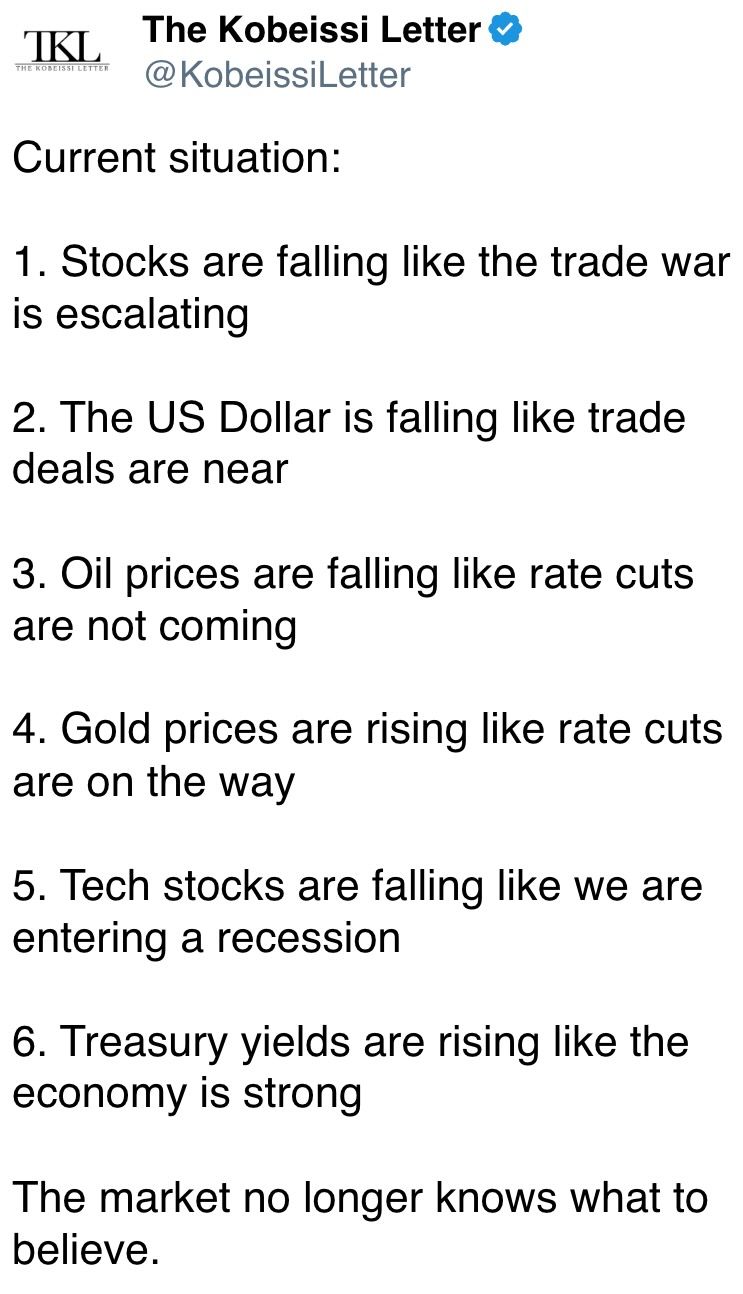

Bitcoin Flexes Dominance as Traditional Markets Stumble—Gold’s Shiny Distraction Hits All-Time High

While Wall Street frets over bond yields and equities dip, Bitcoin stages a quiet takeover—proving, yet again, that crypto laughs last when fiat currencies sweat. Meanwhile, gold soars to record highs, because nothing says ’stable store of value’ like a 5,000-year-old shiny rock. (Bonus jab: Traders still hedging with gold? How quaint—like using a fax machine in a Zoom world.)

What to Watch

- Crypto:

- April 22: The Lyora upgrade goes live on the Injective (INJ) mainnet.

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on "Key Considerations for Crypto Custody".

- April 28: Enjin Relaychain increases active validator slots to 25 from 15, to enhance decentralization.

