Stablecoins Poised to Trigger Blockchain’s ’ChatGPT Moment’—Citi Predicts $3.7T Boom by 2030

Wall Street’s latest crystal-ball gaze lands on stablecoins—the unsexy, pragmatic workhorses of crypto—as the unlikely catalyst for mass blockchain adoption. Citi’s analysts suggest these dollar-pegged tokens could do for decentralized finance what ChatGPT did for AI: make it suddenly useful for normies.

Forget moonboys and apes—real adoption starts when grandma can send $50 to Venezuela without losing half of it to SWIFT fees or volatility. The report’s $3.7 trillion projection assumes stablecoins finally bridge the gap between crypto’s wild west and the regulated financial system. (Though let’s be real—banks will still find a way to slap on a 2% ’convenience fee.’)

The kicker? This growth hinges on regulators not doing what they do best: knee-jerk crackdowns that stifle innovation while somehow still missing the actual fraudsters.

Stablecoin issuers to become major U.S. Treasury holders

Stablecoins are expected to remain heavily dollar-denominated in the future. The report anticipates that around 90% of stablecoins in circulation in 2030 will still be tied to the U.S. dollar, cementing its dominance.

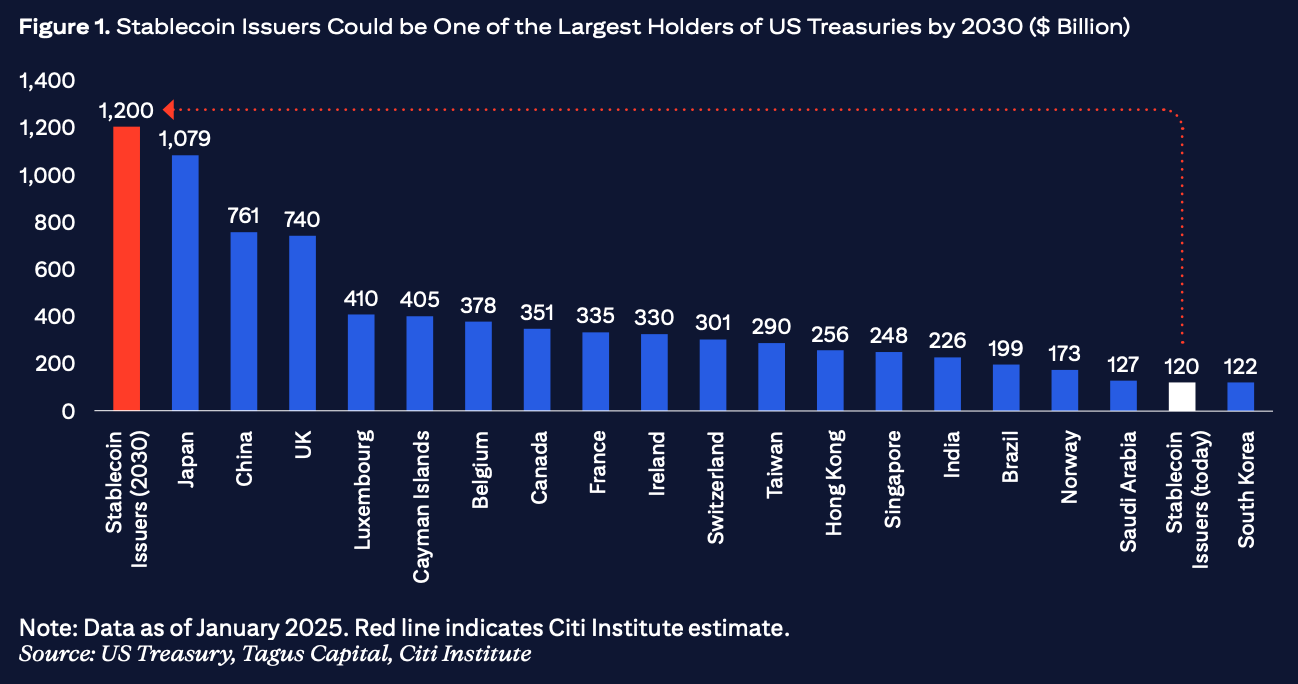

This has major implications for the global financial system. Dollar stablecoin issuers could become one of the largest buyers of U.S. Treasuries, assuming that regulations push toward backing tokens with low-risk, highly liquid traditional financial assets like government bonds. Citibank estimated issuers could hold $1.2 trillion in U.S. government debt by the end of the decade, potentially surpassing all major foreign sovereign holders.

Meanwhile, the central banks of countries in Europe and Asia will likely promote their own digital currencies, or CBDCs, the report noted.

The report pointed to several risks that could hamper the growth. Stablecoins de-pegged nearly 1,900 times in 2023 alone, including more than 600 instances involving major tokens, the report’s authors wrote, citing Moody’s data.

In extreme cases, mass redemptions—like those following the collapse of Silicon Valley Bank (SVB) that consequently hit USDC—can disrupt crypto liquidity, force automated selloffs and Ripple through financial markets, the authors added.