Bitcoin Stumbles But Doesn’t Fall: ETF Cash Flood & Fed Watch Keep Crypto Bulls Salivating

Another dip, another dollar-cost-average opportunity—Wall Street’s ETF money hose keeps the floor under BTC despite shaky hands.

Fed week looms large: Traders are placing bets on Powell’s poker face while pretending they understand ’neutral rates.’ Spoiler: Nobody does.

Meanwhile, crypto’s institutional sugar daddies keep writing checks—because nothing says ’mature asset class’ like needing billion-dollar babysitters to prevent 20% flash crashes.

What to Watch

- Crypto:

- May 5, 11 a.m.: The Crescendo network upgrade goes live on the Kaspa (KAS) mainnet. This upgrade boosts the network’s performance by increasing the block production rate to 10 blocks per second from 1 block per second.

- May 6: Casper Network (CSPR) launches its 2.0 mainnet upgrade, introducing faster transactions, enhanced smart contracts and improved staking features to boost enterprise adoption.

- May 7, 6:05 a.m.: The Pectra hard fork network upgrade will get activated on the Ethereum (ETH) mainnet at epoch 364032. Pectra combines two major components: the Prague execution layer hard fork and the Electra consensus layer upgrade.

- May 8: Judge John G. Koeltl will sentence Alex Mashinsky, the founder and former CEO of the now-defunct crypto lending firm Celsius Network, at the U.S. District Court for the Southern District of New York.

- Macro

- May 5, 9:45 a.m.: S&P Global releases (Final) U.S. April purchasing managers’ index (PMI) data.

- Composite PMI Est. 51.2 vs. Prev. 53.5

- Services PMI Est. 51.4 vs. Prev. 54.4

- May 5, 10 a.m.: Institute for Supply Management (ISM) releases U.S. April economic activity data.

- Services PMI Est. 50.6 vs. Prev. 50.8

- May 6, 9 a.m.: S&P Global releases Brazil April purchasing managers’ index (PMI) data.

- Composite PMI Prev. 52.6

- Services PMI Prev. 52.5

- May 7, 7 p.m.: The Federal Reserve announces its interest rate decision. The FOMC press conference is livestreamed 30 minutes later.

- Federal Funds Rate Target Range Est. 4.25%-4.5% vs. Prev. 4.25%-4.5%

- May 5, 9:45 a.m.: S&P Global releases (Final) U.S. April purchasing managers’ index (PMI) data.

- Earnings (Estimates based on FactSet data)

- May 6: Cipher Mining (CIFR), pre-market, $-0.07

- May 8: CleanSpark (CLSK), post-market, $-0.01

- May 8: Coinbase Global (COIN), post-market, $2.08

- May 8: Hut 8 (HUT), pre-market

- May 8: MARA Holdings (MARA), post-market

- May 13: Semler Scientific (SMLR), post-market

Token Events

- Governance votes & calls

- Uniswap DAO is voting on whether to pay Forse, a data‑analytics platform from StableLab, $60,000 in UNI to build an “analytics hub” that tracks how incentive programs are working on four more blockchains. Voting ends on May 6.

- Arbitrum DAO is voting on whether to put the last $10.7 million from its 35 million ARB diversification plan into three low‑risk, dollar‑based funds from WisdomTree, Spiko and Franklin Templeton. Voting ends on May 8.

- May 5, 4 p.m.: Livepeer (LPT) to host a Treasury Talk session on Discord.

- May 6, 1:30 p.m.: MetaMask and Aave to host an X Spaces session on USDC supplied to Aave being spendable on the MetaMask card.

- May 7, 7:30 a.m.: PancakeSwap to host an X Spaces Ask Me Anything (AMA) session on the future of trading.

- May 7, 11 a.m.: Pendle to host a Pendle Yield Talk: Stablecoin Alpha X Spaces session.

- May 8, 10 a.m.: Balancer and Euler to host an Ask Me Anything (AMA) session.

- Unlocks

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating supply worth $13.59 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating supply worth $9.85 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating supply worth $88.46 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating supply worth $58.36 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating supply worth $1.13 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $17.02 million.

- Token Launches

- May 5: Sonic (S) to be listed on Kraken.

