Dogecoin and XRP ETF Buzz Sparks Market Frenzy—Social Media Data Confirms Rally Fuel

Meme coins and payment tokens are stealing the spotlight as ETF speculation goes mainstream. Retail traders are piling in—proof that hope still beats fundamentals in crypto.

Dogecoin’s +30% weekly surge and XRP’s sudden liquidity spike suggest Wall Street’s favorite gambling excuse—’institutional adoption’—is back in play. Never mind that the SEC still treats both like unregistered securities.

Key drivers: VanEck’s XRP ETF filing whispers, plus renewed DOGE futures volume. Cynics note this mirrors 2021’s ’greater fool’ patterns—but when has that ever stopped a bull run?

Bottom line: The market’s betting on ETFs as the next narrative lifeline. Just don’t ask who’ll actually use these tokens when the hype fades.

Such a boost in confidence comes despite the SEC’s recent decision to delay rulings on spot DOGE and XRP ETF proposals until June 17. Technical analysis remains bullish, showing strong accumulation patterns in the current market lull.

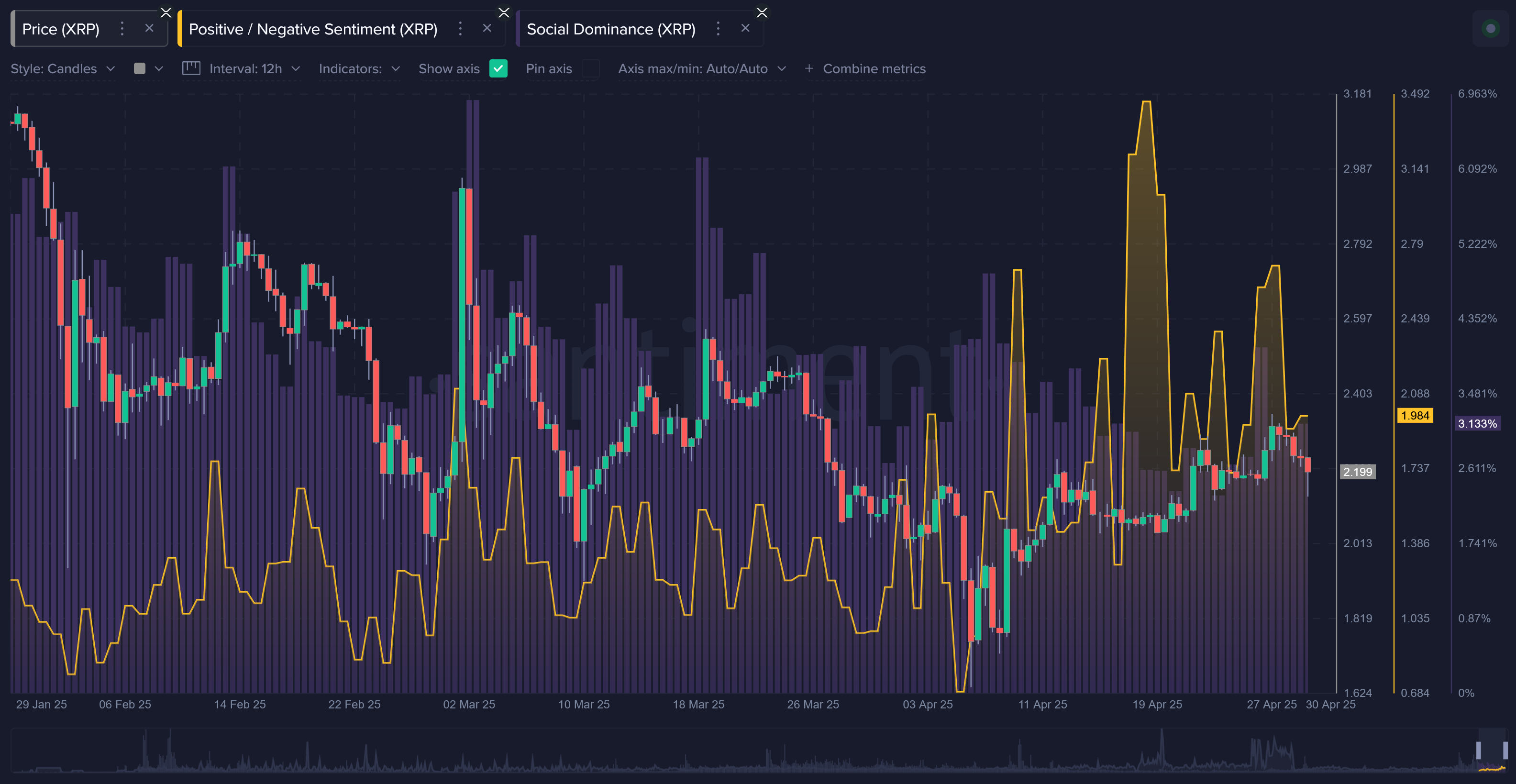

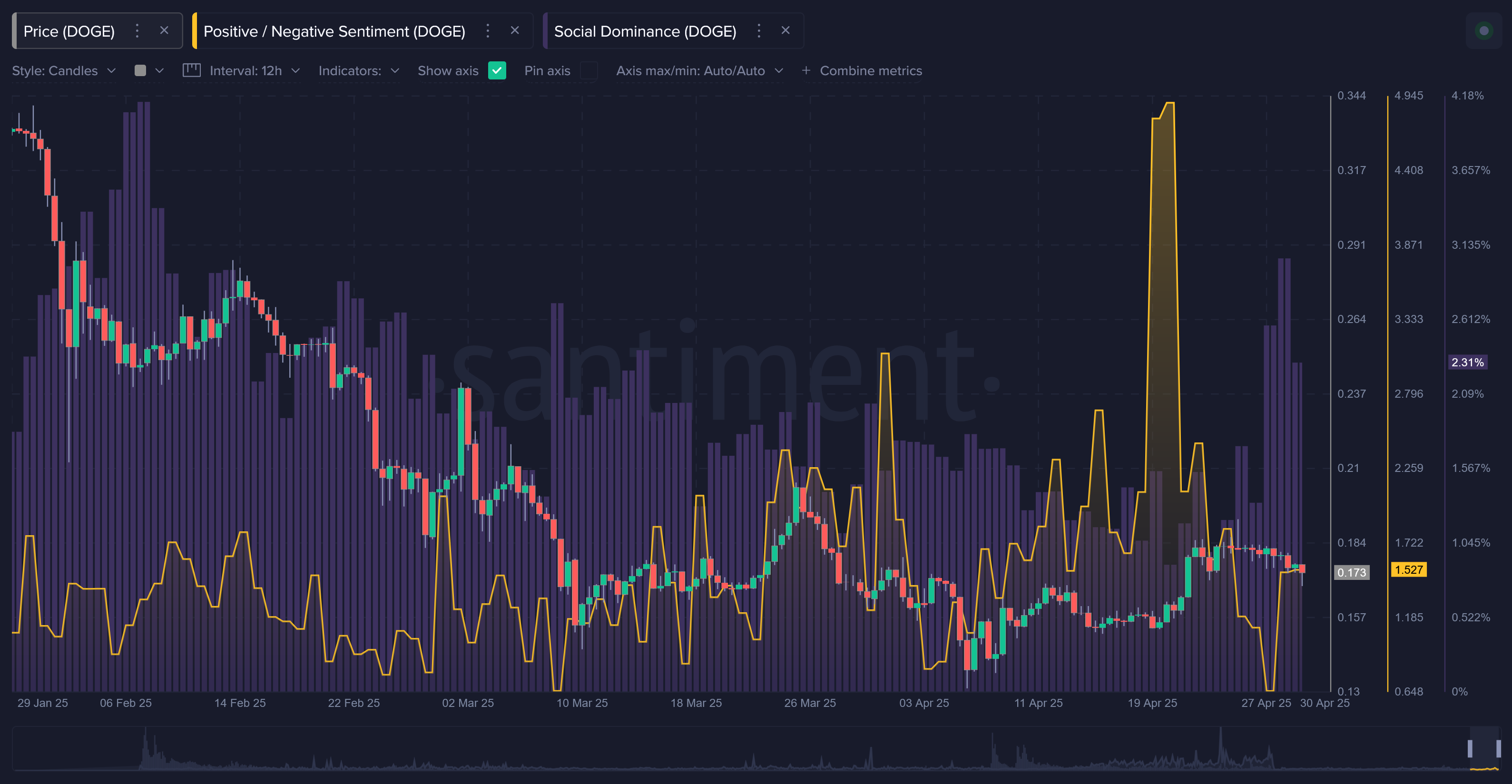

Online tone for Dogecoin has shifted dramatically following the April filings by 21Shares and Bitwise for Doge spot ETFs. Until late April, DOGE was in a prolonged lull in social attention, but its social dominance has now surged to a three-month high, Santiment noted.

The House of Doge and Dogecoin Foundation’s support for 21Shares’ application has added further credibility to the effort, helping DOGE shed some of its "memecoin" baggage.

“After being seen mainly as a meme or joke coin, DOGE is now viewed as a more serious investment option with potential for wider adoption,” Santiment said.

“Analysts and traders have noticed heavy accumulation by whales, with bullish patterns forming in the charts, which has added to the sense that Dogecoin may be entering a new growth phase," it added.

Meanwhile, tokens like ether (ETH), Solana’s SOL and BNB show mixed social signals even as Bitcoin staged a recovery above $97,000 early Friday.