Cantor Equity Partners Bets Big: $458M Bitcoin Purchase Signals Institutional Confidence

Wall Street’s latest crypto move isn’t subtle—Cantor just dropped half a billion on Bitcoin while traditional finance still debates its legitimacy. Talk about hedging your bets.

Why it matters: When institutional players make moves this size, they’re not gambling—they’re positioning. This isn’t your cousin’s ’HODL’ strategy anymore.

The cynical take: Nothing makes bankers believe in decentralization faster than the fear of missing out on 300% returns. Suddenly, ’volatile asset’ becomes ’strategic reserve’ when the balance sheet needs spice.

Twenty One Capital is being launched by Brandon Lutnick—the son of U.S. Commerce Secretary and Cantor Fitzgerald chairman Howard Lutnick—via a SPAC structure using Cantor Equity Partners. The company will be led by Strike CEO Jack Mallers and majority-owned by Tether and Bitfinex’s parent company, iFinex. SoftBank will take a significant minority stake, the companies said

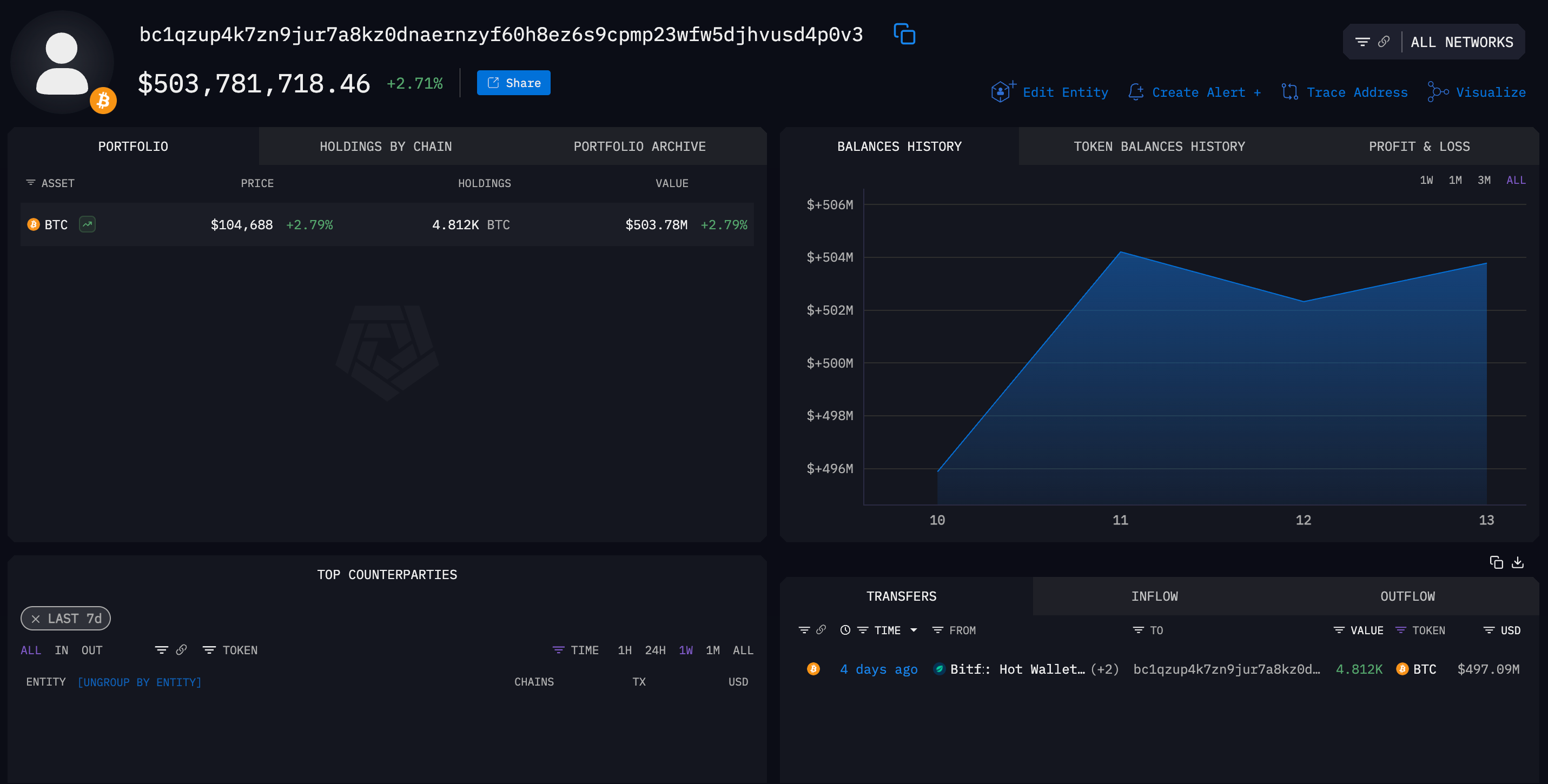

The company said it plans to have more than 42,000 BTC at launch.

CEP shares are higher by 3.7% in after hours trading.