Bitcoin’s Liquidity Rollercoaster Sets Stage for Potential ATH Breakout

Volatility spikes in BTC markets aren’t just shaking out weak hands—they’re priming the pump for a historic surge. When liquidity gets this twitchy, the big moves follow.

The squeeze play: On-chain data shows whales accumulating during dips while retail traders panic-sell. Classic bull market behavior, but with 10x the leverage of 2021.

Wall Street’s watching: Institutional flows into Bitcoin ETFs hit $1.2B last week despite the chop. Nothing gets capital flowing like the fear of missing the next leg up.

Cynical take: The same banks calling crypto ’too risky’ are quietly building their own digital asset desks. Volatility isn’t a bug—it’s a profit center for the suits.

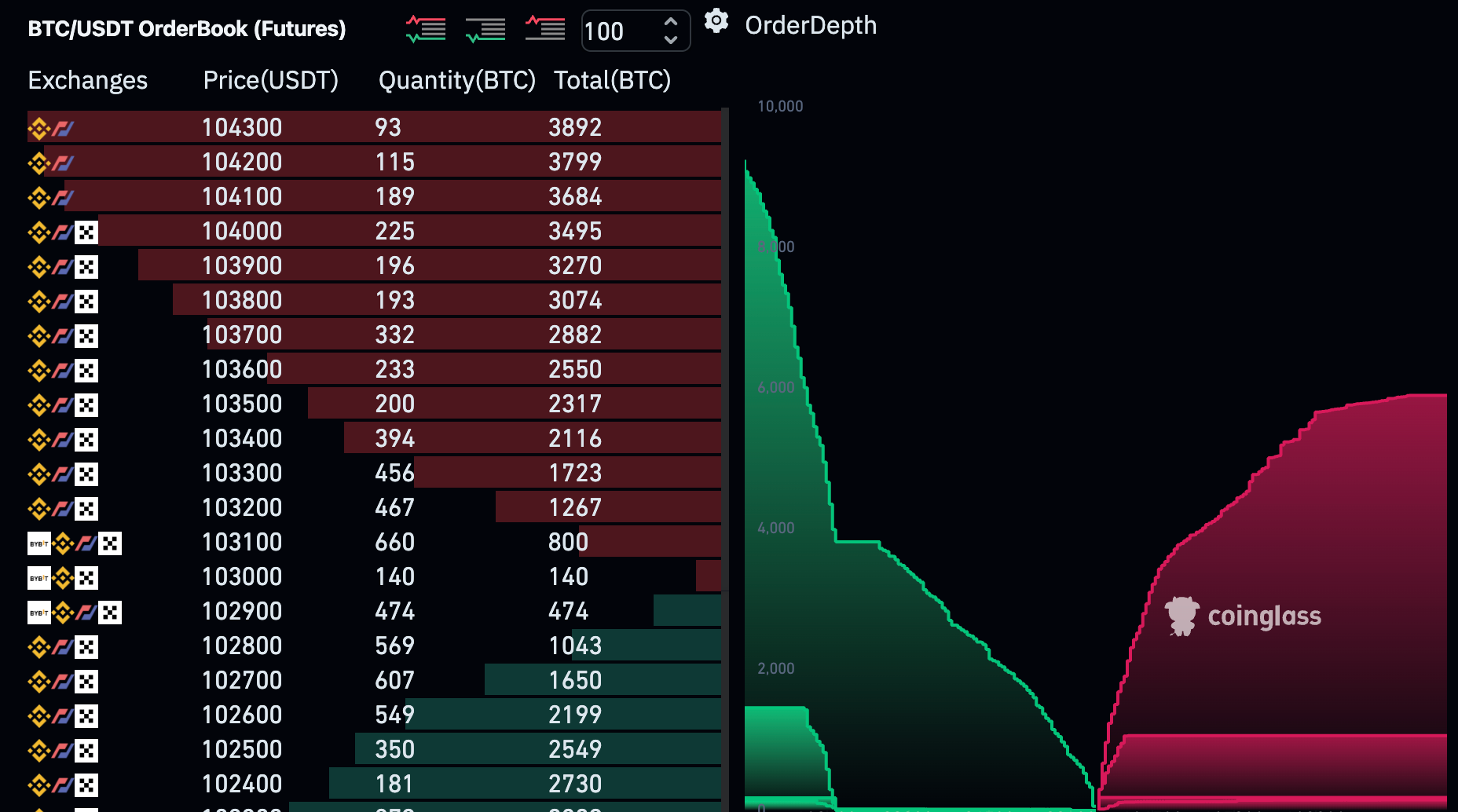

Now, market depth all the way up to $110,000 is minimal compared to limit orders lining the book down to $100,000. This means that any upside thrust will likely take this level out and see bitcoin trade at a new record high.

However, it’s worth considering the other side of the coin. It is also conceivable that the Sunday evening price action was a typical stop-loss hunt, which involves traders targeting a zone where those in short positions WOULD want to exit, thus creating an impulse in buy pressure as short traders scurry to buy back their position.

This strategy often takes place alongside entry into a larger short position. For example, if a trader wants to short BTC with a risk tolerance of 4%, it would be advantageous to open that position at $107,000 with a stop loss at $111,280 as opposed at $105,000 with a stop at $109,200. Astute traders can secure that entry by assessing levels of liquidity and squeezing short positions into closing, which temporarily lifts price to an ideal entry.

Either way, with liquidity now relatively low around record highs, bitcoin is one news catalyst away from that awaited upside thrust, and these potentially fresh short positions at $107,000 could provide the ammunition to that eventual break out.