Crypto Advisors, Meet Your New Competitor: Netflix Binge-Watching

Wall Street’s latest existential threat isn’t another hedge fund—it’s couch potatoes with Coinbase accounts. As crypto literacy spreads through docu-series and influencer explainers, financial advisors face an ironic twist: their clients now get investment theses between episodes of ’Stranger Things.’

The Netflix-ification of crypto education cuts both ways. Sure, it demystifies blockchain for the masses—but good luck charging 1% AUM fees when YouTube tutorials do it for free. Suddenly ’DYOR’ doesn’t just mean reading whitepapers; it means cross-referencing TikTok traders with actual fundamentals.

Here’s the cynical kicker: The same advisors who dismissed crypto as a fad now compete with its most powerful onboarding tool—the autoplay button. Maybe next quarter’s performance reports should include a ’streaming hours’ metric alongside Sharpe ratios.

Storytelling 3.0: When AI, Blockchain and IP Collide

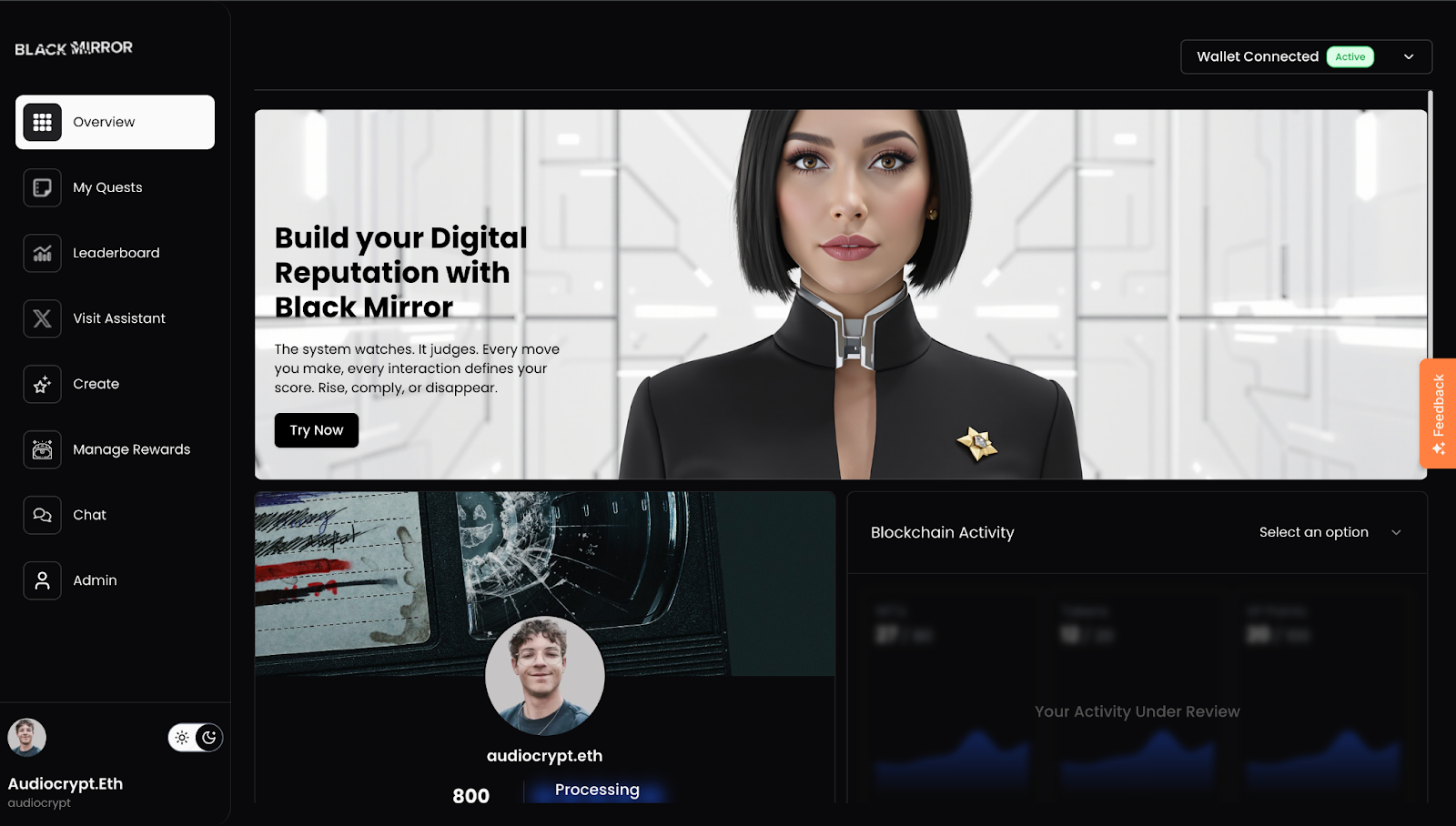

How Black Mirror’s on-chain experiment is paving the way for the future of entertainment monetization.