- May 7: Obol (OBOL) to be listed on Binance, Bitget, Bybit, Gate.io, MEXC, and others.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- May 6-7: Financial Times Digital Assets Summit (London)

- May 6-8: Stripe Sessions (San Francisco)

- May 7-9: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- Memecoin markets are not attracting celebrity hype anymore.

- Prices of the GORK token, which references a parody AI chatbot that itself mimics XAI’s Grok chatbot, failed to jump higher over the weekend even as technocrat Elon Musk widely referenced the Gork X account.

— gorklon rust (@elonmusk) May 3, 2025 - Musk even changed his X picture to the one used by Gork. He later added pit viper sunglasses — a reference to Mog Coin — after a MOG holder asked Musk to "put those" on.

- GORK, which was issued last week, zoomed to an $80 million market capitalization in four days, but did not rise after Musk’s references, a possible sign of fatigue among memecoin speculators. Such an endorsement last year would probably have led to a massive spike in prices.

- That muted reaction highlights a broader shift in memecoin dynamics: Celebrity engagement no longer guarantees price momentum. In 2023 and early 2024, even a single tweet or like from high-profile figures could trigger double- or triple-digit percentage gains in minutes.

- But the market has since matured, or, arguably, burned out. Now, traders seem more focused on liquidity depth, tokenomics and narrative stickiness than quick-hit endorsements.

- GORK’s stalled reaction, despite Musk’s implicit nod, suggests that attention alone isn’t enough — memecoins need sustained community traction or utility memes to drive value.

- It also hints that retail appetite may be cooling, especially as memecoins become more saturated and short-term rotations grow more competitive.

Derivatives Positioning

- Monero’s (XMR) perpetual futures market looks overheated, with annualized funding rates nearing the 100% mark. Extreme bullish positioning often translates into sudden price pull backs.

- BCH and SUI markets face the opposite situation with bias for shorts driving funding rates to minus 20% or lower. This could potentially lead to a short squeeze and a big move higher.

- BTC futures open interest on the CME rose to $14.01 billion on Friday, the highest since Feb. 21. ETH open interest remains flat near recent lows under $1.5 billion.

- On Deribit, BTC calls trade at a premium to puts across multiple time frames, risk reversals show. In ETH’s case, bullishness is seen only after the end-May expiry.

