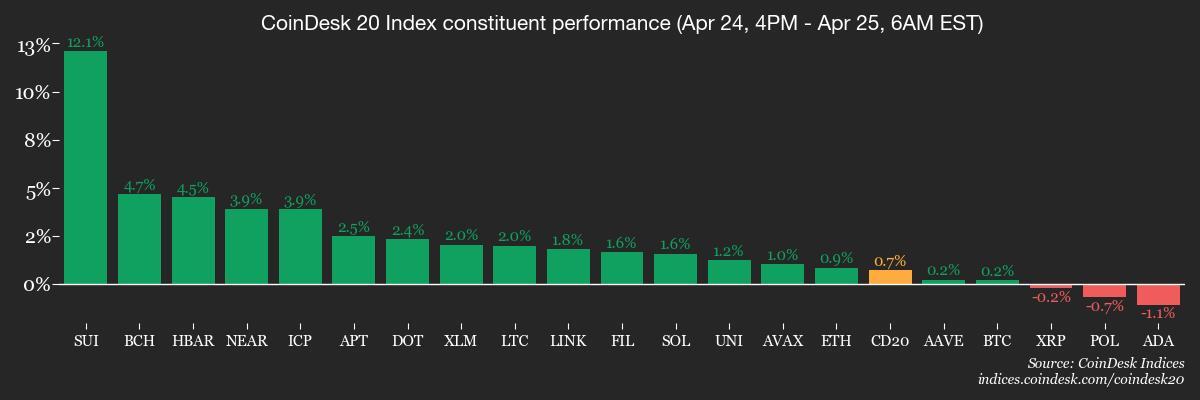

SUI and STX Lead Altcoin Charge as Bitcoin Whales Stack for Next Leg Up

Move over, BTC—today’s action is in the alts. SUI and STX post double-digit gains while Bitcoin whales quietly accumulate positions. The smart money’s playing chess while retail traders chase pumps.

Watch those whale wallets: When the big players position like this, they’re betting on more than just a dead-cat bounce. Meanwhile, Wall Street still can’t decide if crypto’s the future or just a high-beta toy for their client portfolios.

What to Watch

- Crypto:

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on "Key Considerations for Crypto Custody".

- April 28: Enjin Relaychain increases active validator slots to 25 from 15 to enhance decentralization.

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, offering exposure through futures and swap agreements, to begin trading on NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra hard fork on its mainnet at slot 21,405,696, epoch 1,337,856.

- Macro

- Day 5 of 6: World Bank (WB) and the International Monetary Fund (IMF) spring meetings in Washington.

- April 25, 8:30 a.m.: Statistics Canada releases (Final) February retail sales data.

- Retail Sales Ex Autos MoM Est. -0.4% vs. Prev. 0.2%

- Retail Sales MoM Est. -0.4% vs. Prev. -0.6%

- Retail Sales YoY Prev. 4.2%

- April 25, 10:00 a.m.: The University of Michigan releases (Final) April U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 50.8 vs. Prev. 57

- April 28: Canadian federal election.

- Earnings (Estimates based on FactSet data)

- April 29: PayPal Holdings (PYPL), pre-market, $1.16

- April 30: Robinhood Markets (HOOD), post-market, $0.33

- May 1: Block (XYZ), post-market, $0.97

- May 1: Reddit (RDDT), post-market, $0.02

- May 1: Riot Platforms (RIOT), post-market, $-0.23

- May 1: Strategy (MSTR), post-market, $-0.11

Token Events

- Governance votes & calls

- Lido DAO is voting to extend its delegate incentivization program (DIP) through Q4 with a $225,000 LDO budget. Voting ends April 28.

- Uniswap DAO will vote on establishing a licensing and deployment framework for Uniswap v4 to accelerate its adoption across multiple chains. The proposal grants the Uniswap Foundation a blanket exemption to deploy v4 on any DAO-approved chain and gives the Uniswap Accountability Committee authority to update deployment records. Voting is April 24-30.

- April 30, 12 p.m.: Helium to host a community call meeting.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating supply worth $23.45 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating supply worth $221.99 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating supply worth $11.28 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating supply worth $13.69 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating supply worth $13.91 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating supply worth $11.33 million.