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, offering exposure through futures and swap agreements, to begin trading on NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra hard fork on its mainnet at slot 21,405,696, epoch 1,337,856.

- Macro

- Day 2 of 6: World Bank (WB) and the International Monetary Fund (IMF) spring meetings in Washington.

- April 22, 8:30 p.m.: Statistics Canada releases March producer price inflation data.

- PPI MoM Est. 0.3% vs. Prev. 0.4%

- PPI YoY Prev. 4.9%

- April 22, 6 p.m.: Fed Governor Adriana D. Kugler will deliver a speech titled "Transmission of Monetary Policy."

- April 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail sales data.

- Retail Sales MoM Prev. 0.6%

- Retail Sales YoY Prev. 2.7%

- April 23, 9:45 a.m.: S&P Global releases (flash) U.S. April purchasing managers’ index (PMI) data.

- Composite PMI Prev. 53.5

- Manufacturing PMI Est. 49.4 vs. Prev. 50.2

- Services PMI Est. 52.8 vs. Prev. 54.4

- Earnings (Estimates based on FactSet data)

- April 22: Tesla (TSLA), post-market

- April 30: Robinhood Markets (HOOD), post-market

- May 1: Block (XYZ), post-market

Token Events

- Governance votes & calls

- Aave DAO is discussing partnering with Ether.fi to create a custom Aave market on EVM layer 2 to “facilitate on-chain credit for everyday payments through the Ether.fi Cash credit card program.”

- April 23, 9 p.m.: Manta Network to host a townhall meeting with its founders.

- April 24, 8 a.m.: Alchemy Pay to host an Ask Me Anything (AMA) session on its 2025 roadmap.

- April 30, 12 p.m.: Helium to host a community call meeting.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating supply worth $21.83 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating supply worth $170.93 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating supply worth $10.46 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating supply worth $11.92 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating supply worth $13 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating supply worth $11.23 million.

- Token Launches

- April 22: Hyperlane to airdrop its HYPER tokens.

- April 22: BNB to be listed on Kraken.

- April 23: Zora to airdrop its ZORA tokens.

- April 24: Initia (INIT) to be listed on Binance, CoinW, WEEX, KuCoin, MEXC, and others.

Conferences:

- CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 1 of 3: Money20/20 Asia (Bangkok)

- April 23: Crypto Horizons 2025 (Dubai)

- April 23-24: Blockchain Forum 2025 (Moscow)

- April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador)

- April 29: IFGS 2025 (London)

Token Talk

By Shaurya Malwa

- Pope Francis’ death on Easter Monday triggered significant activity in crypto markets and prediction platforms as traders aimed to capitalize on the news.

- LUCE, a Solana-based memecoin tied to the Vatican’s Holy Year 2025 mascot, surged 45% in value, reaching $0.013, according to CoinGecko data.

- Daily trading volume in the token skyrocketed to $60.27 million from $5 million the previous day, despite the price being down 95% from its November peak of 30 cents.

- Although unaffiliated with the Vatican, LUCE has attracted around 44,800 holders.

- Meanwhile, a Polymarket bet on who will be the next pope has attracted over $3.5 million in volumes since going live on Dec. 31, with over 18 candidates in the mix.

- As of Tuesday morning, Pietro Parolin leads odds at 37%, followed by Luis Antonio Tagle at 23% and Matteo Zuppi at 11%.

Derivatives Positioning

- HBAR, XLM and TRX have seen the most growth in perpetual futures open interest among major tokens in the past 24 hours. However, only TRX has seen a positive cumulative volume delta, implying an influx of new money predominantly on the bullish side.

- BTC’s open interest in has increased to 695K BTC, the most since March 25. ETH’s open interest held shy of the recent record above 11.9 million ETH.

- Perpetual funding rates for most major tokens remain marginally positive in a sign of cautiously bullish sentiment.

- On Deribit, BTC’s short and near-dated calls are now trading at par or a slight premium to puts, another sign of renewed bullishness. ETH puts, however, continue to trade at a premium to calls.

