0x Gobbles Up Rival Flood in Power Play for Dominance Over $2.3B DEX Aggregator Wars

Decentralized exchange (DEX) heavyweight 0x just made a strategic acquisition—snapping up competitor Flood in a bid to tighten its grip on the $2.3 billion aggregator market. The move reeks of classic consolidation—because why innovate when you can just buy the competition?

Aggregator arms race heats up: With Flood’s tech under its belt, 0x aims to streamline liquidity routing across chains, cutting slippage and trader headaches. Because nothing says ’decentralization’ like a handful of players controlling the flow.

Wall Street would be proud: The playbook here is familiar—scale fast, absorb rivals, and pray regulators don’t notice. Meanwhile, traders just want better prices. Will this actually deliver? Or is it another ’growth hack’ masking mediocre fundamentals?

‘Niche domain’

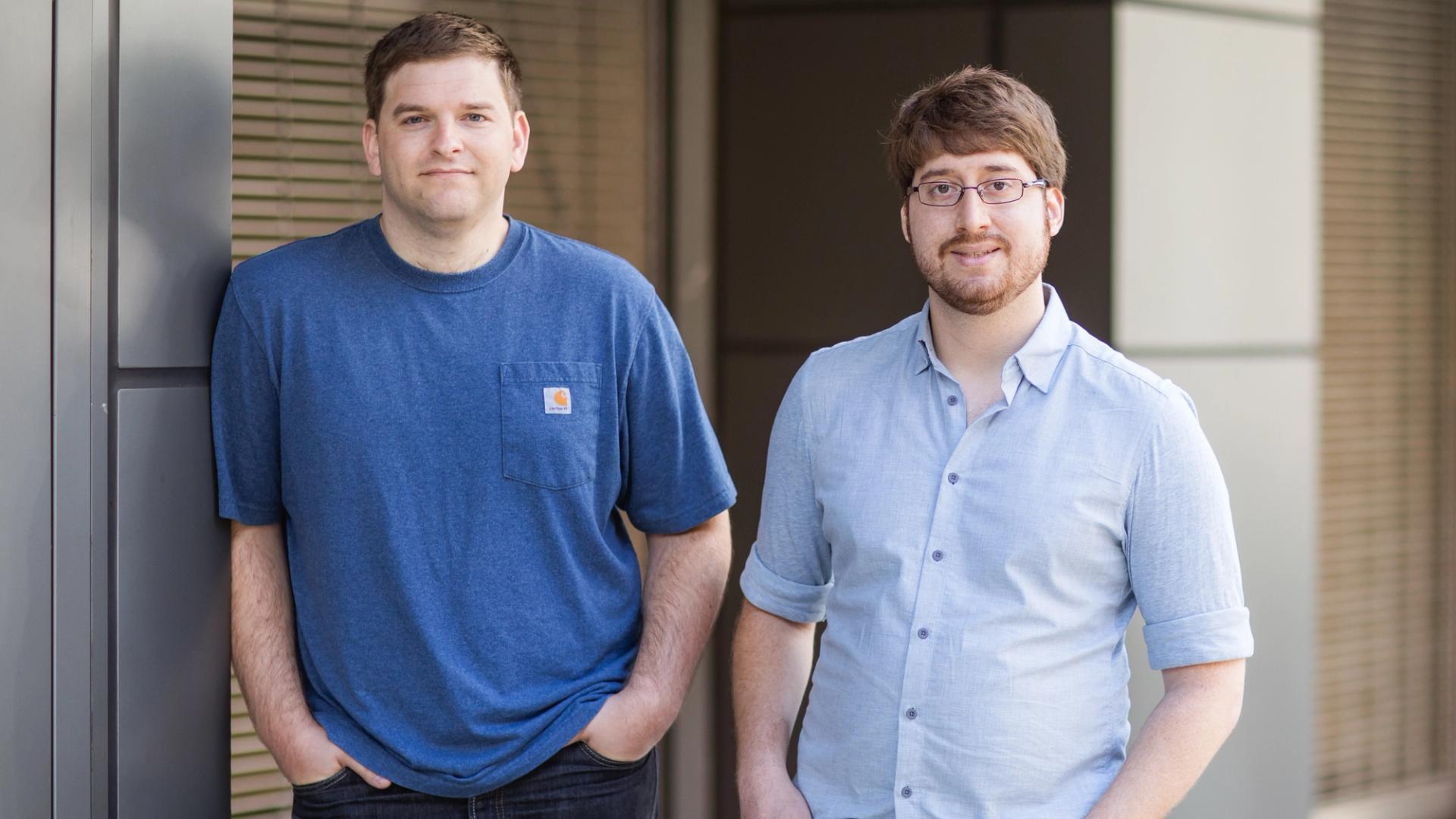

Another motivation for the acquisition was Flood’s team of developers.

“This is a pretty niche domain,” Bandeali said, explaining that it’s very difficult for his firm to find talented developers who specialize in aggregation and trade routing.

Having the right developers therefore is crucial to an aggregator’s continued success.

“It sounds simple but it’s really complicated,” he said. “It gets more complicated as new chains and new tokens launch.”

The reward for proving the best swaps is great. CoW Swap is set to bring in almost $11 million in revenue this year, according to DefiLlama data. (It’s unclear how much revenue 1INCH makes, while Jupiter’s projected $162 million in revenue comes from more than just its aggregation services).

0x has also expanded into other areas, such as providing APIs that integrate its aggregator into other products, and trading analytics.

But improving its Core aggregation product, which powers swaps in apps like Coinbase Wallet, Robinhood, Phantom and Farcaster, is still the main focus.

And with DeFi getting more complex by the day, the demand for aggregators is likely to keep increasing.

“We’re just trying to abstract away the complexity faster than it’s created for our customers,” Bandeali said.