Crypto Markets on Edge: New Inflation Report Could Trigger Major Volatility

Hold onto your wallets. The crypto market is holding its breath, its price charts looking more like a seismograph waiting for the big one. The culprit? A fresh inflation report is about to drop, and its numbers could send shockwaves through every digital asset from Bitcoin to the latest memecoin.

The Fed's Favorite Gauge

Forget the old CPI chatter. Traders are laser-focused on the PCE index—the Federal Reserve's preferred inflation thermometer. It's the data point that dictates whether the central bank keeps the pressure on with hawkish policy or finally gives the economy some breathing room. For crypto, it's the difference between a risk-on rally and a flight to safety.

Why Crypto Cares About Macro Noise

It's the eternal tension. Crypto was built to bypass traditional finance, yet it can't escape its gravitational pull. When inflation runs hot, the Fed tightens. That means higher rates, which makes risky assets like tech stocks and speculative altcoins less attractive. Liquidity dries up. Leverage gets unwound. The correlation isn't perfect, but it's undeniable—macro is the tide that lifts or sinks all boats, even the decentralized ones.

The Trader's Playbook

So, what's the move? The smart money isn't just watching Bitcoin. They're tracking the DXY (U.S. Dollar Index) like a hawk. A hotter-than-expected print could send the dollar soaring, crushing crypto. A cooler print might just be the catalyst for the next leg up. Options markets are pricing in a monster move. Volatility, measured by the Crypto Fear & Greed Index, is creeping higher. It's a binary bet with billions on the line.

Beyond the Headline Hysteria

Here's the cynical finance jab: Wall Street spends millions on analysts and algorithms to predict this stuff, yet the market often reacts in the exact opposite way everyone predicted. Sometimes, the 'sell the news' event turns into a furious rally because, well, the market's just a moody beast. The real inflation might be in the number of hot takes this report will generate.

The bottom line? This isn't just another data point. It's a potential regime-shift signal. A confirmation that the old rules still apply, or evidence that crypto's decoupling narrative is finally gaining steam. Either way, brace for impact. The charts are about to get interesting.

Summarize the content using AI

ChatGPT

Grok

ContentsHYPE Coin and the Evolution of Next-Gen DEXHYPE Coin Investment Strategy

Cryptocurrencies are gearing up for another turbulent day with the impending release of a new U.S. inflation report. Additionally, volatility is expected to surge on Friday with Japan’s interest rate decision. This period of uncertainty precedes a holiday week, during which two significant negative developments are anticipated to impact the crypto market until January 15th. With several reasons justifying further declines, what is the outlook for HYPE Coin?

