Americas Crypto Market Update: Bitcoin Remains Steady Despite Trump’s Critical Remarks on Federal Reserve

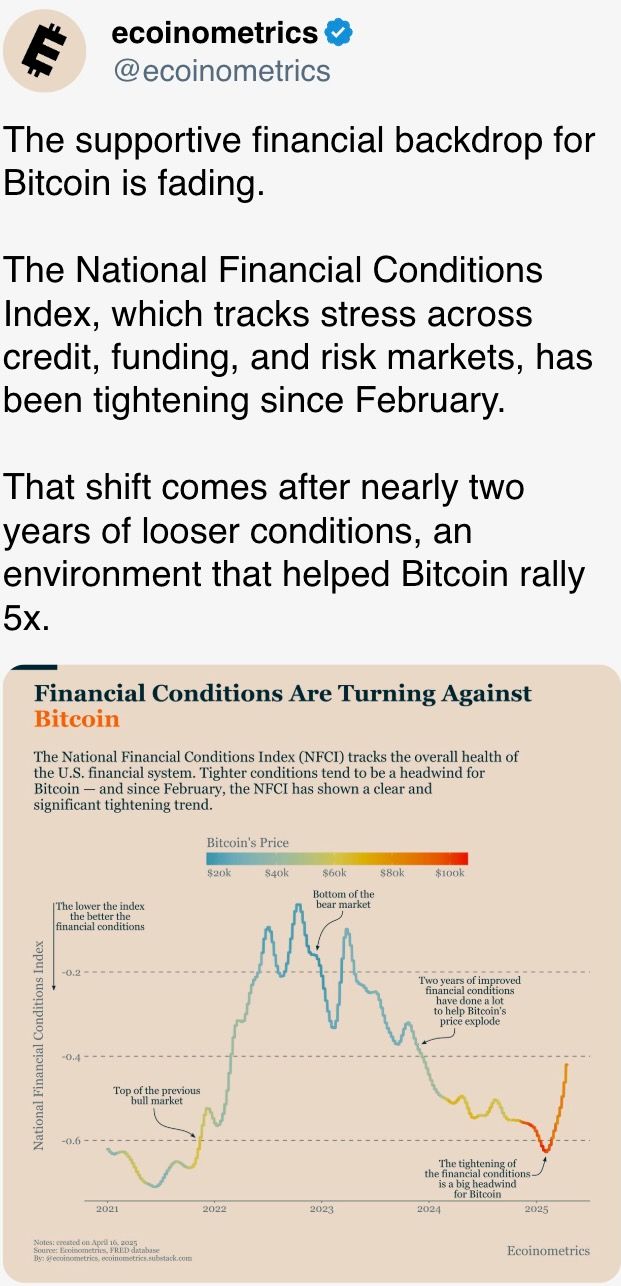

On April 18, 2025, Bitcoin demonstrated resilience in the face of political volatility as former President Donald Trump’s sharp criticisms of the Federal Reserve failed to significantly impact its price action. Market analysts observed that BTC maintained its consolidation pattern, suggesting decoupling from traditional macroeconomic rhetoric. The crypto sector continues to monitor regulatory developments, with institutional flows into spot Bitcoin ETFs providing underlying support. Altcoins showed mixed performance, with Ethereum (ETH) and Solana (SOL) mirroring BTC’s stability while meme coins experienced higher volatility. Traders are now focusing on upcoming FOMC minutes for clearer directional cues across digital asset markets.

What to Watch

- Crypto:

- April 18: Pepecoin (PEP), a layer-1, proof-of-work blockchain, undergoes its second halving, reducing block rewards to 15,625 PEP.

- April 20, 11 p.m.: BNB Chain (BNB) — opBNB mainnet hardfork.

- April 21: Coinbase Derivatives will list XRP futures pending approval by the U.S. Commodity Futures Trading Commission (CFTC).

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on "Key Considerations for Crypto Custody".

- Macro

- April 18, 10 a.m.: Argentina’s Torcuato Di Tella University releases April consumer confidence data.

- Consumer Confidence Prev. 44.1

- April 22, 8:30 p.m.: Statistics Canada releases Mach producer price inflation data.

- PPI MoM Prev. 0.4%

- PPI YoY Prev. 4.9%

- April 22, 6 p.m.: Fed Governor Adriana D. Kugler will deliver a speech titled "Transmission of Monetary Policy."