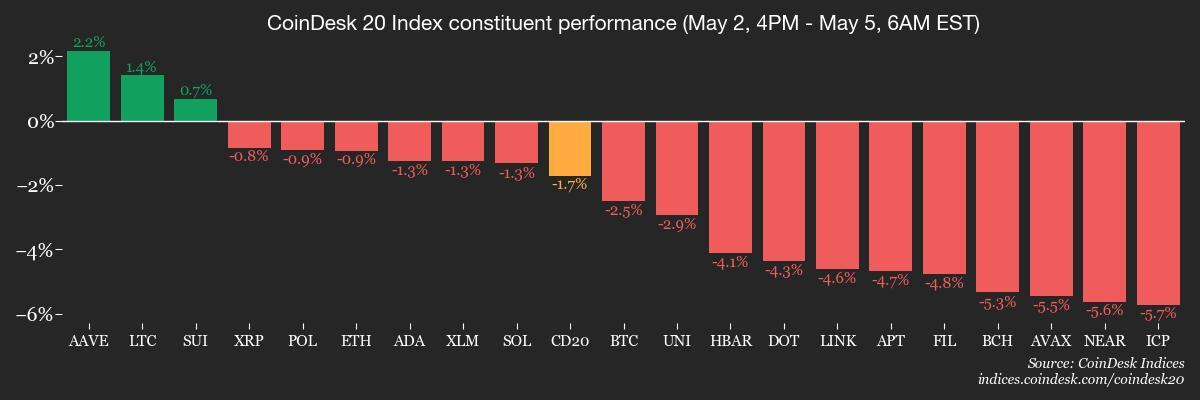

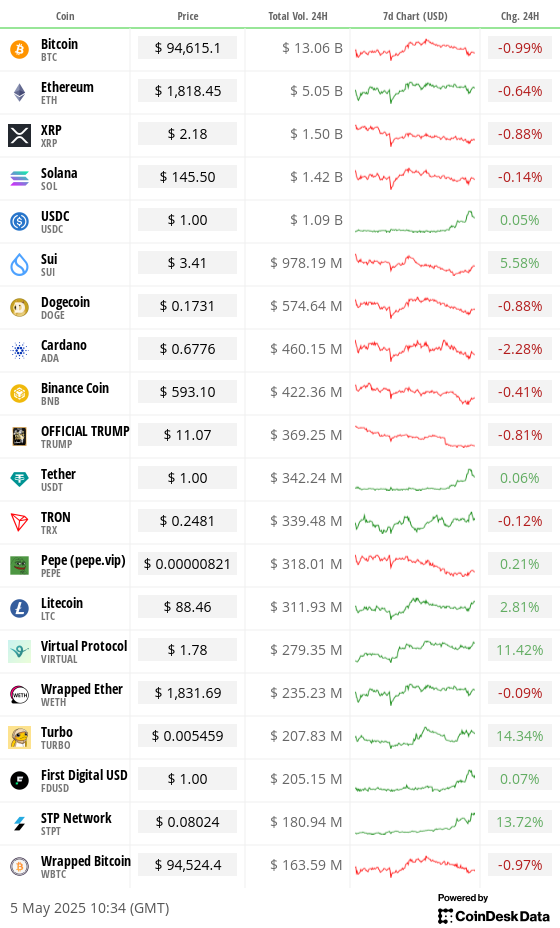

Market Movements

- BTC is down 1.27% from 4 p.m. ET Sunday at $94,447.49 (24hrs: -1.07%)

- ETH is down 0.77% at $1,819.25 (24hrs: -0.39%)

- CoinDesk 20 is down 0.70% at 2,721.32 (24hrs: unchanged)