- Block options flows have been muted on Paradigm, with calendar spreads and April put spreads lifted in BTC and ETH.

Market Movements:

- BTC is up 1.45% from 4 p.m. ET Monday at $88,539.04 (24hrs: +1.16%)

- ETH is up 3.43% at $1,628.60 (24hrs: -0.84%)

- CoinDesk 20 is up 1.49% at 2,544.64 (24hrs: -0.3%)

- Ether CESR Composite Staking Rate is up 3 bps at 2.98%

- BTC funding rate is at -0.0058% (-2.1353% annualized) on Binance

- DXY is up 0.1% at 98.38

- Gold is up 4.28% at $3,456.97/oz

- Silver is up 0.5% at $32.57/oz

- Nikkei 225 closed -0.17% at 34,220.60

- Hang Seng closed +0.78% at 21,562.32

- FTSE is up 0.49% at 8,315.81

- Euro Stoxx 50 is down 0.28% at 4,922.48

- DJIA closed on Monday -2.48% at 38,170.41

- S&P 500 closed -2.36% at 5,158.20

- Nasdaq closed -2.55% at 15,870.90

- S&P/TSX Composite Index closed -0.76% at 24,008.86

- S&P 40 Latin America closed unchanged at 2,384.47

- U.S. 10-year Treasury rate is unchanged at 4.42%

- E-mini S&P 500 futures are up 0.98% at 5,235.75

- E-mini Nasdaq-100 futures are up 1.02% at 18,105.00

- E-mini Dow Jones Industrial Average Index futures are up 0.87% at 38,660.00

Bitcoin Stats:

- BTC Dominance: 64.39% (-0.09%)

- Ethereum to bitcoin ratio: 0.01839 (1.88%)

- Hashrate (seven-day moving average): 840 EH/s

- Hashprice (spot): $45.0 PH/s

- Total Fees: 6.56BTC / $572,645

- CME Futures Open Interest: 139,765 BTC

- BTC priced in gold: 25.5 oz

- BTC vs gold market cap: 7.22%

Technical Analysis

- If you feel gold’s rally is overstretched or overdone, think again.

- The ratio between gold’s spot price and its 200-day simple moving average, currently 1.3, is well below highs seen in 2011-2012 when the yellow metal rose to its then-record price of $2,000.

- The ratio went as high as 5.80 in the 1980.

- Bitcoin tends to follow gold with a lag of couple of months.

Crypto Equities

- Strategy (MSTR): closed on Monday at $317.76 +0.18%), up 2.02% at $324.19 in pre-market

- Coinbase Global (COIN): closed at $175 (-0.02%), up 1% at $176.75

- Galaxy Digital Holdings (GLXY): closed at C$15.38 (+0.13%)

- MARA Holdings (MARA): closed at $12.29 (-2.92%), up 2.36% at $12.59

- Riot Platforms (RIOT): closed at $6.29 (-2.63%), up 2.07% at $6.42

- Core Scientific (CORZ): closed at $6.39 (-3.62%)

- CleanSpark (CLSK): closed at $7.47 (-0.53%), up 2.68% at $7.67

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $11.74 (-2.49%)

- Semler Scientific (SMLR): closed at $29.83 (-8.17%)