- Token Launches

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB) and Wing Finance (WING).

- May 5: Sonic (S) to be listed on Kraken.

Conferences:

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

- April 30-May 1: TOKEN2049 (Dubai)

Token Talk

By Shaurya Malwa

- Stablecoin supply on Solana hit a record $12.8 billion on Thursday, buoyed by Circle minting $1.75 billion of its USDC stablecoin in the recent weeks.

- The minting signals strong demand and liquidity growth in Solana’s ecosystem despite a market lull.

- Supply of Tether’s USDT on Tron crossed the $70 billion mark on Thursday.

- Rollup builder Initia’s new INIT tokens climbed to 92 cents after a Thursday issuance at an initial price of 60 cents. The token was airdropped to users based on their activity on the Initia network.

- Content coin creation platform Zora’s ZORA dropped 17% despite being added to the Coinbase listing roadmap (which is historically bullish for tokens) after failing to grab demand among retail traders.

Derivatives Positioning

- SUI, ONDO, UNI and HBAR are have shown the most growth in perpetual futures open interest in the past 24 hours.

- Open interest in BTC and ETH futures has flatlined.

- Perpetual funding rates for most major tokens remain moderately positive, highlighting bullish sentiment.

- The CME bitcoin futures basis still remains below 10%.

- In options, traders bought ETH puts via OTC platform Paradigm while the BTC call option at $95K dominated the flow.

Market Movements

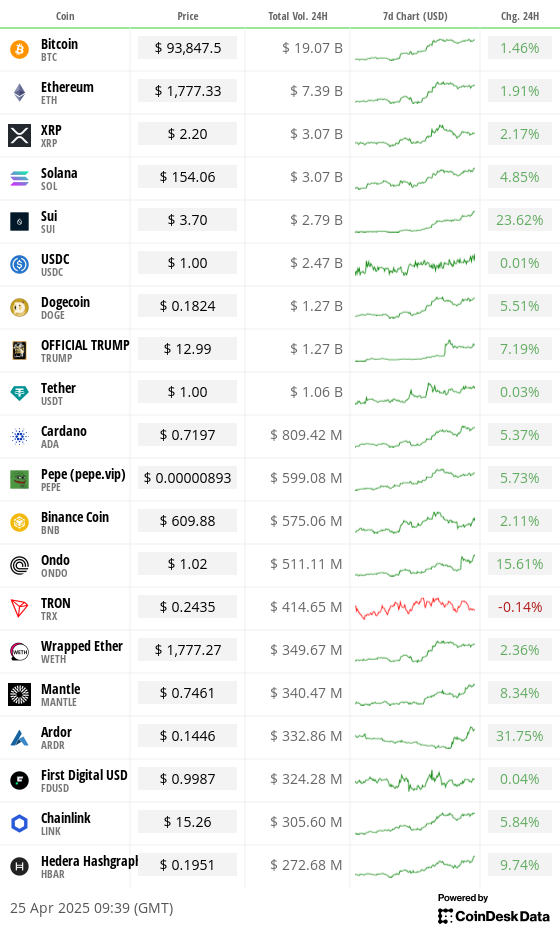

- BTC is up 0.23% from 4 p.m. ET Thursday at $93,701.46 (24hrs: +1.32%)

- ETH is up 0.62% at $1,774.26 (24hrs: +1.92%)

- CoinDesk 20 is up 0.45% at 2,750.46 (24hrs: +2.79%)

- Ether CESR Composite Staking Rate is up 1 bps at 3.13%

- BTC funding rate is at 0.0024% (2.6608% annualized) on Binance

- DXY is up 0.26% at 99.63

- Gold is up 0.9% at $3,304.78/oz

- Silver is down 0.45% at $33.38/oz

- Nikkei 225 closed +1.9% at 35,705.74

- Hang Seng closed +0.32% at 21,980.74

- FTSE is up 0.15% at 8,419.93

- Euro Stoxx 50 is up 0.68% at 5,149.61

- DJIA closed on Thursday +1.23% at 40,093.40

- S&P 500 closed +2.03% at 5,484.77

- Nasdaq closed +2.74% at 17,166.04

- S&P/TSX Composite Index closed +1.04% at 24,727.53

- S&P 40 Latin America closed +1.83% at 2,521.21

- U.S. 10-year Treasury rate is down 2 bps at 4.3%

- E-mini S&P 500 futures are up 0.24% at 5,524.75

- E-mini Nasdaq-100 futures are up 0.26% at 19,373.00

- E-mini Dow Jones Industrial Average Index futures are down 0.11% at 40,219.00

Bitcoin Stats:

