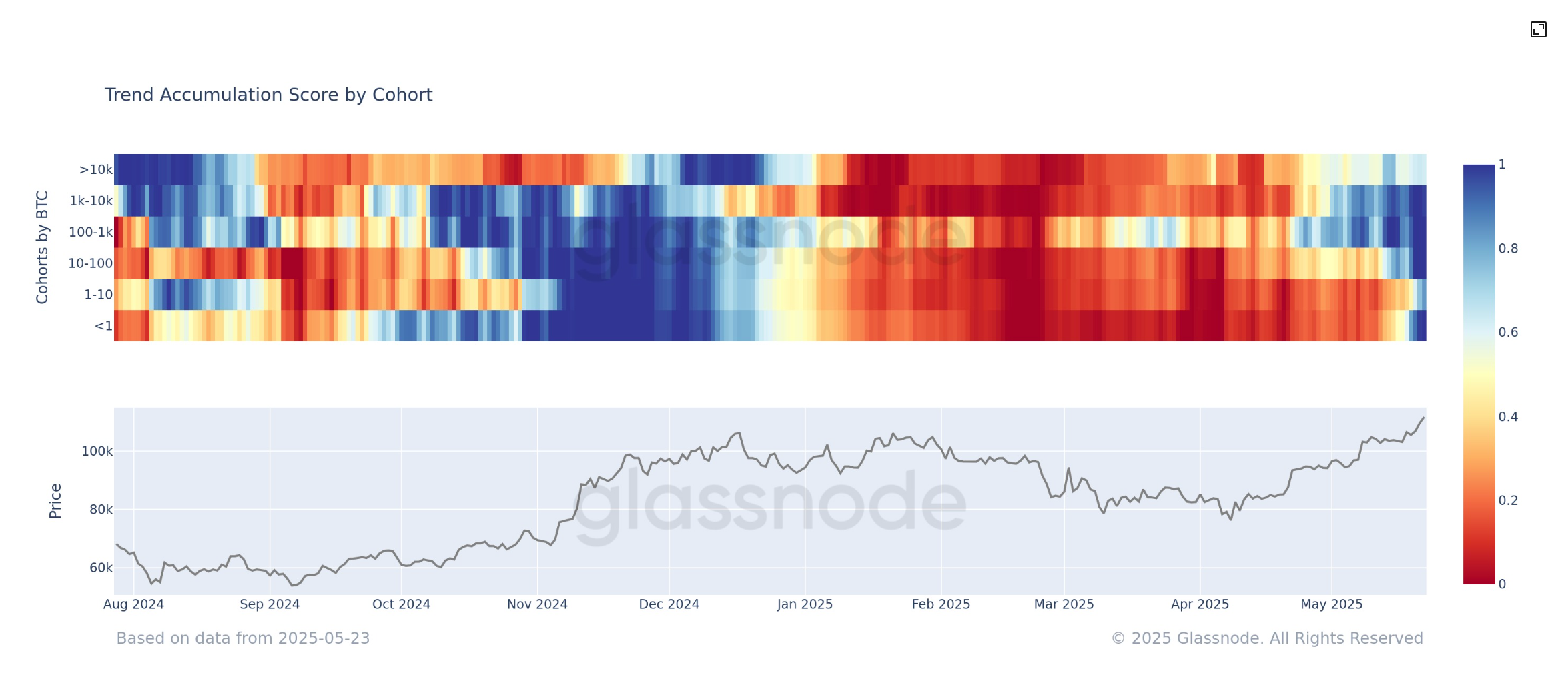

Bitcoin Smashes Through $110K as Whales Go on Buying Spree—Strongest Accumulation Since January

BTC just triggered its most aggressive accumulation phase in five months—bulls aren’t waiting for dips.

Price surge meets institutional FOMO: On-chain data shows wallets with 1,000+ BTC loading up like it’s Q1 all over again. Meanwhile, retail traders still think ’this time it’s different.’

Cynics’ corner: Wall Street’s suddenly rediscovered its ’long-term vision’ after missing the last 300% rally.

The renewed demand is supported by options market activity, with CoinDesk Research highlighting large bullish positions. The $300,000 strike for June expiry has become the most popular call option, with $620 million in notional value, and an additional $420 million is concentrated around the $200,000 strike.

While bitcoin historically tends to fall after hitting an all-time high due to profit-taking, traditional assets like the S&P 500 and gold often extend their rallies in similar scenarios. If bitcoin were to follow this more mature asset behavior, it may signal the beginning of a sustained bull cycle, a trend many in the market are now watching closely.