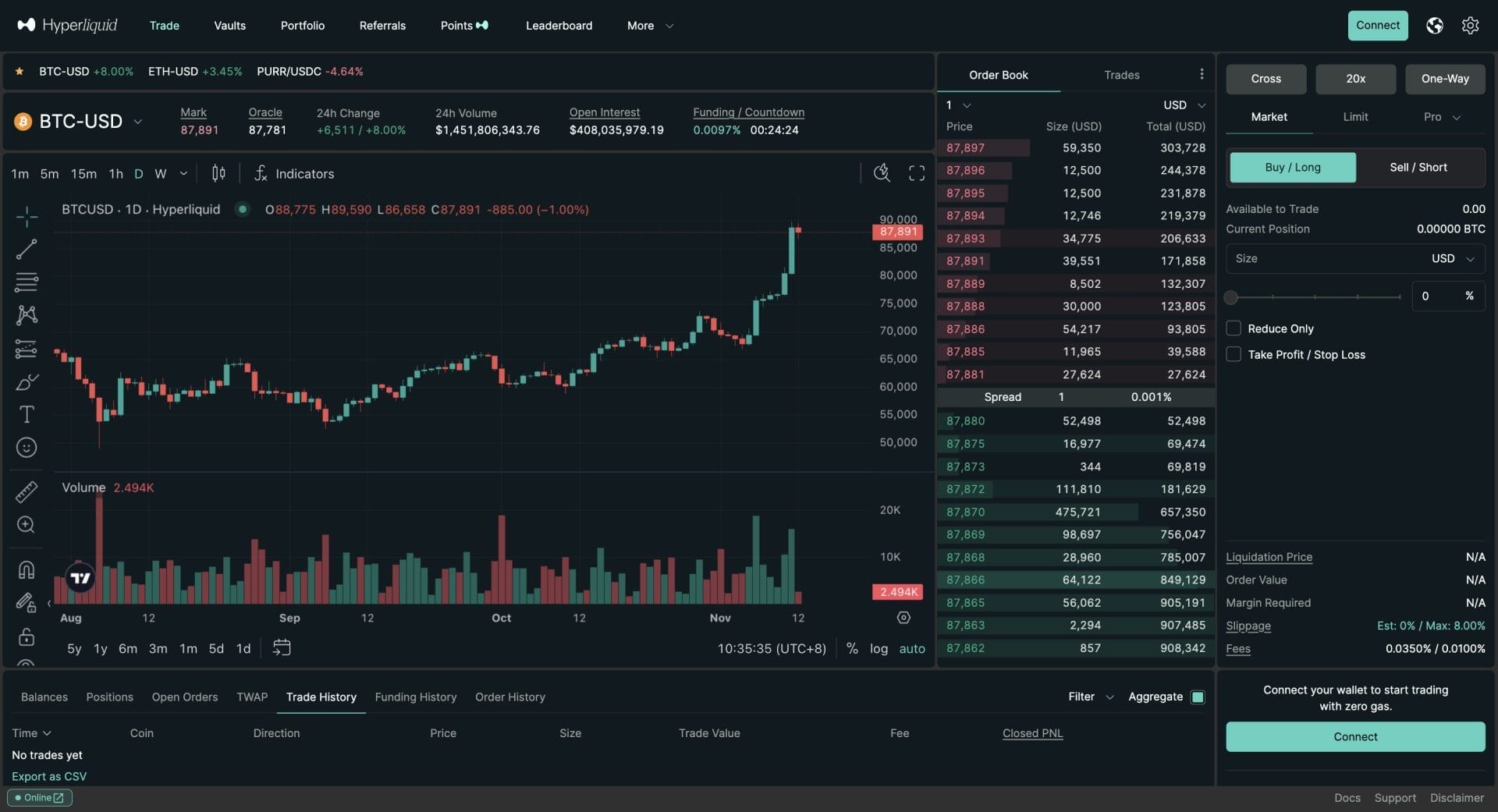

HYPE Coin and the Evolution of Next-Gen DEX

For long-term investors, Hyperliquid (HYPE) is emerging as a popular choice, leading the new generation of decentralized exchanges (DEX) alongside Aster. Following the collapse of FTX, interest in decentralized finance (DeFi) is expected to increase exponentially in the next bull market, necessitating improvements in user experience. By the end of 2022, platforms like Hyperliquid and Aster successfully transformed into DeFi spaces that resemble centralized exchanges in appearance.

Traditional DeFi platforms were often too complex for novice investors. The new generation platforms have bridged this gap, enabling even those new to cryptocurrency to navigate decentralized finance effortlessly. This has resulted in significant interest in futures trading, with investors appreciating the control wallet-based decentralized platforms offer, akin to centralized exchanges.

Due to these factors, Hyperliquid may remain relevant for a long time, unless more advanced DEX platforms emerge, causing Hyperliquid and Aster to lose popularity. However, CZ’s open support for Aster suggests that these two platforms may not encounter formidable competition in the medium term. While the sentiment of short and medium-term investors in cryptocurrencies may be variable, HYPE Coin holds potential for long-term growth. Investors previously competed to purchase HYPE Coin above $35 and now find opportunities to buy at lower prices, yet fear seems to hold them back.

HYPE Coin Investment Strategy

Altcoin Sherpa, a pseudonymous analyst, offers insights to those interested in HYPE Coin while seeking different perspectives in technical analysis. Sherpa discusses two trading strategies under consideration. Despite being an experienced trader, Sherpa emphasizes the importance of developing personal market perspectives rather than merely replicating strategies.

Sherpa outlines two avenues:

- First Path: A long-term movement around the $27-28 region. Sherpa hopes for stability in this area and a steady Bitcoin

$90,357.50. Although recent movements have been unproductive, Sherpa anticipates recovery soon.

$90,357.50. Although recent movements have been unproductive, Sherpa anticipates recovery soon.

- Second Path: A broader fluctuation around the $23-20 range. Sherpa notes the presence of significant liquidity in this region and remains uncertain if these levels will be reached, but recognizes potential market interest. Sherpa continues to consider HyperLiquid as a leading crypto project worthy of investment.

The analyst expresses uncertainty regarding the timing of reaching these lower levels, linking it to Bitcoin’s performance.

“Bottom formations take time and the last one took relatively a few weeks (returning to $9). Some peculiar price movements are expected during Lighter’s TGE, given their resemblances. I’ll be observing in general.” — Sherpa

You can follow our news on Telegram, Facebook, Twitter & Coinmarketcap Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.