Revolutionizing Private Credit: The On-Chain Transformation

Blockchain rails are tearing down the ivory towers of private credit—and traditional lenders should be worried.

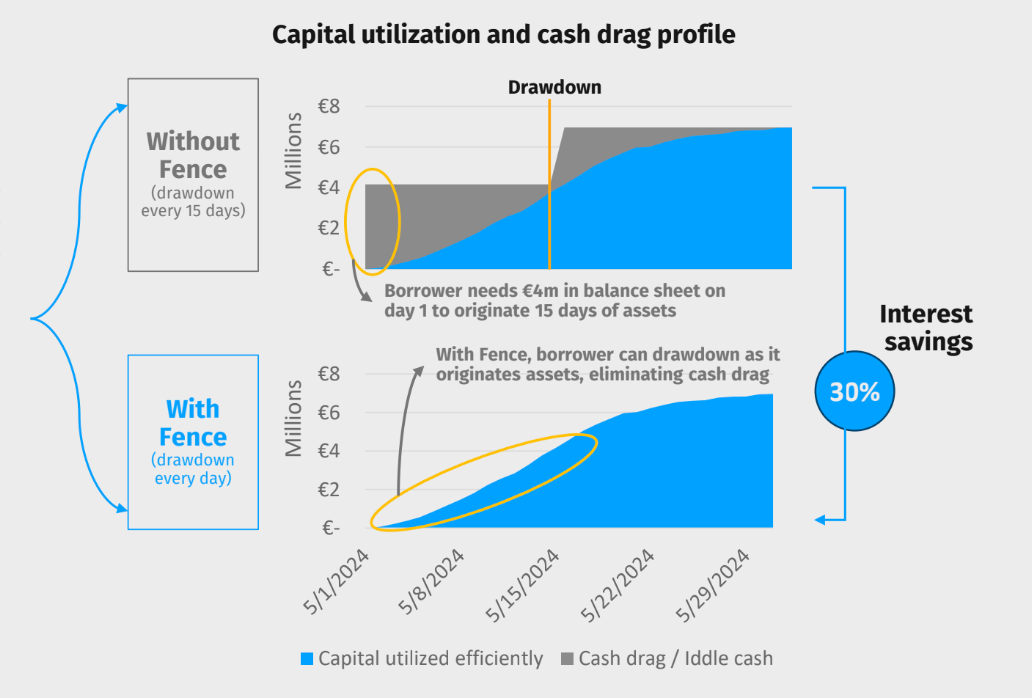

The $1.2 trillion private credit market just got its disruptor moment. On-chain infrastructure cuts settlement times from weeks to minutes while bypassing legacy intermediaries. Smart contracts automate covenant enforcement, and tokenization unlocks secondary market liquidity that traditional structures can't touch.

Why This Changes Everything

Forget waiting for quarterly statements. Real-time transparency becomes the new standard. Investors see portfolio performance instantly—no more black box operations where fund managers hide behind outdated reporting systems.

The Compliance Advantage

Regulatory hurdles? On-chain solutions turn compliance from a cost center into a feature. Automated KYC/AML checks happen at wallet level, while immutable audit trails make regulatory reporting almost effortless. It's the kind of efficiency that makes traditional finance's manual processes look downright archaic.

Liquidity Meets Private Markets

Fractional ownership through tokenization democratizes access while creating exit opportunities that simply don't exist in conventional private credit funds. Suddenly, institutional-grade deals become accessible to a broader investor base—and they can trade positions without waiting for fund maturity.

The revolution isn't coming; it's already here. Traditional private credit firms face a simple choice: adapt to on-chain infrastructure or watch from the sidelines as more agile players eat their lunch. After all, what's more cynical than watching billion-dollar funds scramble to adopt technology they dismissed as 'niche' just years ago?

Source: Fence.Finance

The implications are profound. Large managers like Apollo and Blackstone can shed operational bloat, while smaller funds, emerging managers and family offices can participate without needing armies of staff. On-chain infrastructure can ultimately help to democratize access to a market that has historically been closed off to all but the largest institutions. Over time, incumbents who remain tied to manual processes leveraging traditional rails risk losing ground to specialist credit funds adopting on-chain infrastructure.

Amid renewed enthusiasm for crypto and the spotlight on stablecoin issuance, ABF is already applying the tech to solve real frictions and capture the rapidly expanding market opportunity. Watch this space.