Bitcoin Braces for New Low as Markets Stumble Toward Dull 2025 Finish

Bitcoin's price action is flashing warning signs as analysts predict a potential plunge to fresh lows, capping off what's shaping up to be a lethargic end to 2025 for digital asset markets.

The Looming Floor

Market technicians are pointing to weakening momentum and a breakdown in key support levels. The chatter isn't about if, but how far the drop could go. The prevailing sentiment suggests the current consolidation is merely a pause before the next leg down.

A Year-End Snooze

Beyond Bitcoin, the broader crypto landscape appears stuck in neutral. Trading volumes are thinning, and volatility—the lifeblood of many a trader's portfolio—has largely evaporated. It's the kind of market that puts everyone to sleep, except those nervously watching their positions.

Silver Linings & Storm Clouds

For long-term holders, this could present a classic accumulation zone. For everyone else, it's a harsh reminder that crypto winters can have false springs. The only thing moving faster than prices right now might be the excuses from fund managers who promised 'asymmetric returns.'

Ultimately, markets cycle between fear and greed. Right now, fear is writing the script, with boredom handling the direction. Whether this predicted low becomes a launching pad or a trap door will be the first major story of 2026.

Advice from the Analyst Who Predicted the Drop

As the year ends, the Bitcoin price hovers below $88,000. The U.S. markets, on the verge of an early closure, show no significant developments for the rest of the week. Since mid-December, the global markets have been in a relaxed holiday mode which is expected to continue until the end of the week.

The crypto markets remain dull, lacking in volume and skewing negative, pushing altcoins to deeper lows. Roman Trading, the pseudonymous analyst who forecasted the last drop and now anticipates a bottom at $56,000, suggests a break from markets might be prudent. Amidst ongoing liquidations, this might be the most sensible advice to follow.

“BTC, for the past one and a half weeks, has done nothing but liquidate investors. A typical holiday price movement. Sometimes, stepping back for a while is truly better.”

In his warning dated December 22, the analyst predicted dull days ahead for BTC and U.S. stocks, advising, “everyone is going on holiday, you should enjoy it too.”

Bitcoin (BTC)

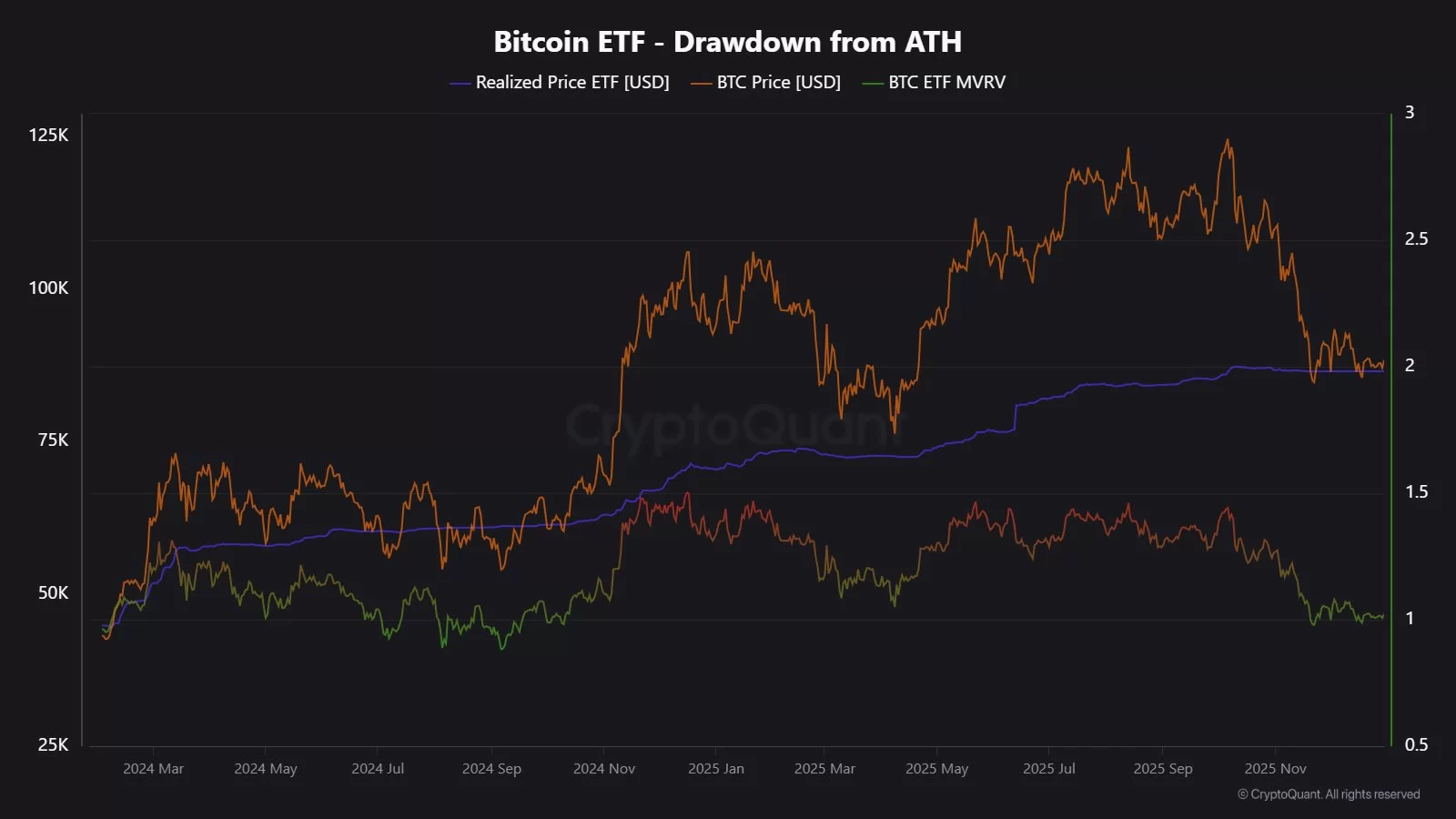

So, what should we focus on? CryptoQuant analyst JA_Maartun emphasizes the importance of the average cost area for BTC ETF buyers as a critical breakpoint. What’s the price point? Precisely $86,500. If crossed as the new year approaches, panic selling could ensue by next week. Conversely, convincing closures above $90,000 are necessary for a rebound.

The end of the fourth quarter in 2025 will be a memorable period, akin to the crash days of 2022. bitcoin hasn’t faced such a poor last quarter since 2018.

Back then, BTC declined by 42.16%. This year’s losses are currently at 22.5%. Even in 2022, BTC ended the month with a 14.75% loss. Unsurprisingly, the largest drop, 56%, occurred in the second quarter. Historically, BTC closed the first and last quarters in red for three years.

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.