- Exodus Movement (EXOD): closed at $36.59 (+0.03%), unchanged in pre-market

ETF Flows

- Daily net flow: $381.3 million

- Cumulative net flows: $35.86 billion

- Total BTC holdings ~ 1.11 million

- Daily net flow: -$25.4 million

- Cumulative net flows: $2.24 billion

- Total ETH holdings ~ 3.30 million

Source: Farside Investors

Overnight Flows

Chart of the Day

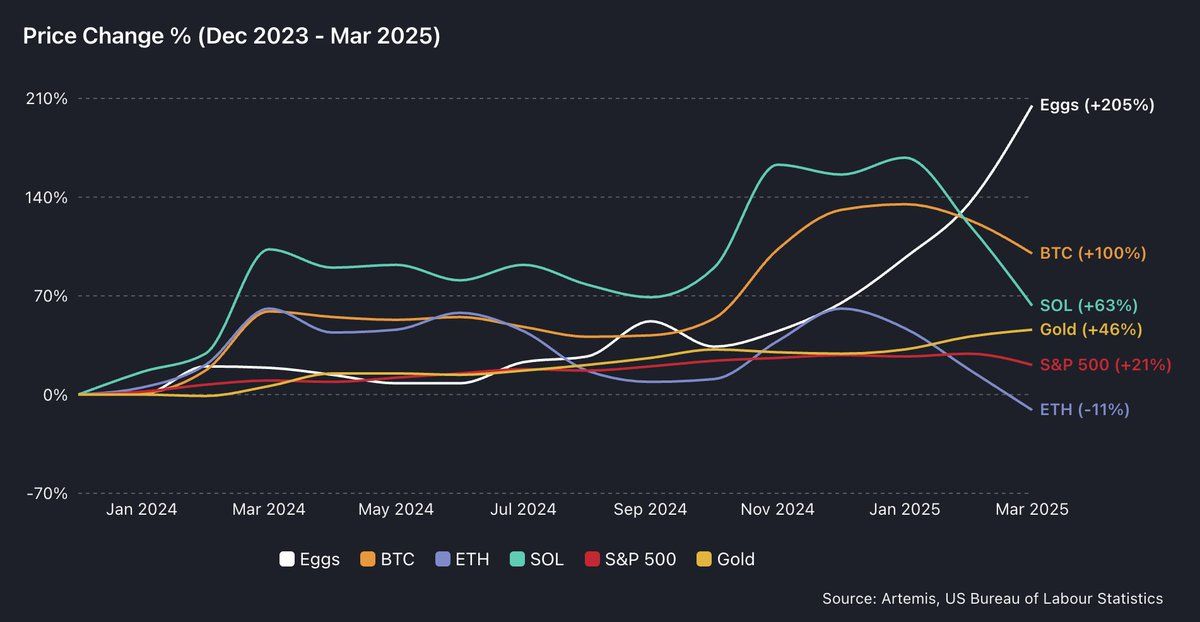

- The chart shows the price of eggs in the U.S. has increased by over 200% since 2024, outperforming BTC’s 100% surge. Gold and the S&P 500 have gained 46% and 21%, respectively, over the same period.

- In other words, asset price growth has failed to compensate holders for the inflation on Main Street.

While You Were Sleeping

- Bitcoin, Euro Options Signal Bullishness Against Dollar Amid Equity and Bond Market Downturns (CoinDesk): Preference for BTC and euro call options over dollar exposure suggests investors are rotating out of U.S. assets and into bitcoin, the euro and gold.

- Dow Headed for Worst April Since 1932 as Investors Send ‘No Confidence’ Signal (The Wall Street Journal): Scott Ladner, chief investment officer at Horizon Investments, said the Trump administration’s policies have made the U.S. economy increasingly unstable and difficult to gauge, deterring investment.

- Bitcoin Runs Into Resistance Cluster Above $88K. What Next? (CoinDesk): Behavioral aspects of trading could influence whether bitcoin rallies further or faces a new downturn from the resistance zone.

- Bearish Dollar Bets Move Toward Levels That Raise Risk of Recoil (Bloomberg): Despite widespread bets against the dollar, steady demand for Treasuries and technical signals suggest a rebound is likely, though gains may be limited or short-lived if negative news continues.

- Japanese Investors Sold $20B of Foreign Debt as Trump Tariffs Shook Markets (Financial Times): Much of Japan’s selling likely involves U.S. Treasuries and mortgage-backed securities guaranteed by the U.S. government, said Tomoaki Shishido, senior rates strategist at Nomura.

- Bitcoin, Stablecoins Command Over 70% of Crypto Market as BTC Pushes Higher (CoinDesk): Bitcoin dominance rose to 64.6%, the highest since January 2021, as ether slumped and the ETH-to-BTC ratio fell to a five-year low of 0.01765.

In the Ether