Bitcoin’s ’10x Money Multiplier’ Threatens to Upend Wall Street’s Status Quo

Forget gold—the real wealth accelerator is flashing orange on crypto charts. Bitcoin’s potential to act as a 10x monetary multiplier isn’t just theoretical anymore; institutional inflows suggest TradFi dinosaurs are finally catching on.

Hedge funds that mocked crypto in 2022 are now quietly stacking SATs—because nothing motivates bankers like missing out on asymmetric returns. The same firms that called Bitcoin a ’fraud’ during bear markets suddenly recognize its velocity advantages over sluggish securities.

Here’s what Wall Street won’t admit: Their precious fractional reserve system looks downright archaic against Bitcoin’s programmable scarcity. While banks recycle the same dollars through 10:1 leverage, Satoshi’s invention enforces hard caps with code—no FDIC theater required.

One cynical truth emerges: Finance always follows the money. When BlackRock starts mining, you know we’ve reached the ’if you can’t beat them, charge 2% management fees’ phase of adoption.

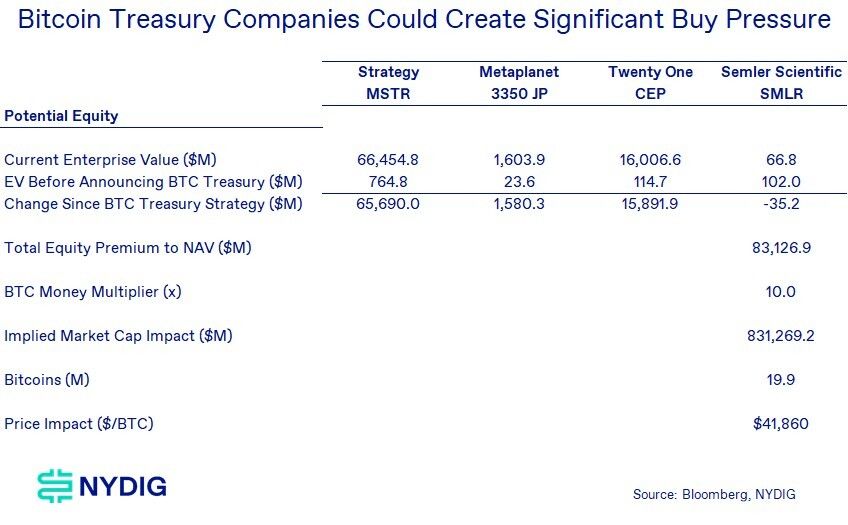

To reach this conclusion, the analysts at NYDIG reviewed Strategy (MSTR), Metaplanet (3350), Twenty One (CEP), and Semler Scientific’s (SMLR) cumulative equity valuation since they adopted the bitcoin buying strategy. This gave the analysts an outline of how much money they could theoretically raise by issuing shares at current stock prices to buy more bitcoin.

If this analysis comes true, the projected price is nearly a 44% increase from the current spot price of $96,000 per bitcoin. If capitalized, Wall Street money managers perhaps wouldn’t mind showing this PnL chart to their clients, especially given the current volatility and uncertainty in the market.

"The implication is clear: this ’dry powder’ in the form of issuance capacity could have a significant upward effect on bitcoin’s price," NYDIG Research said.

Bitcoin’s limited supply also bodes well for the analysis. Publicly-traded companies already hold 3.63% of bitcoin’s total supply, with the lion’s share of those coins being held by Strategy. Adding private company and government holdings, the total is at 7.48% according to BitcoinTreasuries data.

Demand could also grow further in the NEAR future if the U.S. government finds “budget-neutral strategies for acquiring additional bitcoin” for its strategic bitcoin reserve.