Traditional storytelling is hitting its ceiling. The passive, one-way consumption model that has defined entertainment for decades is increasingly out of sync with the expectations of digital-native audiences. And now, with the rise of new technologies, the entertainment intellectual property (IP) is entertainment intellectual property, or IP, is being fundamentally reimagined.

From Bandersnatch to Blockchain

Black Mirror has never been afraid to challenge the status quo. In 2018, the series broke new ground with Bandersnatch, an interactive episode. It hinted at a deeper shift: from stories we watch to stories we shape.

That shift is accelerating. Members of Gen Z and Gen Alpha have been raised in worlds like Minecraft, Roblox and Fortnite, where user-generated content forms the foundation of the experience. These audiences don’t want to passively consume; they want to participate, shape and own the narrative.

Traditional IP Revenue Is Evolving

Traditionally, IP holders made money through licensing, syndication, product placement and box office sales. But generative AI is disrupting this model. With tools like OpenAI’s Sora or Runway, anyone can spin up derivative content, posing both a threat and an opportunity. For IP owners, the challenge is clear: either lose control of the narrative or lean into new models that protect and expand it.

Enter blockchain.

Blockchain as the Rails for Interactive IP

Blockchain brings the missing LAYER of structure. It allows for:

- On-chain IP verification — using blockchain to prove who owns creative content, making it secure and transparent.

- Composable rights — content can be broken down into smaller parts that others can build on, remix or combine with new creations, allowing for microlicensing.

- Community ownership and participation rewards — fans can hold tokens that give them access to exclusive experiences and benefits as the project grows.

- Tokenized incentives for creators and fans — digital tokens are used to reward people for contributing, collaborating or being active in the community.

This format unlocks new paths for storytelling, where fans are stakeholders shaping narratives with their favorite IPs, not just spectators.

Case Study: Black Mirror Enters Web3

Banijay Rights, the global sales arm of content powerhouse Banijay Entertainment, which handles distribution for Black Mirror, has partnered with Pixelynx Inc. and KOR Protocol, a blockchain-based IP infrastructure and entertainment company based in Los Angeles, co-founded by iconic DJs Deadmau5 and Richie Hawtin. Led by visionary CEO Inder Phull, Pixelynx helped bring the Black Mirror universe on-chain in a way that’s interactive, compliant and community-driven.

Their latest initiative is a token inspired by the Nosedive episode, where fans LINK their socials and wallets to earn a reputation score. With more than 300,000 sign-ups, top participants unlock exclusive experiences and rewards, offering IP holders a new way to engage and reward their most passionate fans.

The IP Industry’s Fork in the Road

The future of entertainment lies in embracing this shift through new frameworks that provide clear guardrails for IP usage, that preserve integrity, protect rights and enable value to accrue to fans and creators in a fair and transparent way. This marks the beginning of a new era for IP: one defined by protection, participation and sustainable monetization.

By making IPs interactive, tokenized and on-chain, rights holders aren’t just experimenting—they’re sketching the blueprint for Storytelling 3.0.

Unknown block type "divider", specify a component for it in the `components.types` optionAsk an Expert

Ownership in Web3 is not just about holding an asset. More so, it’s about participating in a system. With the Black Mirror token, owning the token means having a say in governance, gaining access to exclusive ecosystems, and building a digital FORM of identity that has the ability to grow in value over time. Unlike passive stock ownership, this is participatory. You are a stakeholder, not just a shareholder.

Yes, but it’s nuanced. Black Mirror token gamifies trust because your on-chain actions and social interactions can earn tangible rewards. As a financial advisor, I’d caution that while this is exciting, it introduces performance-based risk. That being said, it reflects the direction of where young digitally native investors are heading.

Absolutely. Instead of fixed income yield, this is engagement yield. The more active and credible you are, the more awards you could potentially earn. It could be whitelisting access, platform discounts, or possibly token-based income. This is a new incentive model in some respects.

When speaking to a client, I frame it as a form of behavioral finance in motion. With the right level of risk and time allocation, it becomes an asset that pays in influence and access. It’s also a way to acknowledge that fulfillment and value look different to each person. Not every return is financial.

-

Unknown block type "divider", specify a component for it in the `components.types` optionKeep Reading

- JP Morgan to enable clients to invest in bitcoin.

- Robinhood to acquire Canadian crypto firm Wonderfi.

- The U.S. Senate voted 66-32 to advance its landmark stablecoin legislation, the GENIUS Act.

- Digital Assets: Month in Review, with Joshua de Vos of CoinDesk delivering a monthly column on the crypto markets and ETF/ETP flows.