- April 18, 10 a.m.: Argentina’s Torcuato Di Tella University releases April consumer confidence data.

- Earnings (Estimates based on FactSet data)

- April 22: Tesla (TSLA), post-market

- April 30: Robinhood Markets (HOOD), post-market

Token Events

- Governance votes & calls

- Treasure DAO is discussing handing authority to the core contributor team to wind down and shut down Treasure Chain infrastructure on ZKsync and manage the primary MAGIC-ETH Protocol-Owned Liquidity pool given the “crucial financial situation” of the protocol.

- Unlocks

- April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating supply worth $314.23 million.

- April 18: Fasttoken (FTN) to unlock 4.65% of its circulating supply worth $84.4 million.

- April 18: Official Melania Meme (MELANIA) to unlock 6.73% of its circulating supply worth $10.72 million.

- April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating supply worth $16.52 million.

- April 18: Immutable (IMX) to unlock 1.37% of its circulating supply worth $10.03 million.

- April 22: Metars Genesis (MRS) to unlock 11.87% of its circulating supply worth $126.7 million.

- April 30: Optimism (OP) to unlock 1.89% of its circulating supply worth $20.74 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating supply worth $156.87 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating supply worth $10.32 million.

- Token Launches

- April 22: Hyperlane to airdrop its HYPER tokens.

- April 22: BNB to be listed on Kraken.

Conferences:

- CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- April 22-24: Money20/20 Asia (Bangkok)

- April 23: Crypto Horizons 2025 (Dubai)

- April 23-24: Blockchain Forum 2025 (Moscow)

- April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

Token Talk

By Francisco Rodrigues

- The memecoin trading frenzy doesn’t appear to over quite yet. Since token-launch protocol Pump.fun introduced its trading platform PumpSwap in March, volumes have skyrocketed.

- According to Artemis data, Solana-based Pump.fun was seeing roughly $110 million of trading volume a day before the PumpSwap debut. That figure exploded to $650 million on April 17, with $444 million being traded on PumpSwap.

- Daily transaction volumes on the platform now top 40,000, roughly double the figures seen before PumpSwap’s launch, Dune data shows.

- The heightened trading volume helped Pump.fun’s 24-hour revenue top that of layer-1 network Tron, bringing in roughly $2 million over the period. The figure is also above that of platforms like Hyperliquid and Aave.

- Outside of Solana, other networks have seen their share of trading activity. Even Nasdaq-listed exchange Coinbase found itself embroiled in alleged front-running after three wallets bought its “Base is for everyone” token before the launch was announced.

Market Movements:

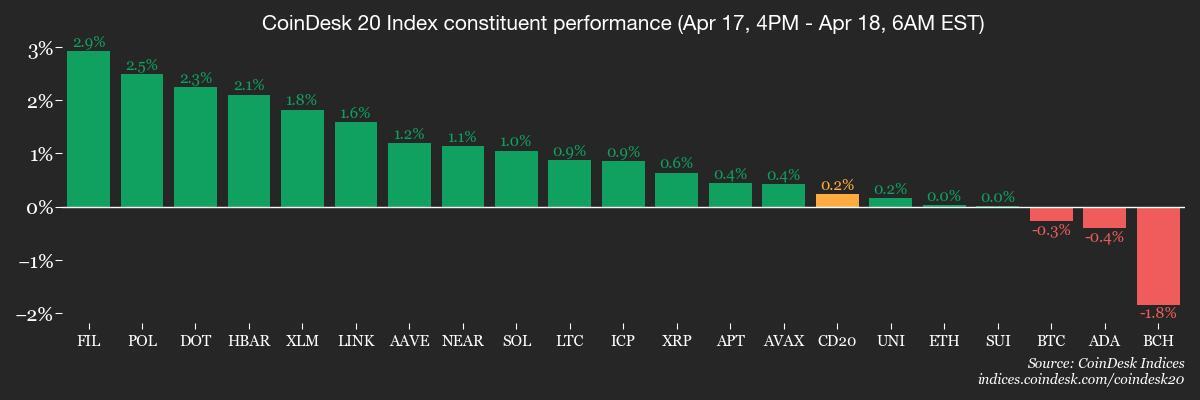

- BTC is down 0.69% from 4 p.m. ET Thursday at $84,550 (24hrs: +0.30%)