- BTC Dominance: 64.18 (-0.37%)

- Ethereum to bitcoin ratio: 0.01902 (1.01%)

- Hashrate (seven-day moving average): 815 EH/s

- Hashprice (spot): $48.25 PH/s

- Total Fees: 8.97 BTC / $834,273

- CME Futures Open Interest: 139,505 BTC

- BTC priced in gold: 28.1 oz

- BTC vs gold market cap: 7.98%

Technical Analysis

- Bitcoin layer-2 protocol Stacks’ native token, STX, has crossed above the Ichimoku cloud to suggest a bullish shift in momentum.

- The ascending 5- and 10-day simple moving averages (SMAs) suggest the same, with $1.05, the August 2024 low, as immediate resistance.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $350.34 (+1.33%), up 0.19% at $351 in pre-market

- Coinbase Global (COIN): closed at $203.87 (+4.66%), up 1.8% at $205.67

- Galaxy Digital Holdings (GLXY): closed at C$20.68 (+10.41%)

- MARA Holdings (MARA): closed at $14.01 (-0.85%), up 0.71% at $14.11

- Riot Platforms (RIOT): closed at $7.79 (+3.87%), unchanged in pre-market

- Core Scientific (CORZ): closed at $7.53 (+5.76%)

- CleanSpark (CLSK): closed at $8.86 (-0.11%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.06 (+4.07%)

- Semler Scientific (SMLR): closed at $34.44 (+0.47%), up 2.47% at $35.29

- Exodus Movement (EXOD): closed at $45.21 (+2.54%), down 0.44% at $45.01

ETF Flows

- Daily net flow: $442 million

- Cumulative net flows: $38.13 billion

- Total BTC holdings ~ 1.14 million

- Daily net flow: $63.5million

- Cumulative net flows: $2.32 billion

- Total ETH holdings ~ 3.32 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The number of BTC held in wallets tied to centralized exchanges continues to slide, hitting the lowest in five years.

- "Historically, such declines have often preceded price increases, as shown in the chart," CryptoRank said.

While You Were Sleeping

- ARK Invest Raises 2030 Bitcoin Price Target to as High as $2.4M in Bullish Scenario (CoinDesk): ARK’s revised bitcoin outlook sees a 2030 bull-case price 60% above last year’s estimate, with base and bear scenarios projecting $1.2 million and $500,000, respectively.

- Stacks’ STX Is Week’s Best Performer as Bitgo Link Seen Boosting Institutional Use (CoinDesk): BitGo opened the door for its customers to explore yield-generating opportunities on Stacks by integrating sBTC, a synthetic derivative that represents bitcoin in a 1:1 ratio on the Stacks blockchain.

- Nvidia Continues to Keep Crypto at Arm’s Length (CoinDesk): A last-minute halt on a crypto announcement underscores how Nvidia still excludes blockchain projects from its flagship programs, despite continued outreach from the sector.

- China May Exempt Some U.S. Goods From Tariffs as Costs Rise (Bloomberg): China is reviewing tariff relief for select U.S. imports, including medical devices, ethane, industrial chemicals, semiconductor inputs and plane leases as officials respond to mounting pressure from affected sectors.

- Ukraine May Have to Give Up Land for Peace – Kyiv Mayor Klitschko (BBC): Speaking hours after a Russian strike on Kyiv killed 12, Klitschko said President Volodymyr Zelensky may accept territorial concessions for temporary peace, though Ukrainians would never accept Russian occupation.

- American Companies Shred Outlooks Over Tariff Uncertainty (The Wall Street Journal): Business leaders say shifting trade levies stall hiring, blur earnings projections and postpone capital spending, forcing continual forecast revisions across airlines, manufacturers and consumer brands.

In the Ether