Solana Sees Green Shoots: On-Chain Activity Hints at Comeback as Traders Circle

After months in crypto purgatory, Solana’s blockchain is flickering back to life—on-chain metrics show the first real uptick in user demand since FTX’s ghost town era. Whispers of ’bottom’ echo through Discord channels.

Devs deploy, degens lurk: The network’s daily active addresses just punched above 450k for the first time since January, while SOL’s price quietly gained 18% against Bitcoin this month. Not quite ’v-shaped recovery’ material, but enough to make bagholders check their wallets for the first time in quarters.

Cynics’ corner: Funny how ’institutional adoption’ narratives resurface right as VCs need exit liquidity. Still, the chain’s throughput—now handling ~3,000 TPS after last year’s upgrades—makes it the only Ethereum alternative that doesn’t choke on its own hype during congestion.

The real test? Whether Solana can sustain this momentum when the next meme coin frenzy hits. After all, nothing revives a blockchain like greater fools rushing in.

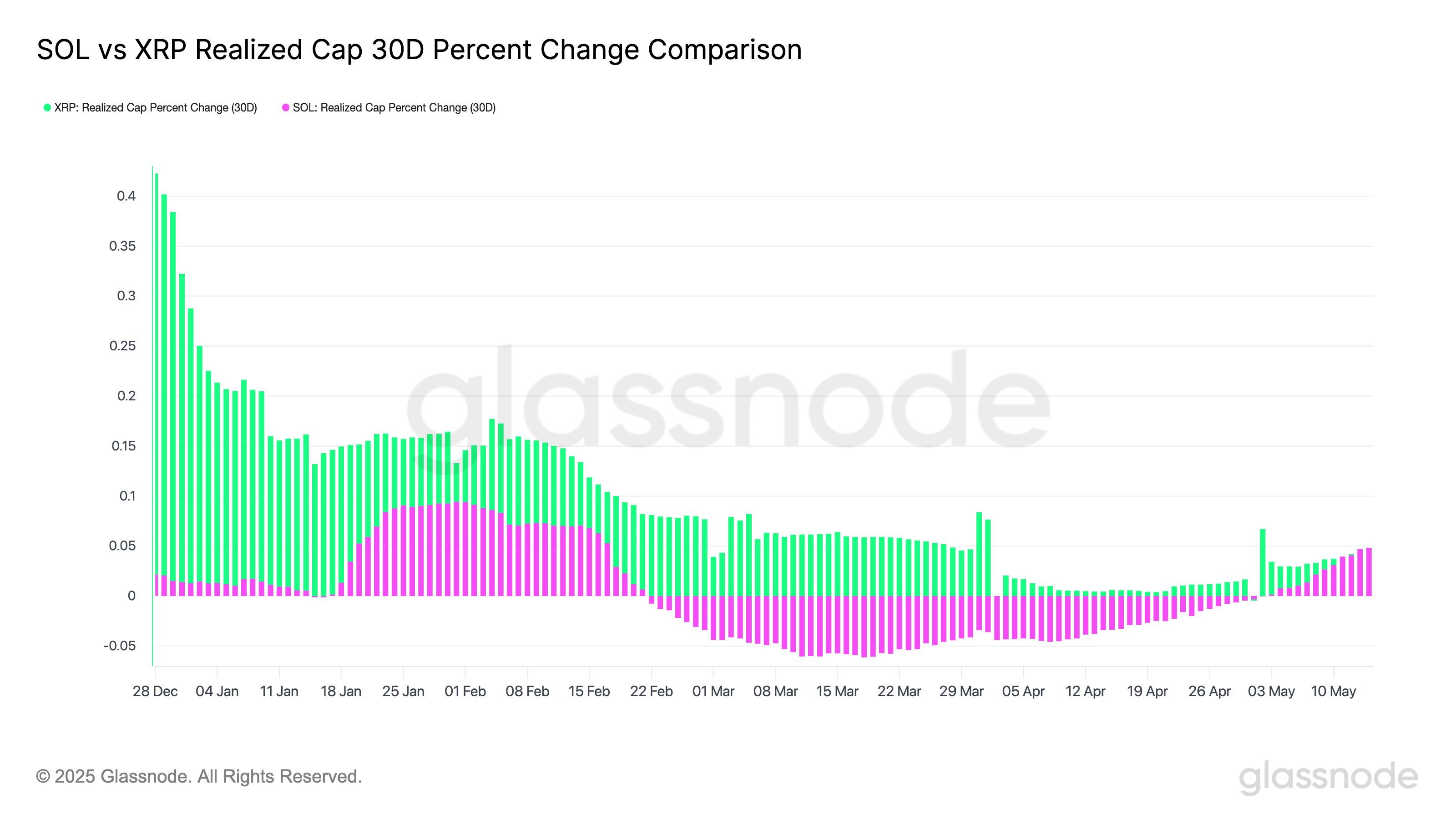

Realized cap inflow is a metric used to gauge actual capital entering or exiting an asset, based on the USD value of coins as they last moved on-chain. It filters out noise from speculative price spikes and instead tracks where holders are actually deploying capital.

For Solana, that number turning green again could indicate that buy-side pressure is finally returning, even if price action hasn’t fully reflected it.

Inflows into realized cap often serve as a leading indicator, suggesting some traders are positioning ahead of a potential bounce, or at the very least, a sign that capitulation has run its course.