Sam Bankman-Fried’s Cryptic ’gm’ Sparks FTT Rally as FTX Prepares $1.6 Billion Repayment Plan

A single two-letter tweet from Sam Bankman-Fried sent shockwaves through crypto markets—FTT token surged 40% overnight as FTX's bankruptcy estate confirmed plans to repay creditors.

The Comeback No One Saw Coming

Bankman-Fried's unexpected 'gm' greeting triggered algorithmic trading bots and retail frenzy simultaneously. Market analysts noted the timing coincided perfectly with court documents revealing FTX's $1.6 billion repayment strategy.

Bankruptcy to Billions

FTX's restructuring team leveraged recovered assets and strategic liquidations to assemble the massive repayment fund. The move marks one of the largest creditor recoveries in crypto history—though some Wall Street veterans quipped 'even broken clocks are right twice a day' about the sudden turnaround.

Market Mechanics Exposed

The FTT price surge revealed how thinly-traded tokens remain vulnerable to sentiment shifts. Trading volume exploded to 300% of its 30-day average as speculators piled in, proving once again that in crypto, narrative often outweighs fundamentals.

While the repayment plan brings legitimate relief to creditors, the coordinated social media activity and price movement raises eyebrows about who really benefits from these carefully timed disclosures.

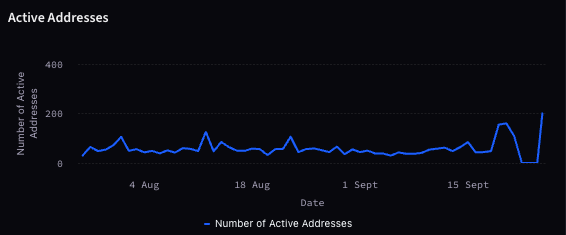

The number of active addresses reached 201, significantly outpacing the monthly average of 56, The Tie said. Additionally, centralized exchange deposits doubled, reaching 13, while withdrawals quadrupled to 38 compared to the monthly average, it added.

'Wen memecoin'

The crypto community on X reacted swiftly with anger, skepticism and humor to SBF's post.

One of the most scathing replies came from on-chain investigator ZachXBT. In a now-deleted post, he condemned SBF, stating that he “deserves zero human rights” due to the harm caused by FTX’s collapse. His view reflects a segment of the community’s lingering resentment towards FTX's collapse, which hurt investors who are still waiting for some of their funds from its bankruptcy estate and the broader crypto community.

Other community members, including Laura Shin, mocked SBF’s sudden social media activity, saying, "That's so 2021."

Meanwhile, Arthur Hayes, the BitMEX co-founder who now runs crypto venture fund Maelstrom, took a humorous jab, replying “Wen memecoin?” — a likely playful reference to the speculative, meme-driven nature of the surge in FTT token after SBF's unexpected post. This potentially underscores a view that the price movement was more about market psychology than substance.

Not the first time

The surge in FTT token — once a key utility token for trading fee discounts and staking benefits on the FTX exchange — has been largely dormant since the platform’s spectacular implosion that ushered in a brutal crypto winter that devastated many investors.

However, strangely enough, this is not the first time this has happened. The same thing unfolded in February of last year, when the SBF's account posted on X for the first time in two years. At the time, he was detained in the Metropolitan Detention Center in Brooklyn, and his lawyers were working through an appeal of his conviction(the appeal is ongoing, with arguments currently scheduled for November 2025).

The new social media post also came as the FTX estate continues to work to repay creditors.

The FTX Recovery Trust is set to release $1.6 billion to creditors at the end of this month, marking the third major payout since the crypto exchange's implosion nearly three years ago.

This recent activity, though potentially short-lived, shows the token still reacts sharply to headlines and sentiments — especially those tied to its controversial founder.