Bitcoin’s Market Grip Tightens as FOMC Meeting Sparks Volatility Fears

BTC dominance hits yearly highs while traders brace for Fed-induced chaos—because nothing says ’stable monetary policy’ like watching Powell flip a coin.

Market analysts warn of imminent price swings as Bitcoin’s dominance metric surges past 55%. The crypto king flexes its muscles while altcoins tremble ahead of the Federal Open Market Committee’s rate decision.

Technical indicators suggest a make-or-break moment for BTC’s price action. Will institutional investors treat the Fed’s announcement as a buying signal—or another excuse to dump crypto ’for risk management purposes’ (wink).

Bitcoin volatility burst on the horizon

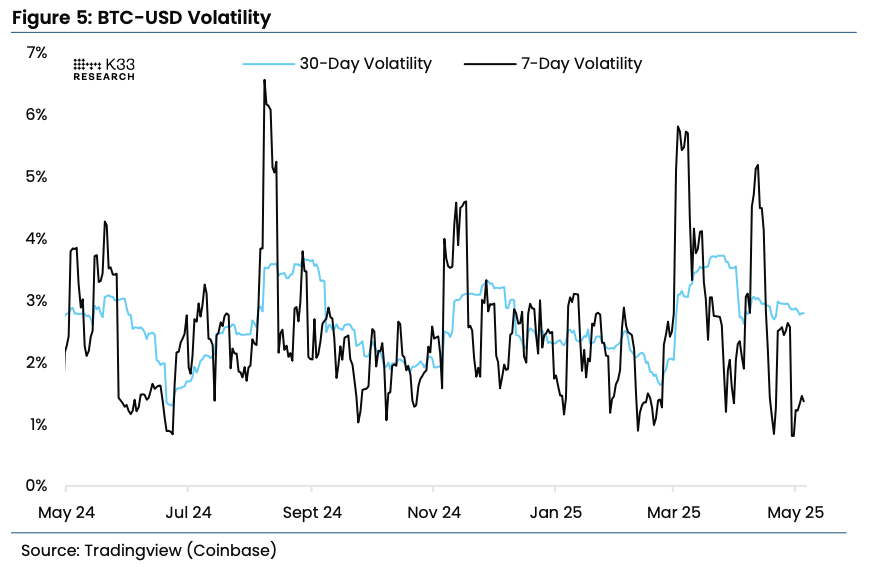

With bitcoin’s recent price action being extremely flat, the upcoming FOMC meeting "is rigged to cause significant volatility," said Vetle Lunde, head of research at K33. He noted in a Tuesday report that BTC’s short term volatility is "abnormally compressed," with the 7-day average dropping to the lowest level last week in 563 days.

"Such low volatility regimes in BTC tend to be short-lived," Lunde said. "Violent volatility outbursts typically follow this form of stability once prices start to move, as Leveraged trades are unwound and traders are reactivated into the market."

He said that a significant cascade lower is unlikely, as funding rates for perpetual swaps are consistently negative. Similar periods historically offered good buying opportunities for medium and long-term investors, Lunde added, favoring "aggressive spot exposure" ahead.