Bitcoin’s Surge Boosts AI and Memecoin Sectors, Highlighting Crypto’s Hedge Potential

Bitcoin’s recent breakout has catalyzed gains across AI-related cryptocurrencies and memecoins, reinforcing its role as a hedge in volatile markets. The rally underscores growing institutional interest and risk-on sentiment in digital assets.

What to Watch

- Crypto:

- April 21: Coinbase Derivatives will list XRP futures pending approval by the U.S. Commodity Futures Trading Commission (CFTC).

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on "Key Considerations for Crypto Custody".

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, offering exposure through futures and swap agreements, to begin trading on NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra hard fork on its mainnet at slot 21,405,696, epoch 1,337,856.

- Macro

- April 21-26: World Bank (WB) and the International Monetary Fund (IMF) spring meetings take place in Washington.

- April 22, 8:30 p.m.: Statistics Canada releases March producer price inflation data.

- PPI MoM Prev. 0.4%

- PPI YoY Prev. 4.9%

- April 22, 6 p.m.: Fed Governor Adriana D. Kugler will deliver a speech titled "Transmission of Monetary Policy."

- April 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail sales data.

- Retail Sales MoM Prev. 0.6%

- Retail Sales YoY Prev. 2.7%

- April 23, 9:45 a.m.: S&P Global releases (flash) U.S. April purchasing managers’ index (PMI) data.

- Composite PMI Prev. 53.5

- Manufacturing PMI Prev. 50.2

- Services PMI Est. 52.9 vs. Prev. 54.4

- Earnings (Estimates based on FactSet data)

- April 22: Tesla (TSLA), post-market

- April 30: Robinhood Markets (HOOD), post-market

- May 1: Block (XYZ), post-market

Token Events

- Governance votes & calls

- Aave DAO is discussing working with Ether.fi to create a custom Aave market on EVM layer 2 to “facilitate on-chain credit for everyday payments through the Ether.fi Cash credit card program.”

- April 23, 9 p.m.: Manta Network to host a townhall meeting with its founders.

- April 24, 8 a.m.: Alchemy Pay to host an Ask Me Anything (AMA) session on its 2025 roadmap.

- April 30, 12 p.m.: Helium to host a community call meeting.

- Unlocks

- April 22: Metars Genesis (MRS) to unlock 11.87% of its circulating supply worth $127.9 million.

- April 30: Optimism (OP) to unlock 1.89% of its circulating supply worth $22.78 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating supply worth $167.97 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating supply worth $10.57 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating supply worth $12.12 million.

- Token Launches

- April 21: Balance (EPT) to be listed on Bitget Bybit, KuCoin, Gate.io, LBank, MEXC, BingX.

- April 22: Hyperlane to airdrop its HYPER tokens.

- April 22: BNB to be listed on Kraken.

Conferences:

- CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- April 22-24: Money20/20 Asia (Bangkok)

- April 23: Crypto Horizons 2025 (Dubai)

- April 23-24: Blockchain Forum 2025 (Moscow)

- April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador)

- April 29: IFGS 2025 (London)

Token Talk

By Shaurya Malwa

- Bitget, a centralized crypto exchange, will reverse trades and compensate users due to "abnormal trading" in its perpetual futures market for VOXEL, a token linked to the Polygon-based RPG game Voxie Tactics.

- Early Sunday, VOXEL’s trading volume surged past bitcoin’s 24-hour volume — with the token’s value surging over 300% in a week — despite being only the 723rd-largest cryptocurrency by market cap.

- An X user claimed six-figure profits from a sub-$100 investment, attributing the surge to a potential bug in Bitget’s market-making robot,. The trade rollback will likely erase these gains.

- Bitget’s investigation revealed possible market manipulation by certain accounts, prompting the exchange to activate its risk-control system and plan a trade rollback within 24 hours.

- Affected users who incurred losses will receive compensation, and Bitget is continuing its investigation.

Derivatives Positioning

- The market-wide futures open interest has climbed to $37.22 billion, the highest since March 24, according to Velo Data. The figure represents open interest in all coins listed on Binance, Bybit, OKX, Deribit and Hyperliquid.

- ETH is the best performing major token in terms of futures open interest growth, followed by BTC and LINK.

- Speaking of OI-adjusted cumulative volume delta, ETH also leads the pack with the highest positive reading, implying an influx of buying pressure in the market.

- On Deribit, BTC and ETH risk reversals for short- and near-dated expiries have flattened out, recovering from the recent persistent negative prints that represented bias for protective put options.

Market Movements:

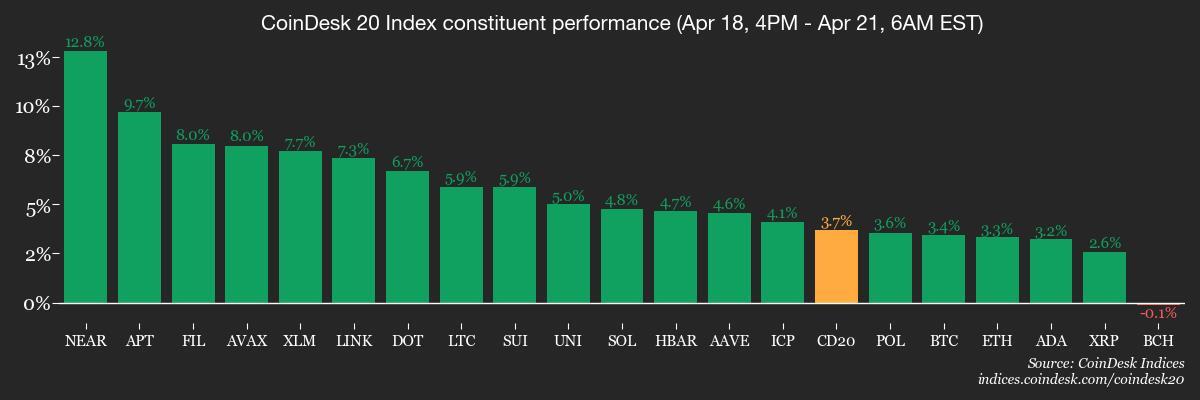

- BTC is up 3.19% from 4 p.m. ET Sunday at $87,270.44 (24hrs: +3.63%)

- ETH is up 2.54% at $1,631.90 (24hrs: +3.17%)

- CoinDesk 20 is up 0.8% at 2,268.01 (24hrs: +3.77%)

- Ether CESR Composite Staking Rate is up 47 bps at 2.47%

- BTC funding rate is at 0.0044% (4.776% annualized) on Binance

- DXY is down 1.11% at 98.26

- Gold is up 2.04% at $3,395.65/oz

- Silver is up 1.12% at $32.89/oz

- Nikkei 225 closed -1.3% at 34,279.92

- Hang Seng closed +1.61% at 21,395.14

- FTSE is closed at 8,275.66

- Euro Stoxx 50 is closed at 4,935.34

- DJIA closed on Thursday -1.33% at 39,142.23

- S&P 500 closed +0.13% at 5,282.70

- Nasdaq closed -0.13% at 16,286.45

- S&P/TSX Composite Index closed +0.36% at 24,192.81

- S&P 40 Latin America closed +1.64% at 2,383.75

- U.S. 10-year Treasury rate is unchanged at 4.33%

- E-mini S&P 500 futures are down 1.04% at 5,275.00

- E-mini Nasdaq-100 futures are down 1.16% at 18,168.25

- E-mini Dow Jones Industrial Average Index futures are down 0.92% at 38,969

Bitcoin Stats:

- BTC Dominance: 64% (0.23%)

- Ethereum to bitcoin ratio: 0.1873 (0.54%)

- Hashrate (seven-day moving average): 858 EH/s

- Hashprice (spot): $45.22

- Total Fees: 5.48 BTC / $479,045

- CME Futures Open Interest: 141,280 BTC

- BTC priced in gold: 25.7 oz

- BTC vs gold market cap: 7.2%

Technical Analysis

- Bitcoin’s breakout has set the stage for a continued move higher to $90,000.

- However, trading volume has dipped, suggesting low participation in the price recovery.

- A low-volume rally often ends up being short-lived.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $317.20 (1.78%), up 3.13% at $327.12 in pre-market

- Coinbase Global (COIN): closed at $175.03 (1.64%) up 1.4% at $177.49

- Galaxy Digital Holdings (GLXY): closed at C$15.36 (-1.41%)

- MARA Holdings (MARA): closed at $12.66 (2.76%), up 2.69% at $13.00

- Riot Platforms (RIOT): closed at $6.46 (1.57%), up 2.63% at $6.63

- Core Scientific (CORZ): closed at $6.63 (0.61%), down 0.45% at $6.60

- CleanSpark (CLSK): closed at $7.51 (3.16%), up 1.86% at $7.65

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.04 (1.09%), up 2.41% at $12.33

- Semler Scientific (SMLR): closed at $32.49 (4.79%)

- Exodus Movement (EXOD): closed at $36.58 (-1.64%), up 2.1% at $37.35

ETF Flows

U.S. equity markets were closed on Friday.

Overnight Flows

Chart of the Day

- XRP’s short- and near-dated risk reversals continue to be priced negative, a sign of persistent demand for put options, which offer downside protection.

While You Were Sleeping

- Pope Francis, Voice for the Poor Who Transformed the Catholic Church, Dies at 88 (CNN): The first Latin American pope died weeks after returning to public life following a life-threatening case of pneumonia.

- China Vows Retaliation Against Countries That Follow U.S. Calls to Isolate Beijing (CNBC): China said it will respond to U.S. tariff deals that undermine its interests, accusing Washington of "unilateral bullying" and warning it risks returning global trade to "law of the jungle."

- BNB, SOL, XRP Spike Higher as Bitcoin ’Digital Gold’ Narrative Makes a Comeback (CoinDesk): Bitcoin’s correlation with U.S. equities appears to be weakening as its price increasingly tracks gold, which has held firm while stocks decline, according to LVRG Research’s Nick Ruck.

- Stablecoin Giant Circle Is Launching a New Payments and Remittance Network (CoinDesk): The fintech firm will unveil a new payments and cross-border remittance product on Tuesday.

- Over $380M Worth of Crypto Stolen During Bybit’s $1.4B Hack Has Gone Dark (CoinDesk): The exchange’s CEO said that 27.6% of the funds stolen by the North Korean Lazarus Group "flowed into mixers then through bridges to P2P and OTC platforms."

- Bitcoin’s Breakout Signals BTC Potentially Rallying to $90K-$92K: Technical Analysis (CoinDesk): Bitcoin’s price surged past $87,000, breaking out of a week-long consolidation between $83,000 and $86,000. The target range previously served as a strong support zone.

In the Ether