- Ether CESR Composite Staking Rate is down 3 bps at 2.90%

- BTC funding rate is at 0.0007% (0.7512% annualized) on Binance

- DXY is down 0.34% at 99.69

- Gold is up 2.29% at $3,316.45/oz

- Silver is up 1.4% at $32.43/oz

- Nikkei 225 closed +1.04% at 36,830.69

- Hang Seng closed +1.74% at 22,504.68

- FTSE closed on Friday +1.17% at 8,596.35

- Euro Stoxx 50 is down 0.35% at 5,266.20

- DJIA closed on Friday +1.39% at 41,317.43

- S&P 500 closed +1.47% at 5,686.67

- Nasdaq closed +1.51% at 17,977.73

- S&P/TSX Composite Index closed +0.95% at 25,031.51

- S&P 40 Latin America closed -2.94% at 2,227.14

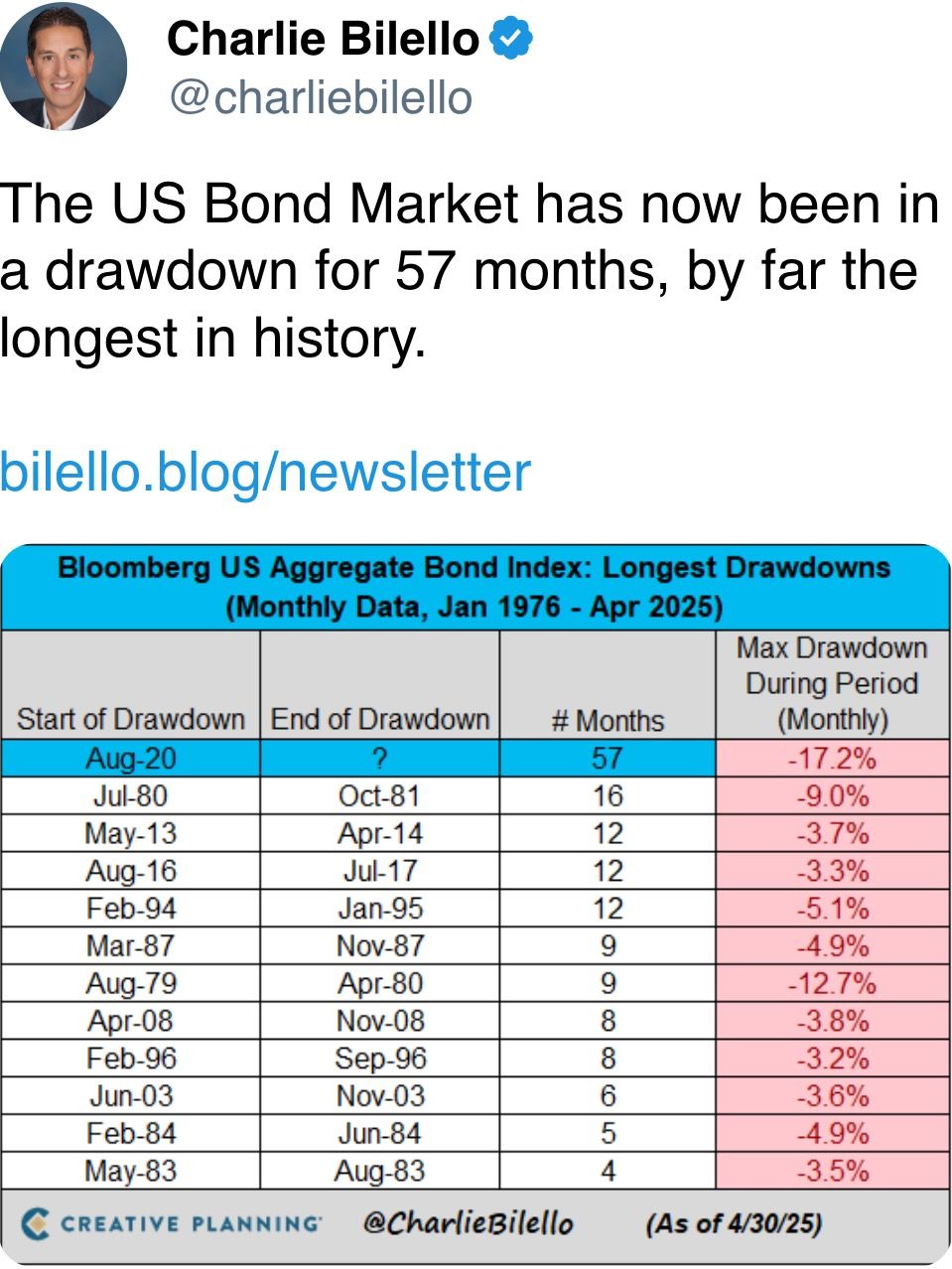

- U.S. 10-year Treasury rate is up 8 bps at 4.32%

- E-mini S&P 500 futures are down 0.75% at 5,666.00

- E-mini Nasdaq-100 futures are up 0.90% at 20,013.75

- E-mini Dow Jones Industrial Average Index futures are down 0.61% at 41,174.00

Bitcoin Stats

- BTC Dominance: 64.65 (-0.21%)

- Ethereum to bitcoin ratio: 0.01928 (+0.52%)