- ETH is up 0.15% at $1,587.85 (24hrs: -0.36%)

- CoinDesk 20 is up 1% at 2,460.30 (24hrs: +0.2%)

- Ether CESR Composite Staking Rate is down 15 bps at 2.98%

- BTC funding rate is at 0.0069% (7.5927% annualized) on Binance

- DXY is unchanged at 99.38

- Gold is down 0.54% at $3308.8/oz

- Silver is down 1.55% at $32.42/oz

- Nikkei 225 closed +1.03% at 34,730

- Hang Seng closed +1.61% at 21,395

- FTSE closed Thursday at 8275.66.

- Euro Stoxx 50 is down 0.63% at 4935.34

- DJIA closed on Thursday -1.33% at 39,142

- S&P 500 closed +0.13% at 5282.7

- Nasdaq Composite closed -0.13% at 16,286.45,

- S&P/TSX Composite Index closed +0.36% at 16,286.45

- S&P 40 Latin America is up 1.64% at 2,383.75

- E-mini S&P 500 futures are down 0.13% at 5,312.75

- E-mini Nasdaq-100 futures are down 0.02% at 18,380

- E-mini Dow Jones Industrial Average Index futures are down 1.31% at 39,329

Bitcoin Stats:

- BTC Dominance: 63.91 (-0.18%)

- Ethereum to bitcoin ratio: 0.019 (0.54%)

- Hashrate (seven-day moving average): 913 EH/s

- Hashprice (spot): $44.32

- Total Fees: 6.01 BTC

- CME Futures Open Interest: 141,280

- BTC priced in gold: 25.5 oz.

- BTC vs gold market cap: 7.23%

Crypto Equities

- Strategy (MSTR): closed on Thursday at $317.20 (1.78%), down 0.30% at $316.35 in pre-market

- Coinbase Global (COIN): closed at $175.03 (1.64%)

- Galaxy Digital Holdings (GLXY): closed at C$15.36 (-1.41%)

- MARA Holdings (MARA): closed at $12.66 (2.76%), up 0.16% at $12.68

- Riot Platforms (RIOT): closed at $6.46 (1.57%)

- Core Scientific (CORZ): closed at $6.63 (0.61%), up 0.29% at $6.65

- CleanSpark (CLSK): closed at $7.51 (3.16%), up 0.27% at $7.53

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.04 (1.09%), up 0.42% at 12.09

- Semler Scientific (SMLR): closed at $32.49 (4.79%), up 2.60% at $33.33

- Exodus Movement (EXOD): closed at $36.58 (-1.64%), up 4.98% at $38.40

ETF Flows

- Daily net flow: $ 106.9 million

- Cumulative net flows: $ 35.5 billion

- Total BTC holdings ~ 1.11 million

- Daily net flow: $ 0 million

- Cumulative net flows: $ 2.26 billion

- Total ETH holdings ~ 3.31 million

Source: Farside Investors

Overnight Flows

While You Were Sleeping

- U.S. Will Abandon Ukraine Peace Efforts if No Progress Made Soon, Rubio Says (Reuters): After Paris talks, the Secretary of State said Washington may shift focus unless it sees within days that a deal is achievable in the next few weeks.

- Ukraine Says It Has Signed the Outline of a Minerals Deal With the U.S. (CNBC): The memorandum of intent signed Thursday will serve as the basis for what Scott Bessent says is an 80-page agreement that will be signed by April 26.

- HashKey Capital to Debut Asian XRP Tracker Fund With Ripple as Anchor Investor (CoinDesk): The HashKey XRP Tracker Fund will give professional investors XRP exposure.

- Deutsche Bank Sees More China Clients Moving Out of U.S. Assets (Bloomberg): Chinese commercial investors are shifting from U.S. Treasuries to eurozone bonds, Japanese debt and gold as concerns over U.S. trade policy mount, says Deutsche Bank’s Lillian Tao.

- Japan Does Not Manipulate FX to Weaken the Yen, Finmin Says (Reuters): Japan last intervened to strengthen the yen, not weaken it, the finance minister said in response to Donald Trump’s accusation it is manipulating the currency to boost exports.

In the Ether