- Hashrate (seven-day moving average): 886 EH/s

- Hashprice (spot): $50.30

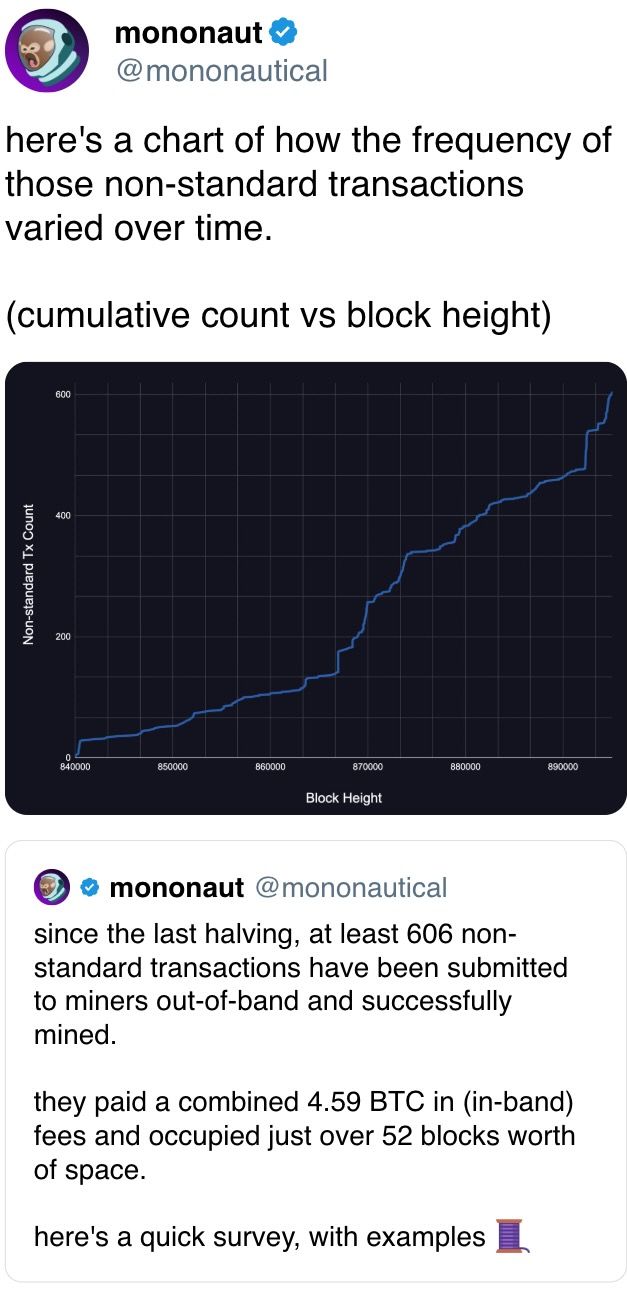

- Total Fees: 3.40 BTC / $321,456

- CME Futures Open Interest: 145,920 BTC

- BTC priced in gold: 28.9 oz

- BTC vs gold market cap: 8.18%

Technical Analysis

- TON traded at the support level offered by the trendline connecting lows registered in March and April.

- Potential violation of trendline would signal an end of the corrective bounce from first-quarter lows, exposing the yearly low of $2.43.

Crypto Equities

- Strategy (MSTR): closed on Friday at $394.37 (+3.35%), down 2.38% at $384.98 in pre-market

- Coinbase Global (COIN): closed at $204.93 (+1.8%), down 1.81% at $201.22

- Galaxy Digital Holdings (GLXY): closed at $26.84 (+11.6%)

- MARA Holdings (MARA): closed at $14.48 (+3.06%), down 2.56% at $14.11

- Riot Platforms (RIOT): closed at $8.39 (+7.98%), down 2.15% at $8.21

- Core Scientific (CORZ): closed at $8.74 (+2.22%), down 1.49% at $8.61

- CleanSpark (CLSK): closed at $8.81 (+1.61%), down 2.50% at $8.59

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.97 (+2.6%)

- Semler Scientific (SMLR): closed at $36.16 (+8.49%)

- Exodus Movement (EXOD): closed at $44.79 (+10.92%), up 2.66% at $45.98

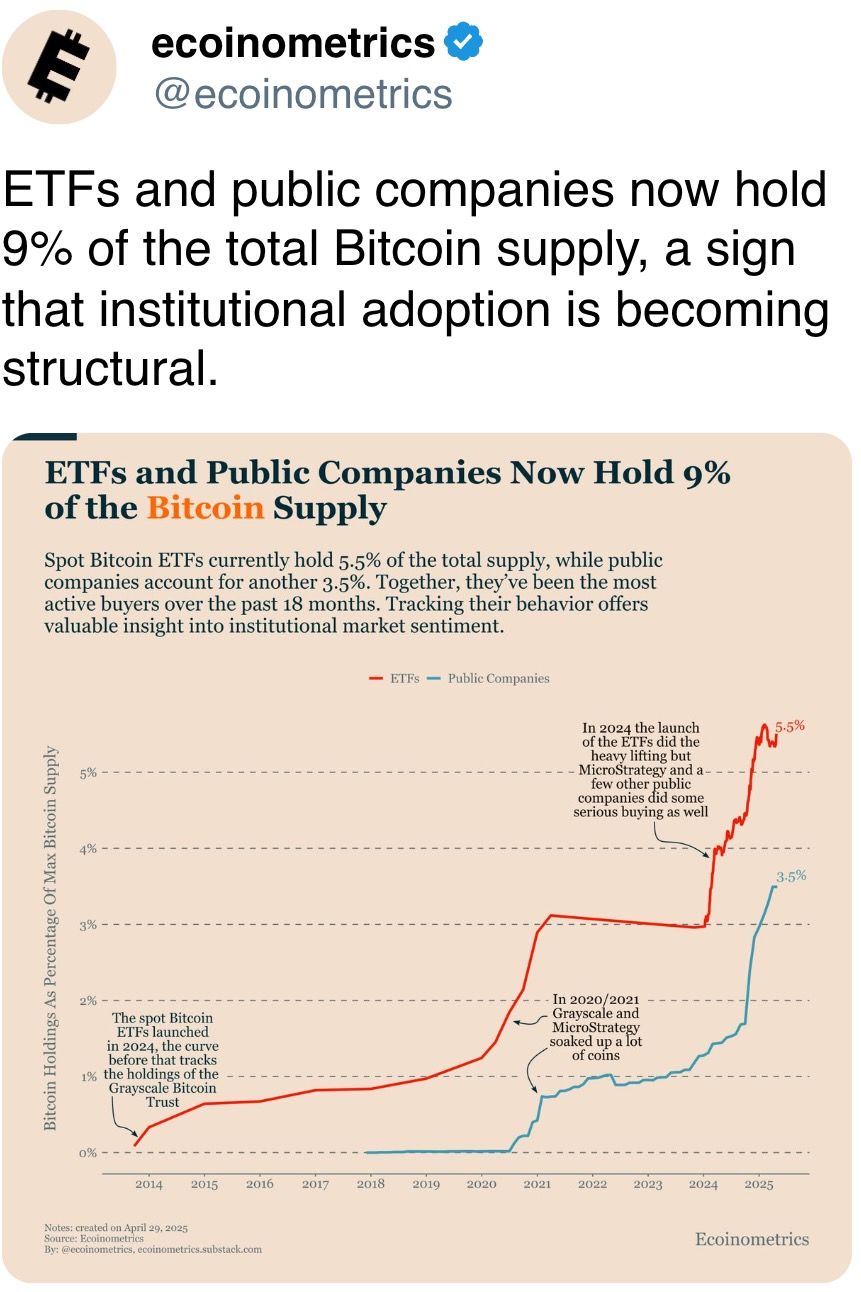

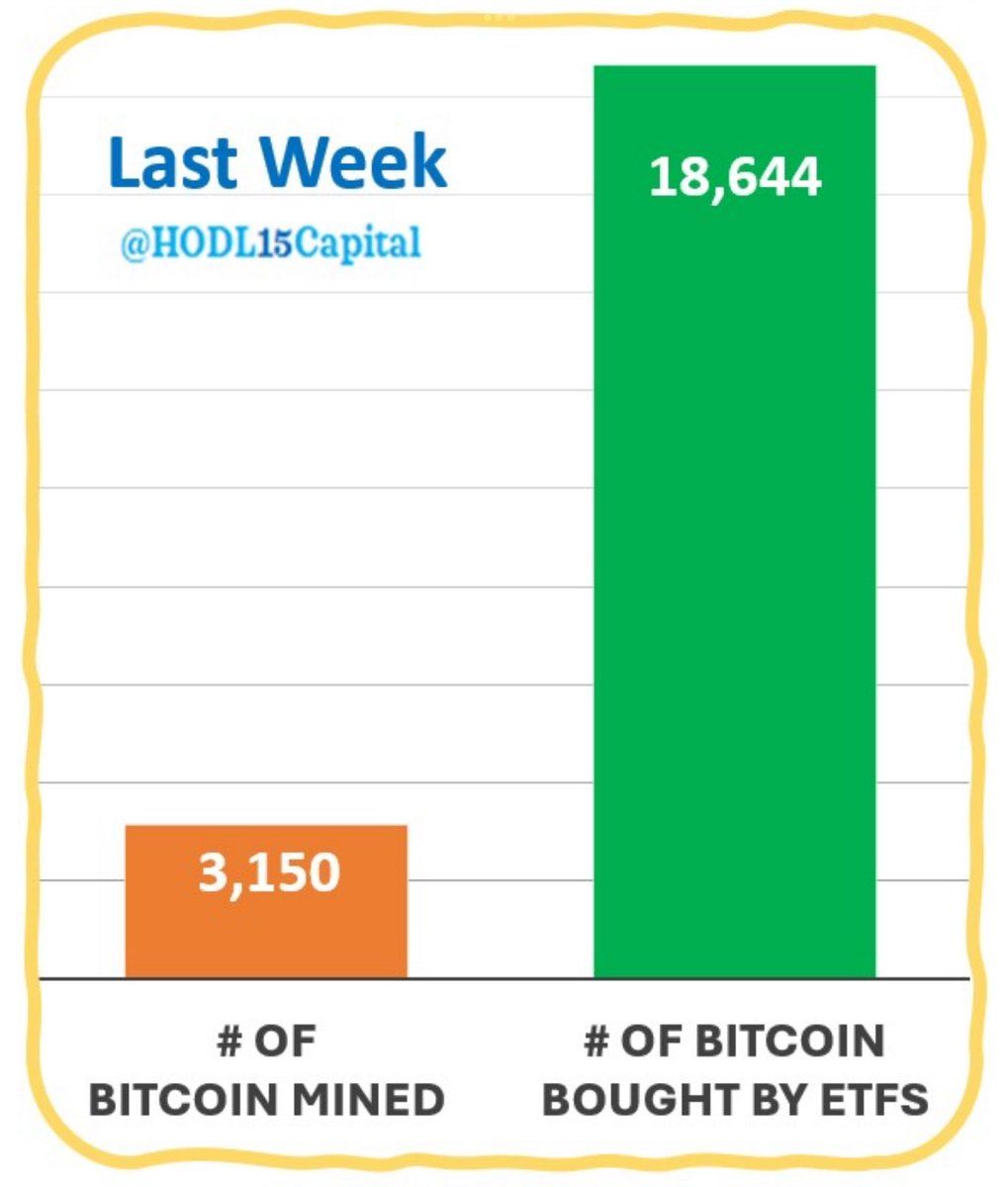

ETF Flows

- Daily net flow: $674.9 million

- Cumulative net flows: $40.20 billion

- Total BTC holdings ~ 1.16 million

- Daily net flow: $20.1 million

- Cumulative net flows: $2.52 billion

- Total ETH holdings ~ 3.46 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows the U.S.-listed spot bitcoin ETFs snapped up over 18,000 BTC last week, significantly outpacing the new supply from miners.

While You Were Sleeping

- President Donald Trump Denies He’s Profiting From TRUMP Token: (NBC): In an interview with "Meet the Press" moderator Kristen Welker, Trump said he hasn’t checked his crypto token’s value.

- Maldives Could Soon Become a Crypto Hub Thanks to Dubai Family Office’s $9B Commitment (CoinDesk): A Dubai-based family office tied to Qatari royal Sheikh Nayef plans to invest up to $8.8 billion in a Maldives financial hub over five years, with $4 billion already committed.

- Kyrgyzstan’s Gold-Backed Dollar Pegged Stablecoin USDKG to Debut in Q3 (CoinDesk): The stablecoin will be backed by $500 million in gold from the Kyrgyz Ministry of Finance, with plans to expand reserves to $2 billion.

- Why the U.S. Senate Crypto Bill Is in Turmoil (Politico): Nine Democrat senators pulled support Saturday for a revised stablecoin bill, citing diluted anti-money laundering rules, systemic risk concerns and Trump family ties to a $2 billion crypto deal.

- Chinese Exporters ‘Wash’ Products in Third Countries to Avoid Donald Trump’s Tariffs (Financial Times): Authorities in Asia are investigating intermediaries helping Chinese firms reroute goods through nearby countries, where shipments are repackaged and relabeled to obtain new origin certificates.

- OPEC+ Supply Hike Forces Wall Street to Redo Sums, Yet Again (Bloomberg): Saudi Arabia appears willing to accept weaker oil prices to rein in overproducing allies, undercut U.S. shale rivals and demonstrate cooperation with Washington amid global inflation concerns.

In the Ether